Get GA DoR ST-3 2014

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

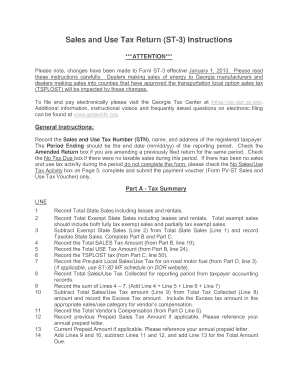

Tips on how to fill out, edit and sign 2013 online

How to fill out and sign Dekalb online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Registering your revenue and declaring all the vital tax papers, including GA DoR ST-3, is a US citizen?s exclusive responsibility. US Legal Forms tends to make your taxes preparation a lot more transparent and correct. You will find any lawful forms you require and complete them digitally.

How to complete GA DoR ST-3 on the web:

-

Get GA DoR ST-3 in your internet browser from your gadget.

-

Gain access to the fillable PDF file with a click.

-

Begin completing the web-template box by box, following the prompts of the sophisticated PDF editor?s user interface.

-

Precisely input textual information and numbers.

-

Select the Date field to place the current day automatically or change it manually.

-

Use Signature Wizard to design your custom e-signature and sign within minutes.

-

Use the Internal Revenue Service directions if you still have questions..

-

Click Done to confirm the changes..

-

Proceed to print the document out, download, or send it via E-mail, SMS, Fax, USPS without exiting your browser.

Keep your GA DoR ST-3 safely. You should make sure that all your appropriate paperwork and data are in order while bearing in mind the due dates and tax rules set up by the IRS. Make it easy with US Legal Forms!

How to edit ST-3D: personalize forms online

Doing documents is more comfortable with smart online tools. Eliminate paperwork with easily downloadable ST-3D templates you can edit online and print out.

Preparing documents and paperwork needs to be more reachable, whether it is an everyday part of one’s profession or occasional work. When a person must file a ST-3D, studying regulations and guides on how to complete a form correctly and what it should include might take a lot of time and effort. Nevertheless, if you find the right ST-3D template, completing a document will stop being a struggle with a smart editor at hand.

Discover a wider range of functions you can add to your document flow routine. No need to print out, fill out, and annotate forms manually. With a smart modifying platform, all the essential document processing functions will always be at hand. If you want to make your work process with ST-3D forms more efficient, find the template in the catalog, select it, and discover a simpler method to fill it in.

- If you want to add text in a random part of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you need.

- Use the Highlight tool to stress the important parts of the form. If you want to cover or remove some text parts, use the Blackout or Erase tools.

- Customize the form by adding default graphic components to it. Use the Circle, Check, and Cross tools to add these elements to the forms, if possible.

- If you need additional annotations, make use of the Sticky note resource and put as many notes on the forms page as required.

- If the form needs your initials or date, the editor has tools for that too. Reduce the possibility of errors by using the Initials and Date tools.

- It is also easy to add custom graphic components to the form. Use the Arrow, Line, and Draw tools to customize the file.

The more tools you are familiar with, the easier it is to work with ST-3D. Try the solution that offers everything necessary to find and edit forms in a single tab of your browser and forget about manual paperwork.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing yy

In this video-guide, we share useful tips on how to complete the doroff fast and easy. Watch this video, fill in the template in minutes, and be ready to print it out or share it.

Businesss FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to GA DoR ST-3

- PV

- GTC

- 033E

- Georgias

- yy

- doroff

- businesss

- 20th

- 2013

- gataxinfo

- aspx

- Dekalb

- ST-3D

- Fulton

- STN

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.