Loading

Get 2023 Concessionaires Sales Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Concessionaires Sales Tax Return online

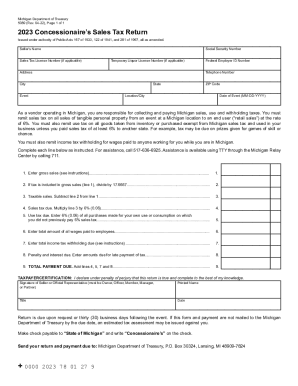

Navigating the 2023 Concessionaires Sales Tax Return can seem daunting, but with clear guidance, you can complete it with confidence. This guide provides step-by-step instructions tailored to users looking to fill out this form online.

Follow the steps to successfully complete your sales tax return.

- Click ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the seller’s name in the provided field. This should be the name of the individual or entity responsible for the sales.

- Input your Social Security Number, or the Sales Tax License Number if applicable. If you possess a Temporary Liquor License, include that as well.

- Fill out your address, including city, state, and ZIP code. Ensure accuracy, as this information is essential for correspondence regarding your return.

- Indicate the event and its location/city. It is crucial to provide the date of the event in the format MM-DD-YYYY.

- Enter your gross sales amount in line 1. This sum should reflect all sales transactions made during the event.

- If the sales tax is included in the gross sales, divide the amount in line 1 by 17.6667 for your calculation in line 2.

- For taxable sales, subtract the figure in line 2 from your gross sales in line 1, entering this amount in line 3.

- Calculate the sales tax due by multiplying the amount in line 3 by 6% (0.06) and record it in line 4.

- If you made any purchases for your own use or consumption for which you did not previously pay sales tax, calculate the use tax due (6% of these purchases) and enter it in line 5.

- Next, enter the total wages paid to employees in line 6.

- Calculate the total income tax withholding and enter it in line 7, referencing the appropriate tax withholding rate.

- If applicable, compute any penalties and interest due for late payment and enter these amounts in line 8.

- Total your payment by adding amounts from lines 4, 5, 7, and 8, and submit this figure in line 9.

- Lastly, review your entries for accuracy, then save your changes. You can choose to download, print, or share the completed form as needed.

Take the next step in your sales compliance by completing your 2023 Concessionaires Sales Tax Return online today!

Sales Tax. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6% sales tax on the total price of their taxable retail sales to the State of Michigan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.