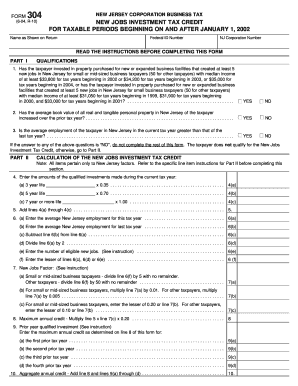

Get Form - 304. New Jersey Coproporation Business Tax - New Jobs Investment Tax Credit For Taxable

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

HMO FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to Form - 304. New Jersey Coproporation Business Tax - New Jobs Investment Tax Credit For Taxable

- CBT-100S

- 304-A

- carryover

- 10A-5

- A-3

- expensed

- HMO

- seq

- nj

- aggregated

- 10A-1

- III

- certifications

- imputed

- certifies

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.