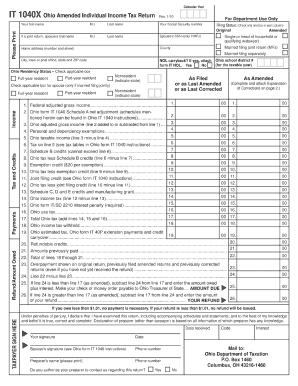

Get OH ODT IT 1040X 2010

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Carryover online

How to fill out and sign Expensing online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, most Americans prefer to do their own income taxes and, moreover, to fill out papers electronically. The US Legal Forms online platform helps make the procedure of e-filing the OH ODT IT 1040X fast and convenient. Now it will require no more than thirty minutes, and you can accomplish it from any location.

How you can fill up OH ODT IT 1040X fast and easy:

-

Open the PDF sample in the editor.

-

Refer to the highlighted fillable lines. Here you can place your details.

-

Click on the variant to choose if you see the checkboxes.

-

Check out the Text icon along with other advanced features to manually change the OH ODT IT 1040X.

-

Confirm all the details before you continue to sign.

-

Create your distinctive eSignature by using a key pad, camera, touchpad, mouse or cellphone.

-

Certify your web-template electronically and specify the date.

-

Click Done proceed.

-

Download or deliver the file to the receiver.

Make sure that you have filled in and sent the OH ODT IT 1040X correctly in due time. Consider any deadline. When you provide false data in your fiscal papers, it may result in serious fees and cause problems with your annual tax return. Be sure to use only expert templates with US Legal Forms!

How to edit W-2: customize forms online

Go with a reliable file editing service you can rely on. Edit, complete, and sign W-2 safely online.

Very often, modifying forms, like W-2, can be pain, especially if you received them in a digital format but don’t have access to specialized software. Of course, you can find some workarounds to get around it, but you risk getting a form that won't meet the submission requirements. Utilizing a printer and scanner isn’t an option either because it's time- and resource-consuming.

We provide a smoother and more efficient way of completing files. A rich catalog of document templates that are straightforward to edit and certify, and then make fillable for other people. Our solution extends way beyond a collection of templates. One of the best parts of using our services is that you can revise W-2 directly on our website.

Since it's a web-based service, it spares you from having to get any software. Additionally, not all corporate rules permit you to download it on your corporate laptop. Here's how you can easily and safely complete your forms with our solution.

- Hit the Get Form > you’ll be instantly taken to our editor.

- As soon as opened, you can start the editing process.

- Select checkmark or circle, line, arrow and cross and other choices to annotate your form.

- Pick the date field to add a particular date to your document.

- Add text boxes, images and notes and more to enrich the content.

- Use the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to generate and create your legally-binding signature.

- Click DONE and save, print, and pass around or get the document.

Say goodbye to paper and other inefficient ways of completing your W-2 or other documents. Use our solution instead that includes one of the richest libraries of ready-to-edit templates and a powerful file editing services. It's easy and secure, and can save you lots of time! Don’t take our word for it, try it out yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2008

Watch this short video to get useful advice about how to complete the 1040EZ. Make the process much faster and easier with these simple step-by-step instructions.

40p FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to OH ODT IT 1040X

- 2006

- carryforward

- preparer

- nonresident

- 2008

- 1040EZ

- 40p

- MFJ

- carryover

- OVERPAYMENTS

- IT40P

- expensing

- W-2

- hio

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.