Notice of Intent to Perform by Corporation or LLC

Note: This summary is not intended to be an all-inclusive discussion of Kansas's construction or mechanic's lien laws,

but does include basic provisions.

What is a construction or mechanic's lien?

Every state permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their state should always consult their state statutes directly.

Who can file a lien in this state?

"Whenever any person,

at or with the owner's request or consent shall perform work, make repairs

or improvements or replace, add or install equipment on any goods, personal

property, chattels, horses, mules, wagons, buggies, automobiles, trucks,

trailers, locomotives, railroad rolling stock, barges, aircraft, equipment

of all kinds, including but not limited to construction equipment, vehicles

of all kinds, and farm implements of whatsoever kind, a first and prior

lien on such personal property is hereby created in favor of such person

performing such work, making such repairs or improvements or replacing,

adding or installing such equipment..." Kan. Stat. Ann. §58-201.

How long does a party have to file a lien?

A contractor must file

a lien statement within four months of the last day that labor and/or material

was provided. A subcontractor must also file a lien statement, but

must serve a copy of the statement on the owner within three months of

the last date of furnishing of labor and/or materials.

How long is a lien good for?

A lien claimant must

bring an action to foreclose on a lien within one year of the filing of

the lien statement.

Are liens assignable?

All claims and rights

of action to recover under Kansas's Lien statute are assignable.

Where a statement has been filed and recorded, the assignment may be made

by separate instrument in writing attached to the original lien.

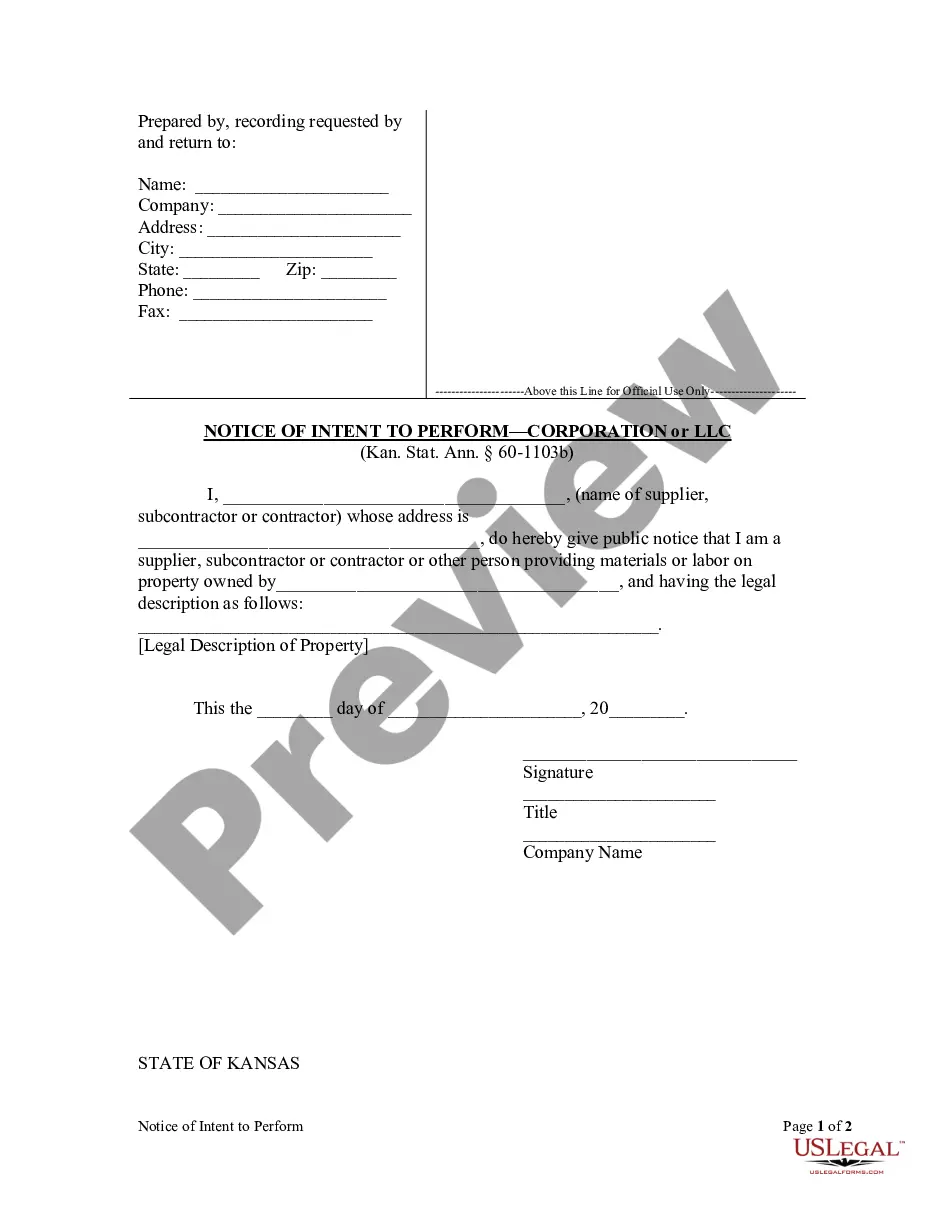

Does this state require or provide for a notice

from contractors, subcontractors, and laborers to property owners?

A subcontractor performing

work on residential property is required to provide the property owner

with a form warning regarding the possibility of a lien. If the subcontractor

files a lien statement, it must be attached to an affidavit attesting to

the fact that the warning was provided.

Also, a subcontractor

working on the construction of new residential property is required to

provide the property owner with a Notice of Intent to Perform.

Does this state require or provide for a notice

from the property owner to the contractor, subcontractor, or laborers?

Property owners may

provide subcontractors with an acknowledgment of receipt of the above mentioned

warning. In addition, after payment in full of a lien claim, the

property owner may demand that the lien claimant provide a written release

of said lien.

Does this state require a notice prior to starting

work, or after work has been completed?

No. Kansas statutes

do not require a Notice of Commencement or a Notice of Completion as required in

some other states.

Does this state permit a person with an interest

in property to deny responsibility for improvements?

No. Kansas statutes

do not have a provision which permits the denial of responsibility for

improvements.

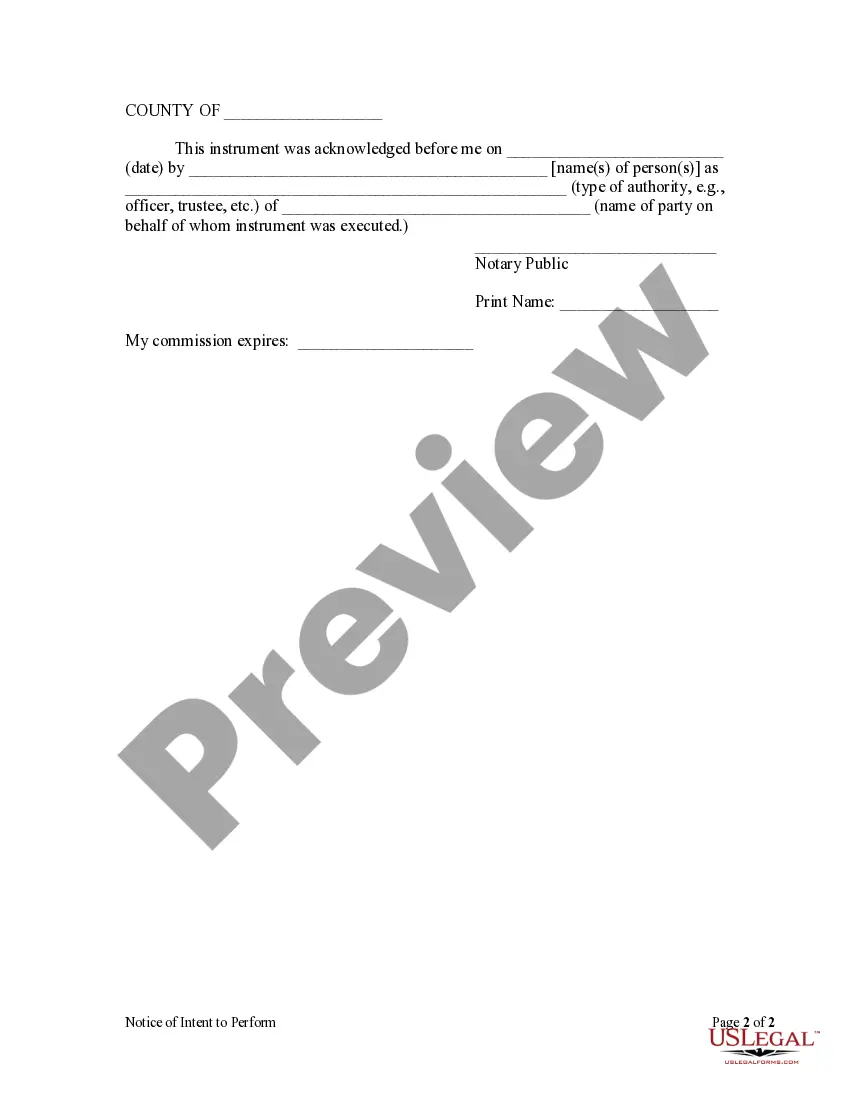

Is a notice attesting to the satisfaction of a

lien provided for or required?

Yes. Kansas law requires

a subcontractor who has filed a notice of intent to perform to also file

a written release of said lien.

By what method does the law of this state permit

the release of a lien?

A lien may be

released by payment in full or expiration of the statute of limitations,

as well as the filing of a bond.

Does this state permit the use of a bond to release

a lien?

Yes.

Kansas law permits the contractor or the owner to execute a bond in the

amount of the contract price. If approved by a judge of the circuit

court, no lien shall attach. Liens already filed are discharged.