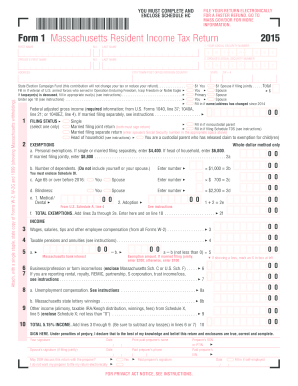

Get MA DoR 1 2015

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SSN online

How to fill out and sign 1040A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Registering your revenue and filing all the vital tax papers, including MA DoR 1, is a US citizen?s sole responsibility. US Legal Forms makes your taxes preparation more accessible and correct. You can get any juridical samples you need and fill out them in electronic format.

How you can complete MA DoR 1 on the internet:

-

Get MA DoR 1 within your web browser from your device.

-

Gain access to the fillable PDF file with a click.

-

Begin filling out the template field by field, following the prompts of the innovative PDF editor?s user interface.

-

Correctly input textual material and numbers.

-

Tap the Date field to put the actual day automatically or alter it manually.

-

Use Signature Wizard to design your custom-made e-signature and sign in seconds.

-

Refer to the IRS instructions if you still have inquiries..

-

Click on Done to confirm the edits..

-

Go on to print the file out, download, or send it via Email, text messaging, Fax, USPS without exiting your browser.

Store your MA DoR 1 securely. You should ensure that all your correct papers and data are in are in right place while remembering the time limits and tax rules set with the IRS. Do it easy with US Legal Forms!

How to edit Sched: customize forms online

Use our advanced editor to turn a simple online template into a completed document. Read on to learn how to modify Sched online easily.

Once you discover an ideal Sched, all you have to do is adjust the template to your needs or legal requirements. Apart from completing the fillable form with accurate data, you might need to remove some provisions in the document that are irrelevant to your circumstance. On the other hand, you may want to add some missing conditions in the original template. Our advanced document editing features are the best way to fix and adjust the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. It is possible to add and erase text, insert fillable fields, and make extra changes while keeping the original formatting of the document. Also you can rearrange the structure of the document by changing page order.

You don’t need to print the Sched to sign it. The editor comes along with electronic signature functionality. The majority of the forms already have signature fields. So, you just need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to build your Sched:

- Open the preferred template.

- Use the toolbar to adjust the form to your preferences.

- Fill out the form providing accurate information.

- Click on the signature field and add your eSignature.

- Send the document for signature to other signers if needed.

After all parties complete the document, you will get a signed copy which you can download, print, and share with other people.

Our solutions enable you to save tons of your time and minimize the risk of an error in your documents. Streamline your document workflows with effective editing tools and a powerful eSignature solution.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing PY

Watch this brief video to get answers on many questions you will have while completing the PWH. Save time and effort for more important things with these short guidelines.

TDS FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to MA DoR 1

- 32f

- preparer

- remic

- 1099s

- PY

- PWH

- TDS

- noncustodial

- SSN

- 1040EZ

- 32d

- 1040A

- sched

- lih

- 32b

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.