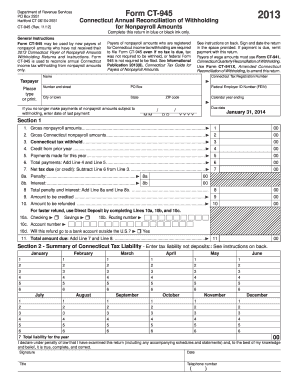

Get CT DRS CT-945 2013

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Nonresidents online

How to fill out and sign Distributions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season started unexpectedly or you just misssed it, it would probably create problems for you. CT DRS CT-945 is not the simplest one, but you do not have reason for panic in any case.

Making use of our powerful on-line software you will learn the right way to complete CT DRS CT-945 even in situations of critical time deficit. You only need to follow these elementary instructions:

-

Open the document using our professional PDF editor.

-

Fill in the info required in CT DRS CT-945, making use of fillable lines.

-

Insert images, crosses, check and text boxes, if you need.

-

Repeating info will be added automatically after the first input.

-

In case of misunderstandings, switch on the Wizard Tool. You will receive some tips for much easier finalization.

-

Do not forget to add the date of application.

-

Create your unique e-signature once and place it in the needed places.

-

Check the details you have included. Correct mistakes if necessary.

-

Click Done to finalize modifying and select how you will send it. You have the opportunity to use digital fax, USPS or e-mail.

-

You can even download the record to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

With this powerful digital solution and its professional instruments, completing CT DRS CT-945 becomes more handy. Do not hesitate to try it and have more time on hobbies and interests rather than on preparing documents.

How to edit Nonwage: customize forms online

Fill out and sign your Nonwage quickly and error-free. Find and edit, and sign customizable form samples in a comfort of a single tab.

Your document workflow can be far more efficient if all you need for editing and handling the flow is arranged in one place. If you are searching for a Nonwage form sample, this is a place to get it and fill it out without looking for third-party solutions. With this intelligent search engine and editing tool, you won’t need to look any further.

Just type the name of the Nonwage or any other form and find the right template. If the sample seems relevant, you can start editing it right on the spot by clicking Get form. No need to print or even download it. Hover and click on the interactive fillable fields to insert your details and sign the form in a single editor.

Use more editing instruments to customize your form:

- Check interactive checkboxes in forms by clicking on them. Check other areas of the Nonwage form text by using the Cross, Check, and Circle instruments

- If you need to insert more text into the document, utilize the Text tool or add fillable fields with the respective button. You can even specify the content of each fillable field.

- Add pictures to forms with the Image button. Add pictures from your device or capture them with your computer camera.

- Add custom visual elements to the document. Use Draw, Line, and Arrow instruments to draw on the document.

- Draw over the text in the document if you want to hide it or stress it. Cover text fragments with theErase and Highlight, or Blackout tool.

- Add custom elements like Initials or Date with the respective instruments. They will be generated automatically.

- Save the form on your device or convert its format to the one you want.

When equipped with a smart forms catalog and a powerful document editing solution, working with documentation is easier. Find the form you require, fill it out instantly, and sign it on the spot without downloading it. Get your paperwork routine simplified with a solution designed for editing forms.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2011

Learn more about how to complete remitters rapidly and easily. Our simple step-by-step video guide shows and explains in detail the process of online filling and what to pay attention to.

CT-941X FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to CT DRS CT-945

- 10c

- 10a

- 10b

- overwithheld

- 2011

- remitters

- CT-941X

- 10d

- Nonresidents

- FEIN

- CT-941

- Distributions

- nonwage

- TDD

- reportable

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.