Loading

Get Release Of Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Release Of Mortgage online

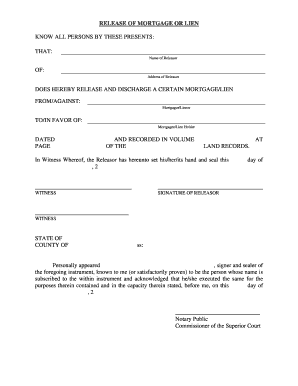

Filling out a Release Of Mortgage is an important step in discharging a mortgage or lien. This guide provides clear and simple instructions to help you complete the form online, ensuring a smooth and efficient process.

Follow the steps to successfully complete the Release Of Mortgage online.

- Press the ‘Get Form’ button to access the Release Of Mortgage form and open it in the online editor.

- Enter the name of the releasor in the designated field at the top of the form. This is the person or entity that is releasing the mortgage or lien.

- Provide the address of the releasor in the specified section. Ensure the address is accurate for proper identification.

- Clearly state the name of the mortgagor or lienor from whom the mortgage or lien is being released in the next field.

- Input the name of the mortgagee or lien holder in the section designated for this purpose. This identifies who the mortgage or lien is paid to.

- Fill in the date on which the release is being executed. This is important for the historical record.

- Complete the page number and volume in which the original mortgage or lien is recorded. This information can typically be found on your original mortgage documents.

- Ensure to add a witness signature section. The witness must sign to validate the release, in accordance with legal requirements.

- The releasor must then provide their signature and date the form. Ensure all signatures are legible and correctly placed.

- Finalize the document by completing the notary public section, including the state and county of notarization, to authenticate the release.

- Once all sections are filled in accurately, save the changes made to the form. You can then choose to download, print, or share the completed Release Of Mortgage.

Complete your digital documents online for a streamlined process today.

A chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle. The movable property, called “chattel,” also acts as collateral for the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.