Loading

Get Discharge Of Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Discharge Of Mortgage online

Filling out a Discharge Of Mortgage form is an essential step for individuals looking to clear a mortgage on a property. This guide offers detailed instructions to help you navigate the online process with ease and confidence.

Follow the steps to complete your Discharge Of Mortgage form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

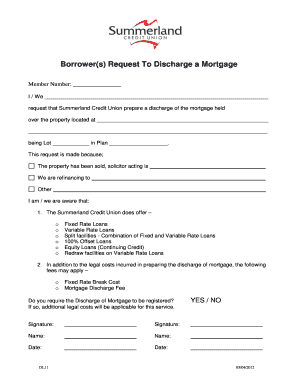

- In the member number field, enter the unique identification number provided by your credit union.

- In the 'I / We' section, provide your names as they appear on the mortgage documents.

- Fill out the property address where the mortgage is held, ensuring accuracy in each detail.

- Specify the lot and plan numbers associated with your property in the designated fields.

- Indicate the reason for your request by selecting from the provided options, or if necessary, specify additional details.

- Review the list of loan types provided by Summerland Credit Union and ensure you understand them; this section outlines options available for borrowers.

- Be aware of additional potential fees, such as the fixed rate break cost and mortgage discharge fee, and mark if these apply to you.

- Decide whether you need the Discharge of Mortgage to be registered; if yes, additional legal costs will be incurred.

- Sign the document in the signature fields, ensuring both borrowers complete this step if applicable.

- Enter your printed names and the date of signing in the corresponding fields.

- Once all fields are completed accurately, save your changes, and download, print, or share the completed form as needed.

Complete your Discharge Of Mortgage form online today and ensure a smooth mortgage discharge process.

A formal deed of release follows the mortgage discharge letter, although sometimes it takes several weeks for this document to come through. The release is similar to a quitclaim deed. By signing it, the lender transfer all its rights and interest in the property back to the borrower.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.