Loading

Get Lesson 1 Homework Practice Sales And Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lesson 1 Homework Practice Sales And Income Tax online

Filling out the Lesson 1 Homework Practice Sales And Income Tax form online can be a straightforward process when following the right steps. This guide aims to provide you with clear instructions for successfully completing the form and ensuring accuracy in your calculations.

Follow the steps to accurately complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field at the top of the form. Ensure you spell your name correctly.

- Next, fill in the date. This should reflect the date you are completing the homework.

- Provide your class period in the appropriate field, ensuring that it corresponds to the correct period for your course.

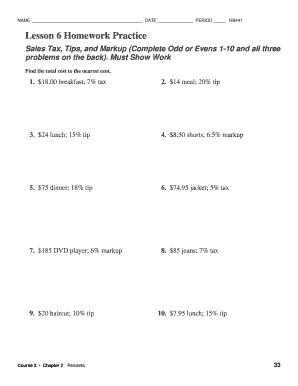

- Proceed to complete the assigned problems. For problems 1 through 10, calculate the total costs, including tax, tips, or markup as specified. Show your work alongside each answer to demonstrate your calculations.

- For problems 11 through 13, apply the correct percentages for gratuity, sales tax, or markup as instructed in the problems. Ensure your calculations are clear and accurate.

- After filling out all sections of the form, review your answers to confirm correctness and completeness.

- Finally, save your changes. You can choose to download, print, or share the completed form as required.

Complete your documents online to ensure timely submission and accurate record-keeping.

Write the sales tax percentage as a decimal. Multiply the sales price of the item by the sales tax rate in decimal form. You now know that the total sales tax charged on a $7.99 purchase is $0.67. So, to determine the total cost of the item, all you must do is add these two together.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.