Loading

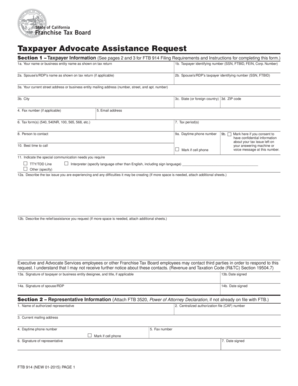

Get Ftb 914 (new 01-2015) Taxpayer Advocate Assistance Request - Ftb Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FTB 914 (NEW 01-2015) Taxpayer Advocate Assistance Request - Ftb Ca online

Filling out the FTB 914 form online is essential for users experiencing financial difficulties due to issues with the Franchise Tax Board. This guide provides a clear, step-by-step approach to assist you in completing the Taxpayer Advocate Assistance Request form accurately.

Follow the steps to complete your tax assistance request form effectively.

- Click ‘Get Form’ button to access the FTB 914 document and open it on your device.

- In Section 1, enter your name or business entity name as it appears on your tax return in field 1a. For field 1b, provide your taxpayer identifying number (either your SSN, FTBID, FEIN, or Corporation Number).

- If applicable, enter your spouse's or registered domestic partner's name in field 2a and their taxpayer identifying number in 2b.

- Complete your current mailing address by filling fields 3a to 3d with your street address, city, state, and ZIP code respectively.

- If you have a fax number, enter it in field 4. Provide your email address in field 5, which will only be used for contacting you regarding time-sensitive issues.

- Specify the tax forms relevant to your case in field 6 and enter the corresponding tax period in field 7.

- Indicate the name of the person who can be contacted regarding your request in field 8, followed by entering your daytime phone number in field 9a and the best time to call in field 10.

- If relevant, check the box in field 9b to consent to leave confidential information on your voicemail.

- In field 11, indicate any special communication needs you may have.

- Describe your tax issue in field 12a and detail the assistance you are requesting in field 12b, attaching additional sheets if necessary.

- Ensure the taxpayer or business entity designee signs in section 13a and enters the date in 13b. If applicable, have your spouse or RDP sign in section 14.

- If you are assigning a representative, complete Section 2 by providing the representative's details and include a power of attorney if necessary.

- Once you have filled in all the necessary information, save your changes. You can then download, print, or share your completed form as needed.

Complete your FTB 914 form online now for timely assistance with your tax issues.

Why you received this notice We do not have enough information to approve the California Earned Income Tax Credit (Cal EITC) and/or the Young Child Tax Credit (YCTC) you claimed on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.