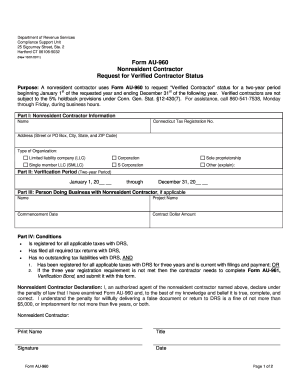

Get CT DRS AU-960 2011

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Holdback online

How to fill out and sign Applicable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period began unexpectedly or you just forgot about it, it would probably cause problems for you. CT DRS AU-960 is not the simplest one, but you have no reason for worry in any case.

Making use of our professional platform you will see the best way to fill CT DRS AU-960 in situations of critical time deficit. The only thing you need is to follow these simple guidelines:

-

Open the file in our professional PDF editor.

-

Fill in all the information needed in CT DRS AU-960, utilizing fillable fields.

-

Add graphics, crosses, check and text boxes, if required.

-

Repeating info will be filled automatically after the first input.

-

In case of troubles, switch on the Wizard Tool. You will see useful tips for easier finalization.

-

Don?t forget to add the date of application.

-

Draw your unique signature once and place it in the required lines.

-

Check the details you have written. Correct mistakes if needed.

-

Click on Done to complete modifying and choose the way you will send it. You will have the opportunity to use digital fax, USPS or electronic mail.

-

You are able to download the document to print it later or upload it to cloud storage like Google Drive, Dropbox, etc.

With this powerful digital solution and its helpful tools, completing CT DRS AU-960 becomes more practical. Do not wait to try it and have more time on hobbies rather than on preparing paperwork.

How to edit Commencement: customize forms online

Facilitate your paperwork preparation process and adapt it to your demands within clicks. Complete and approve Commencement with a powerful yet easy-to-use online editor.

Preparing paperwork is always difficult, especially when you cope with it from time to time. It demands you strictly adhere to all the formalities and accurately complete all fields with full and precise data. Nevertheless, it often happens that you need to adjust the document or add more fields to fill out. If you need to improve Commencement prior to submitting it, the simplest way to do it is by using our comprehensive yet straightforward-to-use online editing tools.

This extensive PDF editing solution enables you to easily and quickly fill out legal paperwork from any internet-connected device, make simple edits to the form, and insert more fillable fields. The service enables you to opt for a specific area for each data type, like Name, Signature, Currency and SSN etc. You can make them mandatory or conditional and decide who should fill out each field by assigning them to a specific recipient.

Make the steps listed below to modify your Commencement online:

- Open needed sample from the catalog.

- Fill out the blanks with Text and place Check and Cross tools to the tickboxes.

- Utilize the right-side toolbar to adjust the template with new fillable areas.

- Select the fields depending on the type of information you wish to be collected.

- Make these fields mandatory, optional, and conditional and customize their order.

- Assign each field to a specific party using the Add Signer tool.

- Verify that you’ve made all the required adjustments and click Done.

Our editor is a versatile multi-featured online solution that can help you quickly and effortlessly adapt Commencement and other forms based on your needs. Optimize document preparation and submission time and make your paperwork look perfect without hassle.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing false

Watch our video to discover how you can easily complete the 2011 and understand the advantages of using online templates. Simplify your paperwork with excellent web-based tools.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to CT DRS AU-960

- 31st

- Sigourney

- STE

- AU-961

- false

- 2011

- smllc

- Proprietorship

- holdback

- III

- declarations

- applicable

- commencement

- liabilities

- filings

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.