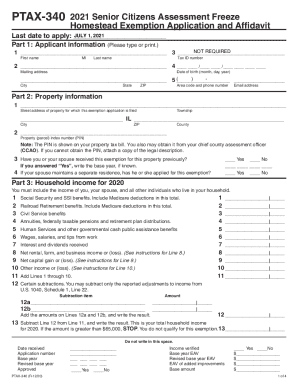

Get IL PTAX-340 2021

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Propertys online

How to fill out and sign Inheritances online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Reporting your revenue and filing all the vital tax documents, including IL PTAX-340, is a US citizen?s sole duty. US Legal Forms tends to make your taxes management a lot more accessible and efficient. You will find any juridical forms you require and fill out them in electronic format.

How to complete IL PTAX-340 on the web:

-

Get IL PTAX-340 in your browser from your device.

-

Open the fillable PDF file with a click.

-

Begin filling out the template box by box, following the prompts of the sophisticated PDF editor?s interface.

-

Correctly input textual material and numbers.

-

Select the Date box to place the current day automatically or change it manually.

-

Apply Signature Wizard to make your personalized e-signature and sign in seconds.

-

Check IRS directions if you still have questions..

-

Click on Done to keep the revisions..

-

Go on to print the file out, save, or send it via E-mail, text message, Fax, USPS without leaving your browser.

Keep your IL PTAX-340 safely. Make sure that all your appropriate papers and records are in order while remembering the time limits and tax rules set with the IRS. Make it simple with US Legal Forms!

How to edit CCAOs: customize forms online

Select a reliable document editing option you can rely on. Edit, complete, and certify CCAOs securely online.

Too often, working with documents, like CCAOs, can be a challenge, especially if you received them online or via email but don’t have access to specialized software. Of course, you can use some workarounds to get around it, but you can end up getting a form that won't fulfill the submission requirements. Utilizing a printer and scanner isn’t an option either because it's time- and resource-consuming.

We offer a simpler and more efficient way of modifying files. An extensive catalog of document templates that are easy to customize and certify, and then make fillable for others. Our solution extends way beyond a collection of templates. One of the best parts of utilizing our option is that you can edit CCAOs directly on our website.

Since it's an online-based solution, it saves you from having to get any software program. Additionally, not all corporate rules allow you to install it on your corporate computer. Here's the best way to easily and securely complete your documents with our platform.

- Hit the Get Form > you’ll be instantly redirected to our editor.

- Once opened, you can start the customization process.

- Select checkmark or circle, line, arrow and cross and other choices to annotate your form.

- Pick the date option to add a particular date to your document.

- Add text boxes, images and notes and more to enrich the content.

- Use the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to create and add your legally-binding signature.

- Hit DONE and save, print, and pass around or get the output.

Say goodbye to paper and other inefficient methods for modifying your CCAOs or other documents. Use our solution instead that includes one of the richest libraries of ready-to-edit templates and a powerful document editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing SSA

Watch this short video to get useful advice about how to complete the subtractions. Make the process much faster and easier with these simple step-by-step instructions.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IL PTAX-340

- carryover

- iras

- ssi

- roth

- SSA

- subtractions

- leasehold

- ILCS

- propertys

- 12b

- 12a

- inheritances

- CCAOs

- Clinton

- SCAFHE

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.