- US Legal Forms

- Form Library

- More Forms

- More Multi-State Forms

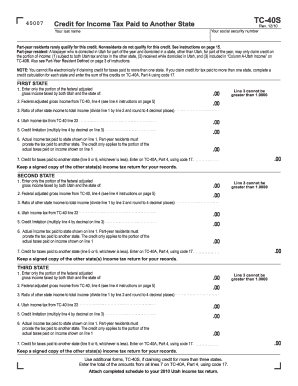

- 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in

Get 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in

Alify for this credit. See instructions on page 15. Part-year resident: A taxpayer who is domiciled in Utah for part of the year and domiciled in a state, other than Utah, for part of the year, may only claim credit on the portion of income: (1) subject to both Utah tax and tax in the other state, (2) received while domiciled in Utah, and (3) included in Column A-Utah Income on TC-40B. Also see Part-Year Resident Defined on page 3 of instructions. NOTE: You cannot file electronically if cl.

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Electronically online

How to fill out and sign Adjusted online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax, legal, business and other electronic documents demand an advanced level of protection and compliance with the law. Our documents are regularly updated in accordance with the latest legislative changes. Plus, with our service, all of the info you include in the 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in is well-protected against loss or damage with the help of industry-leading encryption.

The following tips can help you fill out 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in quickly and easily:

- Open the document in our full-fledged online editor by clicking Get form.

- Fill out the necessary fields that are yellow-colored.

- Hit the green arrow with the inscription Next to move from box to box.

- Use the e-autograph tool to e-sign the template.

- Add the relevant date.

- Look through the whole e-document to ensure that you have not skipped anything important.

- Click Done and save your new form.

Our service allows you to take the whole process of submitting legal documents online. Consequently, you save hours (if not days or even weeks) and eliminate extra expenses. From now on, fill out 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in from home, office, and even while on the go.

How to edit Multiply: customize forms online

Approve and share Multiply together with any other business and personal documentation online without wasting time and resources on printing and postal delivery. Take the most out of our online form editor using a built-in compliant electronic signature option.

Approving and submitting Multiply templates electronically is quicker and more productive than managing them on paper. However, it requires utilizing online solutions that guarantee a high level of data protection and provide you with a certified tool for creating electronic signatures. Our powerful online editor is just the one you need to complete your Multiply and other personal and business or tax forms in a precise and appropriate manner in accordance with all the requirements. It offers all the necessary tools to easily and quickly fill out, modify, and sign documentation online and add Signature fields for other parties, specifying who and where should sign.

It takes only a few simple steps to complete and sign Multiply online:

- Open the selected file for further processing.

- Make use of the top toolbar to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the most significant details and blackout or erase the sensitive ones if needed.

- Click on the Sign option above and choose how you want to eSign your sample.

- Draw your signature, type it, upload its image, or use another option that suits you.

- Move to the Edit Fillable Fileds panel and place Signature areas for others.

- Click on Add Signer and type in your recipient’s email to assign this field to them.

- Check that all data provided is complete and correct before you click Done.

- Share your document with others using one of the available options.

When approving Multiply with our robust online solution, you can always be certain you get it legally binding and court-admissible. Prepare and submit paperwork in the most efficient way possible!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Taxpayer FAQ

-

What is the CT EITC? The Connecticut Earned Income Tax Credit (or CT EITC) is a refundable state income tax credit for low to moderate income working individuals and families. The state credit mirrors the federal Earned Income Tax Credit.

-

EITCs are a tax benefit designed to help low- to moderate-income working people. The federal government, 31 states, the District of Columbia, Guam, Puerto Rico and some municipalities have EITCs. More than 25 million eligible tax filers received almost $60 billion in federal EITC during the 2020 tax year.

-

You may claim this credit if you had income that was taxed by California and another state. The credit will offset the taxes paid to the other state, so you are not paying taxes twice. This credit applies to: Individuals.

-

You may claim this credit if you had income that was taxed by California and another state. The credit will offset the taxes paid to the other state, so you are not paying taxes twice. This credit applies to: Individuals.

-

To choose the foreign tax credit, you generally must complete Form 1116, Foreign Tax Credit and attach it to your U.S. tax return. However, you may qualify for an exception that allows you to claim the foreign tax credit without using Form 1116. Refer to How To Figure the Credit.

-

The credit for taxes paid to another state is automatically calculated in your account when you add a Nonresident return to your already created resident Pennsylvania return if you pay taxes to both Pennsylvania and another state.

-

Generally, residents of California (with the exception of dual-resident estates and trusts) may claim a credit for net income taxes imposed by and paid to another state only on income which has a source within the other state.

-

The credit allowed will be the lesser of the tax paid to the other state or the tax which Connecticut imposes on the resident's out-of-state wages. The credit is claimed by completing Form CT-1040, Schedule 2, and attaching a copy of the return filed with the other state.

Calculation Related content

-

General Instructions for Forms 1099, 1098, 5498...

Filers of Form 1099-G who report state or local income tax ... paid, a flow-through...

Learn more -

2008 Publication 334

15 years ago — This credit applies to the qualified expenses you paid for employee...

Learn more -

2008 Publication 519

14 years ago — • Credit for tax paid by a mutual fund (or from Form 4137 or Form 8919...

Learn more -

Maine State Tax Expenditure Report 2008-2009

A resident estate or trust is allowed a credit for income tax paid to another state, a...

Learn more -

In-State Travel Payment Income Tax Information...

Effective January 1,2012, the payment voucher (PV) process for in-state travel for all...

Learn more -

TAX DECODER is intended to decode the tax code for...

This month Congress will likely approve a “tax extenders” bill, reauthorizing dozens...

Learn more -

8 Steps in Calculating Your Income Taxes

Objectives - be able to: Calculate your marginal tax rate & apply in tax planning; Reduce...

Learn more -

2008 FEDERAL REFERENCE MANUAL FOR REGIONAL ...

by JA Bennett — ... credit and the earned income tax credit. Taxpayers may claim the...

Learn more -

2016 Publication 535

Jan 19, 2017 — This publication discusses common business expenses and explains what is...

Learn more -

2019 Publication 535

4 years ago — This publication discusses common business expenses and explains what is...

Learn more -

FINANCIAL STATEMENTS REPORTS OF THE EXTERNAL ...

1.4. The Council, composed of representatives from 36 States, is elected by the Assembly...

Learn more -

Bulletin No. 2015–8 February 23, 2015

9 years ago — Rev. Proc. 2015–19, page 656. This revenue procedure provides the...

Learn more -

U.S. Chamber of Commerce - Global Energy Monitor...

Apr 30, 2021 — The Council of State Chambers (COSC) is a little known 501(c)(6)...

Learn more -

Keystone XL Oil Pipeline - Global Energy Monitor...

Due to an exemption the state of Kansas gave TC Energy, the local authorities would lose...

Learn more -

Effects of Climate Change on Natural Resources and...

The main topics addressed here are effects of climate change on wildlife habitat, other...

Learn more -

35: Balaji Srinivasan - The Heretic & The Virus...

May 21, 2020 — Investor Balaji Srinivasan is a highly original thinker in Silicon Valley...

Learn more -

The DNAPL Remediation Challenge: Is There a Case...

by MC Kavanaugh · 2003 · Cited by 114 — ... given financial and regulatory...

Learn more -

climate change planning handbook

Stage III. Calculate Benefits and Costs of Action Alternatives. Introduction .

Learn more -

Community ownership of journalism and public goods

This literature review focuses on the economic meaning, in which a public good is...

Learn more -

igem-phototroph-handbook.pdf

iGEM teams working with phototrophic organisms have been underrepresented overall within...

Learn more -

Current Forms - Utah State Tax Commission

Current Utah State Tax Commission forms.

Learn more -

DOR 2008 Individual Income Tax Forms

2008 Individual Income Tax Forms ; Form 1NPR, Nonresident and Part-year Resident Income...

Learn more -

2008 IT-40

Jan 1, 2008 — Over the past three years, more and more taxpayers have begun using...

Learn more -

2013 TC-40, Individual Income Tax Instructions

Fill-in forms are available. Automated forms ... Credit for Income Tax Paid to Another...

Learn more -

2008 Individual Income Tax

No credit for taxes paid to another state will be allowed unless the other state's return...

Learn more -

2008 Missouri Individual Income Tax Long Form...

Income tax you paid to another state or political subdivision. This is not tax withheld...

Learn more -

INSTRUCTIONS FOR 2008 WISCONSIN FORM 1X

Line 21 If you are claiming the credit for net tax paid to another state, fill in the...

Learn more -

SOUTH CAROLINA 2009 Individual Income Tax

The form for claiming the credit is TC ... NOTE: If you are allowed this credit for taxes...

Learn more -

Individual Income Tax Instructions Packet 2023

Nov 6, 2023 — If you're claiming credit for taxes paid to another state, you must...

Learn more -

West Virginia - Personal Income Tax Forms &...

1 Credit for Income Tax paid to another state(s) ... credit from line 2 of Form SCTC-A 2...

Learn more -

2008 Publication 519

Jun 15, 2009 — United States will allow a credit for taxes paid to. You should find out...

Learn more -

2008 Publication 334

Dec 5, 2008 — You may also be able to claim a tax credit of 50% state tax on gross...

Learn more -

Maine State Tax Expenditure Report 2008-2009

A resident estate or trust is allowed a credit for income tax paid to another state, a...

Learn more -

TAX DECODER is intended to decode the tax code for...

This month Congress will likely approve a “tax extenders” bill, reauthorizing dozens...

Learn more -

8 Steps in Calculating Your Income Taxes

Utah Educational Savings Plan Credit: An investment in a 529 may be taken as a deduction...

Learn more -

General Instructions for Forms 1099, 1098, 5498...

of the amount paid, a flow-through entity, or another ... income taxes; and advance earned...

Learn more -

2008 FEDERAL REFERENCE MANUAL FOR REGIONAL ...

by JA Bennett — The amount of real property taxes paid by the taxpayer that is allowable...

Learn more -

Details of the Business and Personal Credits...

by PC ALLOWED · 2011 — Credit for taxes paid to another state. Statutory Language:...

Learn more -

The Virginia Historic Tax Credit Funds Case and...

by WF Machen · 2009 — This article will discuss federal income tax issues arising from...

Learn more -

2008 What's New Supplement

Jan 15, 2009 — They paid $3,500 of real estate tax in 2008. Their standard deduction of...

Learn more -

2008 Publication 519

Jun 15, 2009 — United States will allow a credit for taxes paid to. You should find out...

Learn more -

2008 Publication 334

Dec 5, 2008 — You may also be able to claim a tax credit of 50% state tax on gross...

Learn more -

Maine State Tax Expenditure Report 2008-2009

A resident estate or trust is allowed a credit for income tax paid to another state, a...

Learn more -

TAX DECODER is intended to decode the tax code for...

This month Congress will likely approve a “tax extenders” bill, reauthorizing dozens...

Learn more -

8 Steps in Calculating Your Income Taxes

Utah Educational Savings Plan Credit: An investment in a 529 may be taken as a deduction...

Learn more -

General Instructions for Forms 1099, 1098, 5498...

of the amount paid, a flow-through entity, or another ... income taxes; and advance earned...

Learn more -

2008 FEDERAL REFERENCE MANUAL FOR REGIONAL ...

by JA Bennett — The amount of real property taxes paid by the taxpayer that is allowable...

Learn more -

Details of the Business and Personal Credits...

by PC ALLOWED · 2011 — Credit for taxes paid to another state. Statutory Language:...

Learn more -

The Virginia Historic Tax Credit Funds Case and...

by WF Machen · 2009 — This article will discuss federal income tax issues arising from...

Learn more -

2008 What's New Supplement

Jan 15, 2009 — They paid $3,500 of real estate tax in 2008. Their standard deduction of...

Learn more -

2016 Publication 535

Jan 19, 2017 — This publication discusses common business expenses and explains what is...

Learn more -

FINANCIAL STATEMENTS REPORTS OF THE EXTERNAL ...

1.4. The Council, composed of representatives from 36 States, is elected by the Assembly...

Learn more -

U.S. Chamber of Commerce - Global Energy Monitor...

Apr 30, 2021 — The Council of State Chambers (COSC) is a little known 501(c)(6)...

Learn more -

Keystone XL Oil Pipeline - Global Energy Monitor...

Due to an exemption the state of Kansas gave TC Energy, the local authorities would lose...

Learn more -

Effects of Climate Change on Natural Resources and...

The main topics addressed here are effects of climate change on wildlife habitat, other...

Learn more -

35: Balaji Srinivasan - The Heretic & The Virus...

May 21, 2020 — Investor Balaji Srinivasan is a highly original thinker in Silicon Valley...

Learn more -

The DNAPL Remediation Challenge: Is There a Case...

by MC Kavanaugh · 2003 · Cited by 114 — ... given financial and regulatory...

Learn more -

climate change planning handbook

Stage III. Calculate Benefits and Costs of Action Alternatives. Introduction .

Learn more -

Community ownership of journalism and public goods

This literature review focuses on the economic meaning, in which a public good is...

Learn more -

igem-phototroph-handbook.pdf

iGEM teams working with phototrophic organisms have been underrepresented overall within...

Learn more -

Current Forms - Utah State Tax Commission

Current Utah State Tax Commission forms.

Learn more -

2016 Publication 535

Jan 19, 2017 — This publication discusses common business expenses and explains what is...

Learn more -

2008 Missouri Individual Income Tax Long Form...

Income tax you paid to another state or political subdivision. This is not tax withheld...

Learn more -

united states securities and exchange commission

Feb 25, 2021 — Securities registered pursuant to Section 12(g) of the Act: None...

Learn more -

DOR 2008 Individual Income Tax Forms

2008 Individual Income Tax Forms ; Form 1NPR, Nonresident and Part-year Resident Income...

Learn more -

U.S. Chamber of Commerce - Global Energy Monitor...

Apr 30, 2021 — The Council of State Chambers (COSC) is a little known 501(c)(6)...

Learn more -

2008 IT-40

Jan 1, 2008 — You may be able to take a credit for taxes paid to another state. If you...

Learn more -

Community ownership of journalism and public goods

This literature review focuses on the economic meaning, in which a public good is...

Learn more -

INSTRUCTIONS FOR 2008 WISCONSIN FORM 1X

Line 21 If you are claiming the credit for net tax paid to another state, fill in the...

Learn more -

climate change planning handbook

Stage III. Calculate Benefits and Costs of Action Alternatives. Introduction .

Learn more -

2013 TC-40, Individual Income Tax Instructions

state. To claim the credit, complete and attach form TC-40S,. Credit for Income Tax Paid...

Learn more -

Coal regulations - Global Energy Monitor - GEM...

Apr 29, 2021 — The main U.S. statute controlling coal mining is the Surface Mining...

Learn more -

Individual Income Tax Instructions Packet 2023

Nov 6, 2023 — If you're claiming credit for taxes paid to another state, you must...

Learn more -

One Family Under God - Speeches at the Global...

Aug 4, 2004 — A new short essay about the GPF goes here and lasts two pages. The...

Learn more -

SOUTH CAROLINA 2009 Individual Income Tax

The form for claiming the credit is TC-53. ... 40 Out-of-state income/gain - Do not...

Learn more -

35: Balaji Srinivasan - The Heretic & The Virus...

May 21, 2020 — Investor Balaji Srinivasan is a highly original thinker in Silicon Valley...

Learn more -

Brief Overview and Filing Requirements

Nonresidents are taxed only on the income they receive from sources within Pennsylvania...

Learn more -

The DNAPL Remediation Challenge: Is There a Case...

by MC Kavanaugh · 2003 · Cited by 114 — ... given financial and regulatory...

Learn more -

2008 Individual Income Tax

Schedule A. Other State's Tax Return. If you claim a credit for taxes paid to another...

Learn more -

Effects of Climate Change on Natural Resources and...

The main topics addressed here are effects of climate change on wildlife habitat, other...

Learn more -

Current Forms - Utah State Tax Commission

Current Utah State Tax Commission forms.

Learn more -

2008 IT-40

Jan 1, 2008 — You may be able to take a credit for taxes paid to another state....

Learn more -

2013 TC-40, Individual Income Tax Instructions

state. To claim the credit, complete and attach form TC-40S,. Credit for Income Tax Paid...

Learn more -

DOR 2008 Individual Income Tax Forms

2008 Individual Income Tax Forms ; Form 1NPR, Nonresident and Part-year Resident Income...

Learn more -

2008 Individual Income Tax

No credit for taxes paid to another state will be allowed unless the other state's return...

Learn more -

INSTRUCTIONS FOR 2008 WISCONSIN FORM 1X

Line 21 If you are claiming the credit for net tax paid to another state, fill in the...

Learn more -

Schedule 38-TC - Tax Credits

For each credit, enter the total credit earned or received by the estate or trust on the...

Learn more -

General Tax Consulting

Aug 21, 2013 — -3- Utah Taxpayer Tax Credit provides taxpayers a computed credit for...

Learn more -

West Virginia - Personal Income Tax Forms &...

TAX CREDIT. SCHEDULE. APPLICABLE CREDIT. 1 Credit for Income Tax paid to another state(s)...

Learn more -

SOUTH CAROLINA 2009 Individual Income Tax

NOTE: If you are allowed this credit for taxes paid another state, and that state later...

Learn more -

Current Forms - Utah State Tax Commission

Current Utah State Tax Commission forms.

Learn more -

INSTRUCTIONS FOR 2008 WISCONSIN FORM 1X

Line 21 If you are claiming the credit for net tax paid to another state, fill in the...

Learn more -

2008 Missouri Individual Income Tax Long Form...

Income tax you paid to another state or political subdivision. This is not tax withheld...

Learn more -

DOR 2008 Individual Income Tax Forms

2008 Individual Income Tax Forms ; Form 1NPR, Nonresident and Part-year Resident Income...

Learn more -

2008 IT-40

Jan 1, 2008 — You may be able to take a credit for taxes paid to another state. If you...

Learn more -

2013 TC-40, Individual Income Tax Instructions

Fill-in forms are available. Automated forms ... Credit for Income Tax Paid to Another...

Learn more -

Individual Income Tax Instructions Packet 2023

Nov 6, 2023 — If you're claiming credit for taxes paid to another state, you must...

Learn more -

2008 MO-1040 INDIVIDUAL INCOME TAX RETURN

Income tax you paid to another state or political subdivision. This is not tax withheld...

Learn more -

Schedule 38-TC - Tax Credits

For each credit, enter the total credit earned or received by the estate or trust on the...

Learn more -

SOUTH CAROLINA 2009 Individual Income Tax

The form for claiming the credit is TC-53. CREDIT ... This Worksheet provides a summary of...

Learn more -

2016 Publication 535

Jan 19, 2017 — This publication discusses common business expenses and explains what is...

Learn more -

united states securities and exchange commission

Feb 25, 2021 — Securities registered pursuant to Section 12(g) of the Act: None...

Learn more -

U.S. Chamber of Commerce - Global Energy Monitor...

Apr 30, 2021 — The Council of State Chambers (COSC) is a little known 501(c)(6)...

Learn more -

climate change planning handbook

Stage III. Calculate Benefits and Costs of Action Alternatives. Introduction .

Learn more -

Community ownership of journalism and public goods

This literature review focuses on the economic meaning, in which a public good is...

Learn more -

Coal regulations - Global Energy Monitor - GEM...

Apr 29, 2021 — The main U.S. statute controlling coal mining is the Surface Mining...

Learn more -

One Family Under God - Speeches at the Global...

Aug 4, 2004 — A new short essay about the GPF goes here and lasts two pages. The...

Learn more -

The DNAPL Remediation Challenge: Is There a Case...

by MC Kavanaugh · 2003 · Cited by 114 — ... given financial and regulatory...

Learn more -

Effects of Climate Change on Natural Resources and...

The main topics addressed here are effects of climate change on wildlife habitat, other...

Learn more -

igem-phototroph-handbook.pdf

iGEM teams working with phototrophic organisms have been underrepresented overall within...

Learn more -

General Instructions for Forms 1099, 1098, 5498...

Filers of Form 1099-G who report state or local income tax ... paid, a flow-through...

Learn more -

2008 Publication 334

Dec 5, 2008 — This credit applies to the qualified expenses you paid for employee...

Learn more -

2008 Publication 519

Jun 15, 2009 — • Credit for tax paid by a mutual fund (or from Form 4137 or Form 8919...

Learn more -

Maine State Tax Expenditure Report 2008-2009

A resident estate or trust is allowed a credit for income tax paid to another state, a...

Learn more -

In-State Travel Payment Income Tax Information...

Effective January 1,2012, the payment voucher (PV) process for in-state travel for all...

Learn more -

TAX DECODER is intended to decode the tax code for...

This month Congress will likely approve a “tax extenders” bill, reauthorizing dozens...

Learn more -

8 Steps in Calculating Your Income Taxes

Objectives - be able to: Calculate your marginal tax rate & apply in tax planning; Reduce...

Learn more -

2008 FEDERAL REFERENCE MANUAL FOR REGIONAL ...

... credit and the earned income tax credit. Taxpayers may claim the child tax credit on...

Learn more -

2019 Publication 535

Mar 4, 2020 — This publication discusses common business expenses and explains what is...

Learn more -

Bulletin No. 2015–8 February 23, 2015

Feb 23, 2015 — Rev. Proc. 2015–19, page 656. This revenue procedure provides the...

Learn more

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to 2008 Credit For Income Tax Paid To Another State (TC-40S) Fill-in

- TC-40B

- A-Utah

- Nonresidents

- prorate

- taxed

- limitation

- taxpayer

- Calculation

- electronically

- decimal

- defined

- adjusted

- multiply

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.