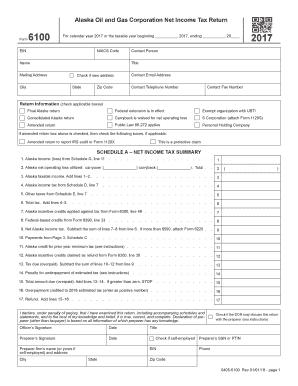

Get AK Form 6100 2017

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 10a online

How to fill out and sign Carryback online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period started unexpectedly or maybe you just misssed it, it could probably cause problems for you. AK Form 6100 is not the simplest one, but you have no reason for panic in any case.

Utilizing our convenient service you will see how you can fill AK Form 6100 even in situations of critical time deficit. You just need to follow these simple instructions:

-

Open the document in our professional PDF editor.

-

Fill in the details needed in AK Form 6100, using fillable fields.

-

Insert images, crosses, check and text boxes, if you want.

-

Repeating information will be added automatically after the first input.

-

In case of difficulties, turn on the Wizard Tool. You will receive some tips for simpler completion.

-

Never forget to include the date of filing.

-

Draw your unique e-signature once and place it in the required places.

-

Check the information you have included. Correct mistakes if required.

-

Click on Done to finalize modifying and choose how you will send it. You have the ability to use virtual fax, USPS or electronic mail.

-

You are able to download the document to print it later or upload it to cloud storage.

With our complete digital solution and its professional instruments, filling out AK Form 6100 becomes more handy. Do not hesitate to try it and have more time on hobbies rather than on preparing paperwork.

How to edit Preparers: customize forms online

Sign and share Preparers together with any other business and personal documents online without wasting time and resources on printing and postal delivery. Take the most out of our online form editor using a built-in compliant eSignature option.

Approving and submitting Preparers documents electronically is faster and more efficient than managing them on paper. However, it requires employing online solutions that ensure a high level of data safety and provide you with a certified tool for generating eSignatures. Our robust online editor is just the one you need to complete your Preparers and other personal and business or tax templates in a precise and suitable manner in accordance with all the requirements. It offers all the essential tools to easily and quickly complete, adjust, and sign documentation online and add Signature fields for other parties, specifying who and where should sign.

It takes just a few simple actions to fill out and sign Preparers online:

- Open the selected file for further managing.

- Make use of the upper panel to add Text, Initials, Image, Check, and Cross marks to your template.

- Underline the important details and blackout or remove the sensitive ones if required.

- Click on the Sign option above and decide on how you want to eSign your document.

- Draw your signature, type it, upload its image, or use an alternative option that suits you.

- Move to the Edit Fillable Fileds panel and place Signature areas for other people.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Verify that all data provided is complete and accurate before you click Done.

- Share your document with others using one of the available options.

When signing Preparers with our extensive online editor, you can always be sure to get it legally binding and court-admissible. Prepare and submit documents in the most effective way possible!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing numerators

Experience the best way to prepare your carryover online in a matter of minutes by following our step-by-step instructions. Use easy-to-submit templates made by professionals for everyday people.

10d FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to AK Form 6100

- stcg

- drd

- preparer

- allocable

- numerators

- carryover

- 10d

- 10b

- 10a

- intercompany

- apportionable

- carryback

- preparers

- naics

- subtractions

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.