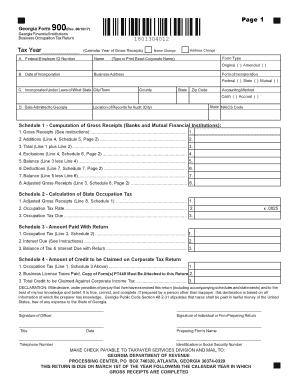

Get GA DoR 900 2017

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Accrues online

How to fill out and sign Accrual online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your income and submitting all the vital tax papers, including GA DoR 900, is a US citizen?s sole responsibility. US Legal Forms makes your tax preparation a lot more available and precise. You will find any juridical forms you want and complete them digitally.

How to complete GA DoR 900 on the internet:

-

Get GA DoR 900 within your web browser from any device.

-

Access the fillable PDF file with a click.

-

Start completing the web-template box by box, following the prompts of the advanced PDF editor?s interface.

-

Correctly input textual content and numbers.

-

Press the Date field to put the current day automatically or change it by hand.

-

Use Signature Wizard to make your custom-made e-signature and certify in seconds.

-

Use the IRS guidelines if you still have any queries..

-

Click Done to keep the edits..

-

Go on to print the file out, download, or send it via E-mail, text messaging, Fax, USPS without leaving your web browser.

Keep your GA DoR 900 safely. You should ensure that all your appropriate papers and records are in are in right place while keeping in mind the time limits and taxation regulations set up by the IRS. Help it become simple with US Legal Forms!

How to edit Accruing: customize forms online

Put the right document editing tools at your fingertips. Complete Accruing with our trusted service that comes with editing and eSignature functionality}.

If you want to execute and sign Accruing online without hassle, then our online cloud-based solution is the ideal solution. We provide a wealthy template-based catalog of ready-to-use forms you can edit and fill out online. Furthermore, you don't need to print out the document or use third-party options to make it fillable. All the necessary features will be available at your disposal once you open the file in the editor.

Let’s go through our online editing tools and their main features. The editor has a self-explanatory interface, so it won't require much time to learn how to use it. We’ll take a look at three major sections that allow you to:

- Edit and annotate the template

- Organize your paperwork

- Make them shareable

The top toolbar comes with the features that help you highlight and blackout text, without graphics and image components (lines, arrows and checkmarks etc.), sign, initialize, date the document, and more.

Use the toolbar on the left if you would like to re-order the document or/and remove pages.

If you want to make the document fillable for other people and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

In addition to the capabilities mentioned above, you can safeguard your file with a password, add a watermark, convert the document to the necessary format, and much more.

Our editor makes modifying and certifying the Accruing a piece of cake. It allows you to make virtually everything concerning working with forms. In addition, we always ensure that your experience editing documents is safe and compliant with the main regulatory standards. All these factors make using our solution even more enjoyable.

Get Accruing, make the necessary edits and changes, and get it in the preferred file format. Try it out today!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing checkbox

Don’t waste your time — watch our short video guide to figure out how to fill in the naics. A few minutes, a few simple steps, and everything gets done.

Participations FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to GA DoR 900

- preparer

- subchapter

- transferor

- 1st

- checkbox

- naics

- participations

- mortgagebacked

- accrues

- correlative

- exclusions

- accrual

- accruing

- enacting

- apportioned

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.