Add a Calculated Field Legal Idaho Startup for S-Corporation Forms For Free

How it works

-

Import your Idaho Startup for S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Idaho Startup for S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add a Calculated Field Legal Idaho Startup for S-Corporation Forms For Free

Legal documentation requires highest accuracy and prompt execution. While printing and filling forms out usually takes considerable time, online PDF editors prove their practicality and efficiency. Our service is at your disposal if you’re searching for a reputable and straightforward-to-use tool to Add a Calculated Field Legal Idaho Startup for S-Corporation Forms For Free quickly and securely. Once you try it, you will be amazed at how easy dealing with official paperwork can be.

Follow the instructions below to Add a Calculated Field Legal Idaho Startup for S-Corporation Forms For Free:

- Add your template via one of the available options - from your device, cloud, or PDF library. You can also get it from an email or direct URL or through a request from another person.

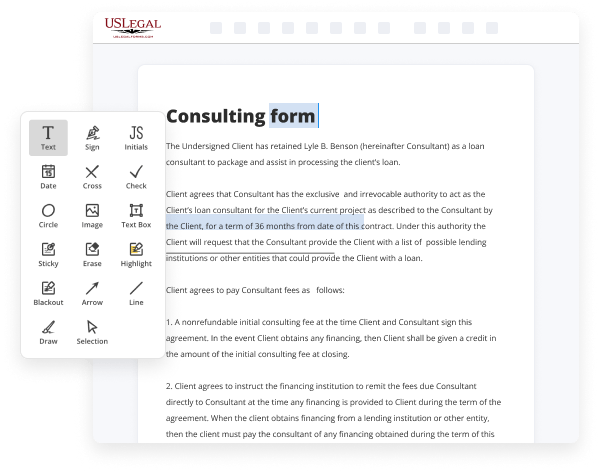

- Make use of the top toolbar to fill out your document: start typing in text fields and click on the box fields to choose appropriate options.

- Make other necessary changes: insert pictures, lines, or signs, highlight or delete some details, etc.

- Use our side tools to make page arrangements - insert new sheets, change their order, delete unnecessary ones, add page numbers if missing, etc.

- Drop extra fields to your document requesting various types of data and place watermarks to protect the contents from unauthorized copying.

- Check if all information is true and sign your paperwork - generate a legally-binding electronic signature the way you prefer and place the current date next to it.

- Click Done when you are ready and decide where to save your form - download it to your device or export it to the cloud in whatever file format you need.

- Share a copy with others or send it to them for signature via email, a signing link, SMS, or fax. Request online notarization and get your form quickly witnessed.

Imagine doing all the above manually on paper when even one error forces you to reprint and refill all the details from the beginning! With online services like ours, things become considerably easier. Give it a try now!

Benefits of Editing Idaho Startup for S-Corporation Forms Online

Top Questions and Answers

To form an Idaho S corp, you'll need to ensure your company has an Idaho formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Tips to Add a Calculated Field Legal Idaho Startup for S-Corporation Forms For Free

- Understand the purpose of a calculated field and how it affects your S-Corporation forms.

- Familiarize yourself with the specific fields in the form where calculations are needed.

- Use clear and consistent formulas to avoid confusion in calculations.

- Double-check the input data to ensure accuracy before applying any calculations.

- Consider consulting with a tax professional to validate your calculated field entries.

- Regularly update your calculated fields as new financial data comes in.

- Keep documentation of your calculations for future reference or audits.

This editing feature for adding a calculated field may be needed when you want to automate calculations for taxes, profits, or distributions, ensuring that your S-Corporation forms are accurate and up-to-date.

A corporation filing as an S corporation for federal income tax purposes must file Idaho Form 41S if either of the following are true. Do you own interest in a S Corporation, Partnership, or LLC taxed as a Partnership? It may qualify as an Affected Business Entity (ABE). Answer simple, plain-English questions, and TaxAct automatically calculates and enters your data into the appropriate tax forms. Eligible corporations or LLCs must meet specific criteria to elect S corp status. You must file Form 2553 with the IRS to be an S corporation. This guide to starting an LLC in Idaho provides step-by-step instructions on filing formation documents, obtaining tax IDs, and setting up company records. Learn what is an S Corp "Reasonable Salary", get S Corp salary examples and know the tax benefits of running an S Corp. Complete and submit the form to apply for S corporation tax election. To create an S corp, you'll need to file form 2553 with the IRS.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.