Loading

Get Irs 8857 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8857 online

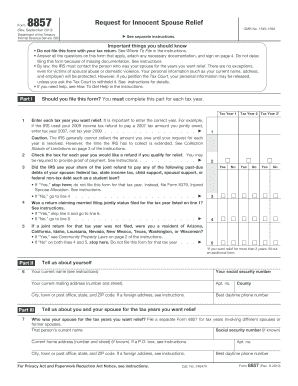

The IRS 8857 form, also known as the Request for Innocent Spouse Relief, allows individuals to seek relief from joint tax liability under certain circumstances. This guide provides step-by-step instructions on filling out the form online, ensuring clarity for users with varying levels of experience.

Follow the steps to accurately complete the IRS 8857 form.

- Press the ‘Get Form’ button to access the IRS 8857 form and open it in your preferred editor.

- Complete Part I by indicating the tax years for which you are seeking relief. Ensure you enter the correct tax year and check if you are eligible for a refund.

- In Part II, fill in your current name, social security number, mailing address, and best daytime phone number. Accurate information is crucial for processing.

- In Part III, provide information about you and your spouse for each relevant tax year, including current marital status and education level.

- Address any history of spousal abuse if applicable, and provide details about your involvement in financial matters and preparation of tax returns.

- In Part IV, describe your involvement in household finances and indicate any assets transferred between you and your spouse.

- Fill out Part V, detailing your current financial situation, including household income, expenses, and assets.

- Finally, review all the information for accuracy, sign the form, and submit it according to the provided mailing instructions.

- After completing, save any changes, and consider printing or sharing the form as needed.

Take action today and complete your IRS 8857 form online for relief.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS debt is generally written off after 10 years from the date of assessment unless certain actions extend that period. Keeping track of the timeline is essential, as it determines when the debt expires. If you have concerns about your situation, completing IRS Form 8857 may help clarify your options and provide potential solutions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.