Loading

Get Nebraska Schedule K-1n - Nebraska Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Schedule K-1N - Nebraska Department Of Revenue online

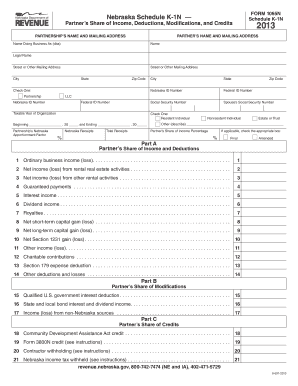

The Nebraska Schedule K-1N is an essential document for partners involved in a partnership, detailing their share of income, deductions, modifications, and credits from the partnership. This guide will walk you through the steps to successfully complete this form online, ensuring accuracy and compliance with Nebraska tax regulations.

Follow the steps to fill out the Nebraska Schedule K-1N online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the partnership's name and mailing address in the designated fields. Please ensure accurate legal names are provided to avoid complications.

- Fill in partner's name and mailing address. If applicable, include the 'Doing Business As' (dba) name.

- Select the appropriate entity type by checking the 'Partnership' or 'LLC' box, and input the respective Nebraska ID numbers and Federal ID number.

- Indicate whether the partner is a resident or nonresident individual by checking the respective box. If applicable, describe any other entity involved.

- Register the partnership's taxable year of organization, specifying the beginning and ending dates of the tax year.

- Input the partnership’s Nebraska apportionment factor.

- Enter each partner's share of income percentage. If applicable, mark any pertinent boxes such as 'Final' or 'Amended'.

- Complete Part A, detailing the partner’s share of income and deductions across all provided lines, ensuring all figures are accurate and legible.

- Move to Part B, and accurately report any modifications to income, including qualified deductions that may apply.

- In Part C, list any eligible credits that the partner may claim from the specified sources.

- Review all entered information for accuracy, ensuring that all necessary fields are complete.

- Finally, save your changes, and choose to download, print, or share the form as needed.

Take the next step in managing your tax responsibilities by filing the Nebraska Schedule K-1N online.

Related links form

Statute of Limitation Periods. If no returns have been filed, the statute of limitation period is five years from the due date of the return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.