Get Nebraska Estate Tax Return Form 706n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Estate Tax Return Form 706n online

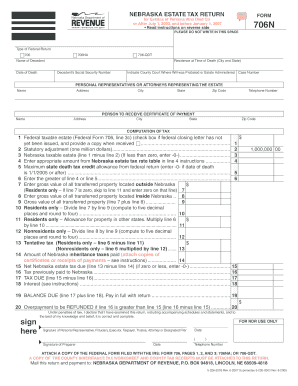

Filling out the Nebraska Estate Tax Return Form 706n can seem challenging, but with careful attention to detail, the process can be straightforward. This guide will help you navigate the form step by step, ensuring you accurately complete each section online.

Follow the steps to complete the Nebraska Estate Tax Return Form 706n online effectively.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the name of the decedent and their date of death in the appropriate fields.

- Complete the residence information at the time of death, specifying the city and state.

- Input the decedent's social security number accurately.

- Indicate the county court where the will was probated or the estate administered.

- Fill in the case number provided by the court.

- Provide the details of the personal representatives or attorneys representing the estate, including name, address, city, state, zip code, and telephone number.

- Identify the person who should receive the certificate of payment by entering their name and address.

- Calculate the federal taxable estate by entering the amount from Federal Form 706, line 3c, in line 1.

- Complete the statutory adjustment by entering the applicable amount in line 2.

- Compute the Nebraska taxable estate by subtracting line 2 from line 1 in line 3.

- Refer to the Nebraska estate tax rate table and enter the appropriate amount in line 4.

- Determine and enter the maximum state death tax credit allowance from the federal return in line 5.

- In line 6, enter the greater amount from line 4 or line 5.

- Proceed to enter gross values for transferred property both outside (line 7) and inside Nebraska (line 8).

- Calculate the total gross value of all transferred property by summing lines 7 and 8 in line 9.

- Complete lines 10 through 12 based on residency status and calculate the tentative tax in line 13.

- Input any Nebraska inheritance taxes paid in line 14, attaching necessary documents.

- Determine the net Nebraska estate tax due in line 15 by taking line 13 and deducting line 14.

- Complete lines 16 through 19 as required, ensuring to check for any overpayment that may apply.

- Finally, sign the form, ensuring the correct party signs as applicable, and date your submission.

- Once completed, save changes, download, print, or share the Nebraska Estate Tax Return Form 706n.

Start filling out the Nebraska Estate Tax Return Form 706n online today to ensure compliance and proper management of estate taxes.

To complete the Nebraska Estate Tax Return Form 706n, you will need various records, including a list of assets owned by the decedent, appraisals of property, bank statements, and outstanding debts. Gathering all relevant financial documents will facilitate the process. Use platforms like uslegalforms to access detailed guides and templates that simplify your filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.