Loading

Get Ar1000v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1000v online

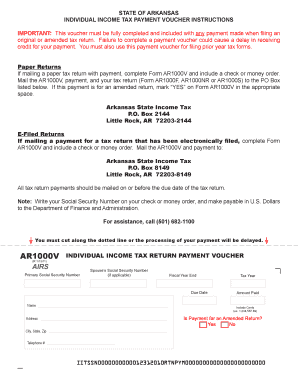

The Ar1000v is an important payment voucher used for individual income tax submissions in Arkansas. This guide provides clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Ar1000v voucher correctly.

- Click the ‘Get Form’ button to access the Ar1000v and open it in your online editor.

- Enter your primary Social Security number in the designated field. If applicable, provide your spouse's Social Security number in the corresponding section.

- Input the fiscal year end date in the specified format to indicate the period for which you are filing the payment.

- Fill in the due date for the payment, ensuring that you use the accurate date relevant to your tax return.

- Provide your name, address, city, state, and zip code in the designated fields to identify yourself properly.

- Include your telephone number so that the tax authority can reach you if there are any questions regarding your payment.

- Specify the tax year for which you are making the payment by selecting the appropriate year from the available options.

- Indicate the amount you are paying, including cents, in the designated box. Ensure that this amount matches your calculations.

- Determine if this payment is for an amended return by marking 'Yes' or 'No' in the appropriate box.

- Once you have completed all fields, review the information entered for accuracy. You can then save changes, print the form, or share it as required.

Start filling out the Ar1000v online to ensure timely and accurate submission of your tax payment.

When filling out an IRS withholding form, such as Form W-4, you will start by providing your personal information and indicating your filing status. Calculate your allowances based on dependents to ensure proper withholding amounts. This process prevents you from overpaying or underpaying taxes. For support in completing these forms, leverage the tools available on the Ar1000v platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.