Add a Calculated Field Legal Minnesota Debt Relief Forms For Free

How it works

-

Import your Minnesota Debt Relief Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Minnesota Debt Relief Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Minnesota Debt Relief Forms For Free

Online document editors have proved their trustworthiness and effectiveness for legal paperwork execution. Use our safe, fast, and intuitive service to Add a Calculated Field Legal Minnesota Debt Relief Forms For Free your documents any time you need them, with minimum effort and greatest precision.

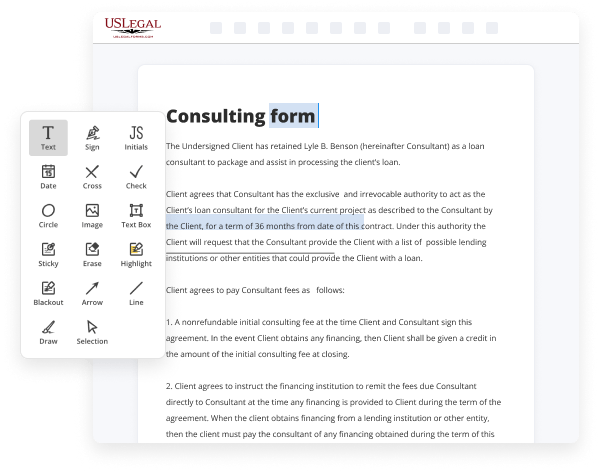

Make these quick steps to Add a Calculated Field Legal Minnesota Debt Relief Forms For Free online:

- Import a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a form library, external URL, or email attachment.

- Fill out the blank fields. Put the cursor on the first empty area and use our editor’s navigation to move step-by-step to avoid missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and symbols, highlight significant components, or remove any unnecessary ones.

- Add more fillable fields. Adjust the template with a new area for fill-out if neccessary. Make use of the right-side tool pane for this, drop each field where you want other participants to leave their data, and make the rest of the fields required, optional, or conditional.

- Organize your pages. Delete sheets you don’t need anymore or create new ones using the appropriate key, rotate them, or alter their order.

- Generate eSignatures. Click on the Sign tool and decide how you’d add your signature to the form - by typing your name, drawing it, uploading its image, or utilizing a QR code.

- Share and send for eSigning. End your editing using the Done button and send your copy to other people for signing via an email request, with a Link to Fill option, in an SMS or fax message. Request a quick online notarization if necessary.

- Save the file in the format you need. Download your paperwork, save it to cloud storage in its present format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal documentation in clicks. Give it a try today!

Benefits of Editing Minnesota Debt Relief Forms Online

Top Questions and Answers

To claim that your wages are exempt from garnishment, you must promptly return to the creditor's attorney the “Debtor's Exemption Claim Notice” that came with the Notice of Intent to Garnish Earnings. You must include a copy of your last 60 days of bank statements with this paperwork.

Tips to Add a Calculated Field Legal Minnesota Debt Relief Forms For Free

- Understand what a calculated field is and how it can help you analyze your debt relief options.

- Identify the specific data you want to calculate, such as total debt, monthly payments, or interest rates.

- Use clear labels to name your calculated fields so you can easily recognize them later.

- Make sure to check the formulas you are using for accuracy to avoid errors in your calculations.

- Test your calculated fields with sample data to ensure they are working correctly before finalizing your forms.

- Keep a backup of your original forms before making any significant changes.

- Consult legal resources or professionals if you are unsure about the calculations involved.

You may need the editing feature for adding a calculated field when you want to customize your forms for accurate financial assessments in your debt relief application.

Related Searches

We register and regulate businesses that help consumers manage debt, resolve debt, and improve their credit. Some court clerks have form Answers which may be of assistance to you. The last date on which you want interest to be calculated, usually today's date (leave the field blank to use today's date). You must monitor claims closely. Select the Exemption Variables tab. The Application Process: 1. Apply for and have your eligibility determined for other sources of financial aid, including federal and state grants. Use this promissory note (IOU) form to lend or borrow money. Judgment Collection Forms Debt Collection and Related Forms Miller-Davis (Commercial) Forms Mortgage relief upon sale or other disposition.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.