Loading

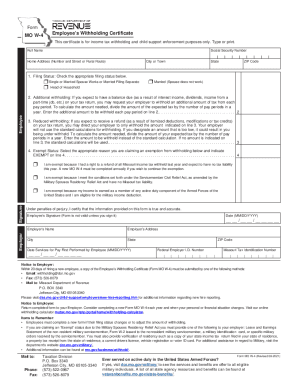

Get Mo W-4 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO W-4 online

Filling out the MO W-4 form is an important step for ensuring accurate income tax withholding from your paychecks. This guide provides clear, step-by-step instructions for completing the form online to meet your personal and financial needs.

Follow the steps to complete the MO W-4 smoothly.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your full name in the designated field, ensuring it matches the name on your Social Security card.

- Provide your Social Security Number in the appropriate section for identification purposes.

- Fill in your home address, including the number and street or rural route, city or town, state, and ZIP code.

- Select your filing status by checking the box next to one of the following options: 'Single or Married Spouse Works', 'Head of Household', or 'Married (Spouse does not work)'.

- If you expect to have additional taxes due, indicate the additional withholding amount on line 2, calculated by dividing the expected tax by the number of pay periods in a year.

- For reduced withholding, enter the amount to withhold instead of the standard calculation on line 3 if you anticipate a tax refund.

- If claiming exempt status from withholding, select the appropriate reason from the listed options and write 'EXEMPT' on line 4.

- Sign and date the form at the bottom. Note that this certification is required for the form to be valid.

- Provide your employer's name and address, along with the date services for pay were first performed.

- Review the completed form for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Complete your MO W-4 online today to ensure your tax withholding is accurate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.