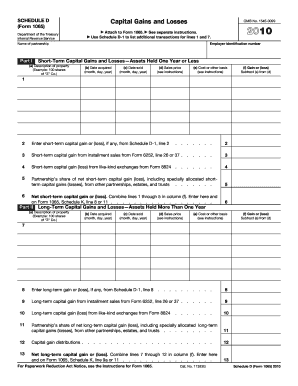

Get IRS 1065 - Schedule D 2010

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Gains online

How to fill out and sign IRS 1065 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season began unexpectedly or you just misssed it, it could probably create problems for you. IRS 1065 - Schedule D is not the easiest one, but you do not have reason for worry in any case.

Making use of our professional online sofware you will learn the right way to fill up IRS 1065 - Schedule D in situations of critical time deficit. You simply need to follow these simple recommendations:

-

Open the document in our advanced PDF editor.

-

Fill in all the information required in IRS 1065 - Schedule D, making use of fillable fields.

-

Include graphics, crosses, check and text boxes, if required.

-

Repeating fields will be filled automatically after the first input.

-

In case of misunderstandings, use the Wizard Tool. You will see some tips for simpler submitting.

-

Never forget to include the date of application.

-

Make your unique signature once and put it in all the required lines.

-

Check the info you have included. Correct mistakes if needed.

-

Click Done to finalize editing and choose how you will deliver it. There is the possibility to use virtual fax, USPS or electronic mail.

-

Also you can download the document to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

Using our complete digital solution and its professional tools, completing IRS 1065 - Schedule D becomes more convenient. Do not wait to work with it and have more time on hobbies instead of preparing documents.

How to edit IRS 1065 - Schedule D: customize forms online

Use our comprehensive editor to transform a simple online template into a completed document. Read on to learn how to modify IRS 1065 - Schedule D online easily.

Once you find a perfect IRS 1065 - Schedule D, all you need to do is adjust the template to your preferences or legal requirements. In addition to completing the fillable form with accurate information, you might need to erase some provisions in the document that are irrelevant to your case. Alternatively, you might want to add some missing conditions in the original template. Our advanced document editing features are the best way to fix and adjust the document.

The editor enables you to modify the content of any form, even if the document is in PDF format. It is possible to add and remove text, insert fillable fields, and make further changes while keeping the initial formatting of the document. Also you can rearrange the structure of the document by changing page order.

You don’t need to print the IRS 1065 - Schedule D to sign it. The editor comes along with electronic signature capabilities. The majority of the forms already have signature fields. So, you simply need to add your signature and request one from the other signing party via email.

Follow this step-by-step guide to make your IRS 1065 - Schedule D:

- Open the preferred template.

- Use the toolbar to adjust the form to your preferences.

- Fill out the form providing accurate details.

- Click on the signature field and add your electronic signature.

- Send the document for signature to other signers if needed.

After all parties complete the document, you will receive a signed copy which you can download, print, and share with other people.

Our solutions let you save tons of your time and minimize the chance of an error in your documents. Enhance your document workflows with efficient editing capabilities and a powerful eSignature solution.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing subtract

Complete your transactions with ease. If you have questions — we have the answers for you in this quick video guide. Prepare accurate and professional documents without any headaches.

II FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1065 - Schedule D

- allocated

- partnerships

- exchanges

- installment

- subtract

- transactions

- II

- estates

- gains

- reduction

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.