Loading

Get Ct Drs C-3 Uge (formerly C-3) 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS C-3 UGE (formerly C-3) online

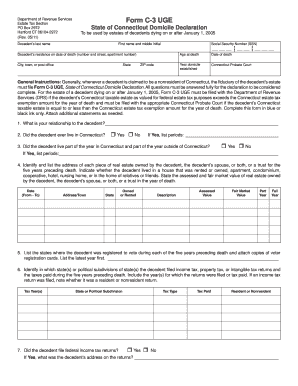

Filling out the CT DRS C-3 UGE form is an essential step for estates of decedents to declare their domicile status, particularly for tax purposes. This guide will provide you with clear instructions to complete the form online efficiently and accurately.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to access the CT DRS C-3 UGE form online and open it in your preferred editor.

- Begin by entering the decedent's last name, first name, and middle initial in the designated fields at the top of the form.

- Input the decedent's address at the time of death, including the street number, apartment number (if applicable), city, state, and ZIP code.

- Provide the decedent's social security number (SSN), followed by the date of death and the age of the decedent at death.

- Indicate the year when the decedent's Connecticut domicile was established.

- Answer the questions regarding the decedent's residency and housing arrangements, ensuring to include any periods spent living in or outside Connecticut.

- List all real estate owned by the decedent or jointly with their spouse, specifying if it was rented or owned, along with assessed and fair market values.

- Complete the section detailing states where the decedent was registered to vote, including attaching copies of voter registration cards.

- Document where the decedent filed taxes in the previous five years, noting any relevant taxes paid.

- Continue through the form, answering all questions accurately about the decedent’s employment history, legal documents executed, and hospitalization records.

- Provide necessary information about the decedent's final days, including their death and burial locations, and attach required documents such as death certificates.

- Finally, review the entire form for accuracy. Save your changes, and if required, you can download, print, or share the completed form.

Complete your CT DRS C-3 UGE form online today to ensure accurate and prompt processing.

Related links form

The estate tax in Connecticut varies based on the total value of the estate. As of the latest updates, estates exceeding the exemption amount established by the CT DRS C-3 UGE (formerly C-3) may be subject to taxes that can range significantly. Understanding these brackets is crucial for compliance and planning. For detailed explanations and resources to assist with this process, visit uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.