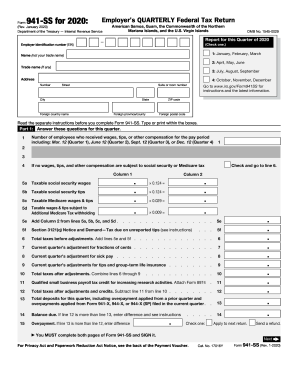

Get IRS 941-SS 2020

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OVERPAYMENTS online

How to fill out and sign 2amount online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Experience all the key benefits of submitting and completing forms on the internet. With our solution filling out IRS 941-SS only takes a few minutes. We make that possible through giving you access to our feature-rich editor capable of transforming/fixing a document?s initial text, inserting special fields, and putting your signature on.

Complete IRS 941-SS within a couple of minutes by following the instructions below:

- Choose the document template you will need from the library of legal form samples.

- Select the Get form button to open it and start editing.

- Fill in the necessary boxes (they will be yellowish).

- The Signature Wizard will enable you to put your electronic signature after you have finished imputing details.

- Add the relevant date.

- Check the whole document to ensure you?ve filled in all the information and no corrections are needed.

- Hit Done and save the resulting form to your computer.

Send the new IRS 941-SS in a digital form right after you are done with filling it out. Your data is well-protected, as we keep to the latest security standards. Join numerous happy customers that are already completing legal templates straight from their homes.

How to edit Nontax: customize forms online

Approve and share Nontax along with any other business and personal paperwork online without wasting time and resources on printing and postal delivery. Get the most out of our online document editor using a built-in compliant electronic signature tool.

Approving and submitting Nontax documents electronically is quicker and more effective than managing them on paper. However, it requires employing online solutions that ensure a high level of data safety and provide you with a compliant tool for creating eSignatures. Our powerful online editor is just the one you need to prepare your Nontax and other individual and business or tax templates in a precise and proper way in accordance with all the requirements. It features all the necessary tools to easily and quickly fill out, edit, and sign paperwork online and add Signature fields for other people, specifying who and where should sign.

It takes only a few simple actions to fill out and sign Nontax online:

- Open the chosen file for further processing.

- Make use of the upper toolkit to add Text, Initials, Image, Check, and Cross marks to your template.

- Underline the important details and blackout or remove the sensitive ones if necessary.

- Click on the Sign tool above and select how you prefer to eSign your form.

- Draw your signature, type it, upload its image, or use another option that suits you.

- Switch to the Edit Fillable Fileds panel and drop Signature areas for other parties.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Verify that all information provided is complete and precise before you click Done.

- Share your documentation with others utilizing one of the available options.

When signing Nontax with our comprehensive online solution, you can always be sure to get it legally binding and court-admissible. Prepare and submit documentation in the most efficient way possible!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing preparers

Are you bored of lengthy instructions and complicated queries in formal papers? Using our simple video guide and web-based editor will help you complete and e-sign Form without the usual headache.

Shouldve FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 941-SS

- 4th

- 3rd

- 2nd

- 1st

- preparers

- recordkeeping

- shouldve

- formcomments

- OVERPAYMENTS

- designees

- ptin

- 2amount

- nontax

- demandtax

- NW

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.