Loading

Get Contract For The Sale Of Residential Property (assuming Existing Loan And Giving Seller Purchase 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

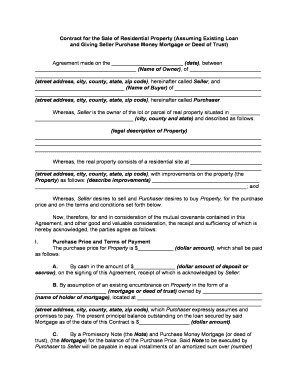

How to fill out the Contract For The Sale Of Residential Property (Assuming Existing Loan And Giving Seller Purchase online

This guide provides clear, step-by-step instructions for completing the Contract For The Sale Of Residential Property. Whether you are a first-time buyer or seller, this document will help you navigate the essential sections of the agreement with ease.

Follow the steps to ensure a smooth completion of your contract.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the date of the agreement in the designated space: ________________________ (date). Ensure this matches the date you are signing.

- Provide the Seller's name and address in the following format: __________________________________ (Name of Owner), of ________________________ (street address, city, county, state, zip code).

- Insert the Buyer's name and address in a similar manner: ______________________________ (Name of Buyer) of _____________________________ (street address, city, county, state, zip code).

- Describe the property being sold, including the legal description and the street address. This information is critical for identifying the Property.

- Detail the purchase price in the section provided: $____________ (dollar amount). Include specific payment terms, such as cash deposit and assumption of existing loan.

- Outline any exceptions to the title being conveyed, such as easements or zoning restrictions. This should be carefully documented to avoid future disputes.

- Identify the costs related to the sale, designating which costs will be borne by the Seller and Purchaser. Make sure to include any fees associated with the closing.

- Complete the insurance section by indicating if any existing policies will be transferred at closing and how they will be maintained during the transaction.

- Finalize the transfer of property details, specifying the conditions under which possession will be transferred and ensuring all parties are clear on their obligations.

- Once all sections are filled out, review the entire document for accuracy and completeness. You can then save your changes, download, print, or share the completed form.

Complete your documents online today for a seamless transaction experience!

When a buyer buys property and assumes a mortgage, the buyer becomes primarily liable for the debt and the seller becomes secondarily liable for the debt. "Assume" means the buyer takes on liability, and the seller is no longer primarily liable. "Subject to" means the seller is not released from responsibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.