Loading

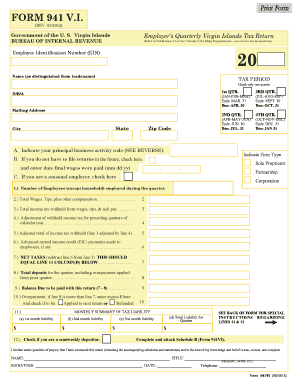

Get Virgin Islands Bureau Of Internal Revenue Employer S Quarterly Virgin Islands Tax Return (refer To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virgin Islands BUREAU OF INTERNAL REVENUE Employer S Quarterly Virgin Islands Tax Return online

Filling out the Employer's Quarterly Virgin Islands Tax Return is essential for employers in the U.S. Virgin Islands to report taxes accurately. This guide provides clear, step-by-step instructions to help you complete the form efficiently.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Employer Identification Number (EIN) in the designated field. This number is crucial for identifying your business for tax purposes.

- Provide your legal name and, if applicable, your trade name in the respective fields. This ensures that your tax return is matched correctly to your business.

- Select the tax period by checking only one of the quarter options, indicating which quarter you are filing for (1st, 2nd, 3rd, or 4th).

- Complete the mailing address section with accurate details including state, city, and zip code. Ensure the address is current for any correspondence related to your tax return.

- Indicate your principal business activity code by selecting the appropriate code from the provided list. This categorizes your business type for revenue purposes.

- If applicable, check the boxes for final wages paid or if you are a seasonal employer. This information affects how your return is processed and how future filings are handled.

- Report the number of employees you had during the quarter (excluding household employees) in the corresponding field.

- Enter the total wages, tips, and other compensation paid to employees on the stated line.

- Fill in the total income tax withheld from wages and tips in the designated area.

- If there were adjustments from prior quarters, enter those figures to ensure your total tax liability is accurate.

- Calculate the net taxes by subtracting any advanced earned income credit payments from your total income tax withheld.

- Summarize your total deposits made for the quarter, including any overpayments applied from previous quarters.

- Determine the balance due to be paid with this return by calculating the difference between net taxes and total deposits.

- If you have an overpayment, indicate the amount and choose whether to apply it to the next return or request a refund.

- Complete the monthly summary of tax liability section if applicable, including liabilities for each month of the quarter.

- Sign and date the form, indicating your title, and provide a contact number to facilitate any communication.

- Once all sections are completed, save your changes, download, and print the form or share it as required.

Begin your tax return process online today to ensure timely and accurate submissions.

To calculate your estimated taxes, you will add up your total tax liability for the current year—including self-employment tax, individual income tax, and any other taxes—and divide that number by four.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.