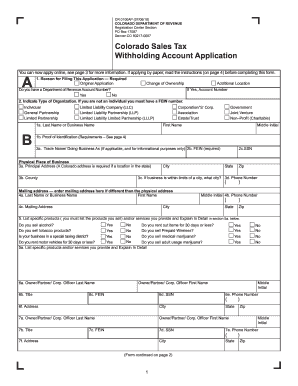

Get CO CR 0100AP 2018-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 2018 cr0100ap form online

How to fill out and sign Cr 0100ap online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season started unexpectedly or maybe you just forgot about it, it could probably create problems for you. CO CR 0100AP is not the simplest one, but you have no reason for panic in any case.

Using our ultimate platform you will see how you can fill up CO CR 0100AP in situations of critical time deficit. All you need is to follow these simple guidelines:

-

Open the record with our professional PDF editor.

-

Fill in the information needed in CO CR 0100AP, utilizing fillable lines.

-

Add images, crosses, check and text boxes, if needed.

-

Repeating information will be filled automatically after the first input.

-

In case of troubles, use the Wizard Tool. You will receive some tips for much easier completion.

-

Never forget to add the date of application.

-

Create your unique e-signature once and place it in the required places.

-

Check the info you have filled in. Correct mistakes if needed.

-

Click on Done to finish editing and select the way you will send it. You will have the opportunity to use virtual fax, USPS or electronic mail.

-

You can even download the record to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

Using our powerful digital solution and its beneficial instruments, submitting CO CR 0100AP becomes more convenient. Do not hesitate to test it and have more time on hobbies rather than on preparing documents.

How to edit Cr0100ap: customize forms online

Simplify your document preparation process and adapt it to your requirements within clicks. Complete and approve Cr0100ap with a robust yet intuitive online editor.

Preparing documents is always troublesome, especially when you cope with it occasionally. It demands you strictly adhere to all the formalities and precisely complete all areas with full and precise data. Nevertheless, it often happens that you need to change the document or insert extra areas to fill out. If you need to improve Cr0100ap before submitting it, the most effective way to do it is by using our powerful yet straightforward-to-use online editing tools.

This extensive PDF editing solution allows you to quickly and easily complete legal paperwork from any internet-connected device, make basic changes to the template, and place additional fillable areas. The service allows you to pick a particular area for each data type, like Name, Signature, Currency and SSN etc. You can make them required or conditional and choose who should complete each field by assigning them to a particular recipient.

Make the steps listed below to optimize your Cr0100ap online:

- Open required sample from the catalog.

- Fill out the blanks with Text and place Check and Cross tools to the tickboxes.

- Utilize the right-side toolbar to adjust the form with new fillable areas.

- Pick the areas based on the type of data you wish to be collected.

- Make these fields required, optional, and conditional and customize their order.

- Assign each area to a particular party using the Add Signer tool.

- Check if you’ve made all the required changes and click Done.

Our editor is a versatile multi-featured online solution that can help you quickly and easily adapt Cr0100ap and other templates based on your requirements. Optimize document preparation and submission time and make your paperwork look professional without hassle.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 2018 colorado cr 0100ap

Watch our video to discover how you can easily complete the 2018 co cr0100ap and understand the advantages of using online templates. Simplify your paperwork with excellent web-based tools.

2018 cr0100ap tax FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to 2018 cr 0100ap

- colorado state tac

- colorado state tax

- colorado state withholding form

- colorado withholding form

- cr 0100

- cr 0100 instructions

- or cr template

- 1099 misc 2020

- withholding tax form

- colorado state refund 1099 g

- colorado income tax

- colorado form cr 0100ap

- colorado dr 1093

- colorado department of revenue annual transmittal of state 1099 forms

- colorado cr0100

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.