Loading

Get Property Transfer Tax Fin 579

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Transfer Tax Fin 579 online

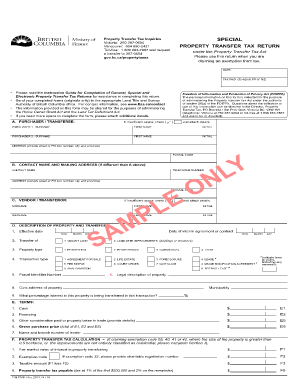

Filling out the Property Transfer Tax Fin 579 form online is a crucial process for individuals needing to declare property transfers in British Columbia. This guide will provide you with detailed and step-by-step instructions to ensure accurate completion of the form.

Follow the steps to complete the Property Transfer Tax Fin 579 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin filling in section A, which requires information about the purchasers or transferees. Enter the surname, first name, and initials for each purchaser. Make sure to include their complete mailing address with postal code.

- Proceed to section B to provide contact details if different from section A. Enter the name, telephone number, and mailing address of the contact person here.

- In section C, fill out details about the vendor or transferor, including surnames, first names, and initials for both parties involved.

- Section D requires a description of the property and the transfer. Specify the effective date, type of property (vacant land or land with improvements), and the transaction type. Make sure to provide the parcel identifier number and legal description of the property.

- Section E involves stating the terms of the transfer, including cash amount and financial details. Fill in the gross purchase price by calculating all components.

- For property transfer tax calculation, go to section F. State the fair market value and any applicable exemption codes before determining the taxable amount and tax payable.

- If you are claiming exemptions, complete section G for transitional tax calculation, outlining fair market value and any applicable tax payable.

- Fill in section I to provide any additional information needed to support your exemption claim, ensuring all necessary details are captured.

- Finally, ensure you complete the signature section, certifying that all information provided is accurate. Enter the date signed and contact telephone numbers for clarification.

- Once all sections are filled out and reviewed, save any changes made, and you can then download, print, or share your completed form.

Complete your property transfer documents online today for a smooth process.

The tax rate is an incremental rate between . 25% and 2.9% based on the purchase price. The rates are published in Form TP-584-NYC-I, Instructions for Form TP-584-NYC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.