Loading

Get 720vi 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 720VI online

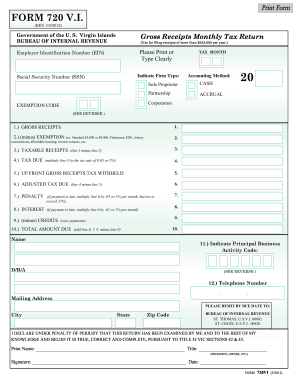

The 720VI form is an essential document for businesses operating in the U.S. Virgin Islands that report gross receipts exceeding $225,000 annually. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring users can file their returns accurately and efficiently.

Follow the steps to complete the 720VI form correctly.

- Press the ‘Get Form’ button to access the 720VI form and open it in your online editor.

- Enter your Employer Identification Number (EIN) in the designated field. If you are a sole proprietor, you can use your Social Security Number (SSN) instead.

- Indicate the tax month for which you are filing the return by selecting the appropriate month from the options provided.

- Select your firm type (sole proprietor, partnership, or corporation) within the form to classify your business correctly.

- Choose the accounting method you use for your business, either cash or accrual, in the relevant section of the form.

- Report your gross receipts in line 1 of the form. This number should represent your total receipts for the tax month.

- Deduct any exemptions applicable to your business in line 2. This could include standard exemptions or specific exemptions such as those for fishermen or affordable housing projects.

- Calculate your taxable receipts by subtracting line 2 from line 1 and enter this figure in line 3.

- Multiply the taxable receipts reported in line 3 by the tax rate of 0.05 (5%) and enter the tax due in line 4.

- If any gross receipts tax has been withheld by the Virgin Islands Government, enter that amount in line 5.

- Calculate the adjusted tax due by subtracting line 5 from line 4 and enter the result in line 6.

- If applicable, calculate any penalties for late payments in line 7 by applying a penalty of 5% per month on line 6, up to a maximum of 25%.

- Calculate any interest charges for late payments in line 8, which are 1% of line 6 for each month overdue.

- Report any credits in line 9. This can include overpayments from previous filings.

- Finally, sum the amounts from line 6, line 7, and line 8, then subtract any credits from line 9 to find the total amount due in line 10.

- Fill in your business name, indicate your principal business activity code, and provide your contact telephone number.

- Complete the mailing address section, including city, state, and zip code.

- Sign and date the form in the designated area, ensuring to include your printed name and title as applicable.

- Review all entered information for accuracy before you save your changes, download, print, or share the form, ensuring it is submitted by the due date.

Complete your 720VI form online today to ensure accurate and timely filing.

Excise taxes apply to services and to goods manufactured or produced in the Philippines for domestic sales, consumption, or for any other disposition and to things imported.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.