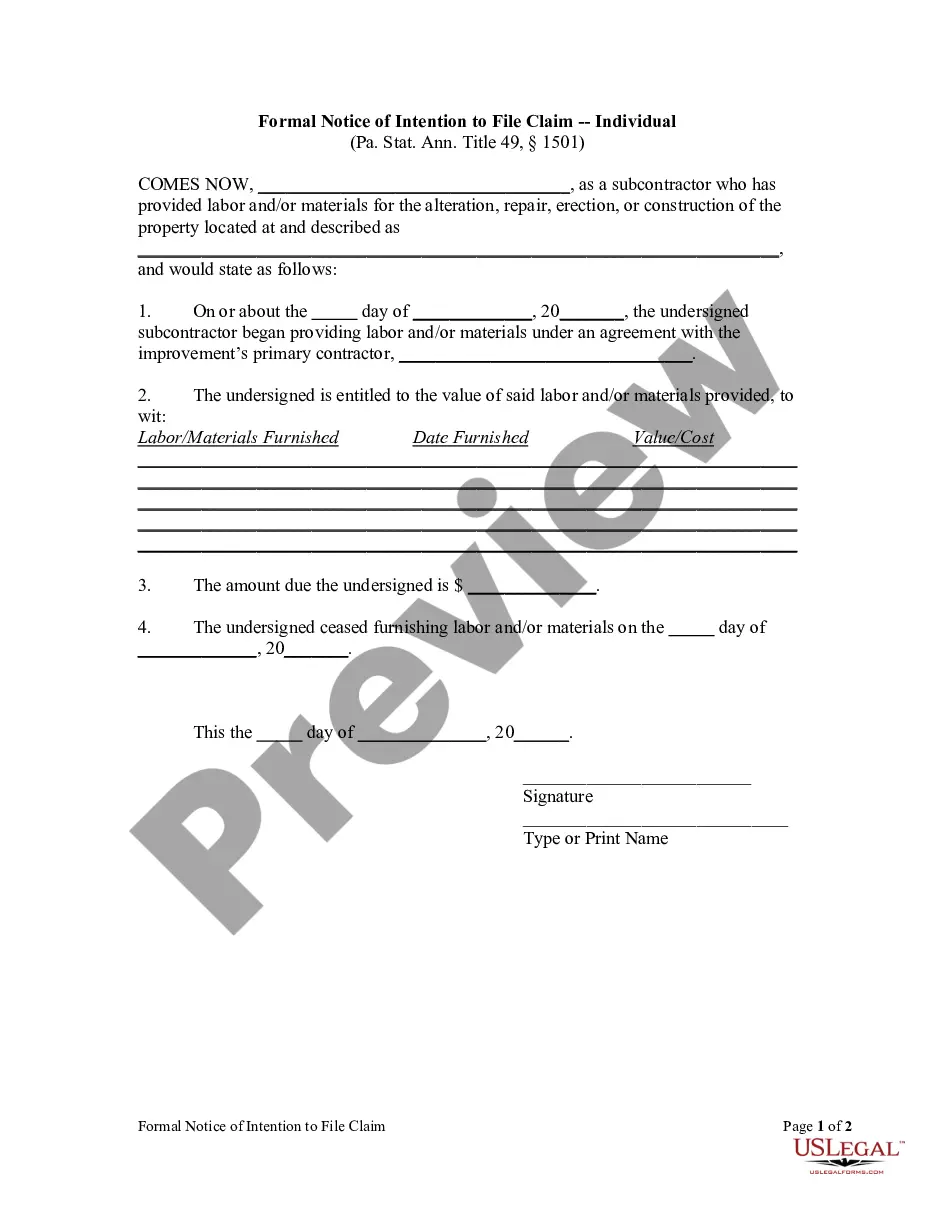

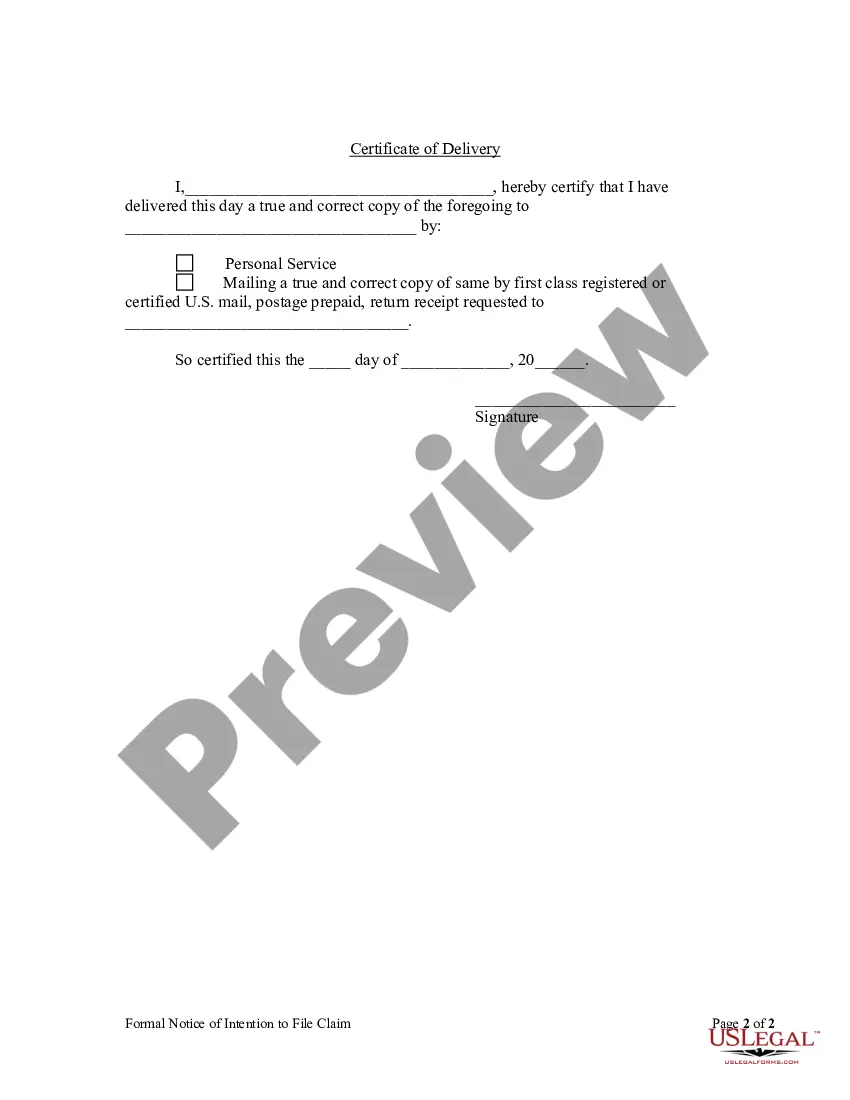

A subcontractor who provides labor and/or material for the alteration and repair of property is required to provide the owner with a Preliminary Notice of Intent to Claim Lien. However, regardless of whether the subcontractor is required to provide a preliminary notice, a subcontractor is ALSO required to provide the property owner with a Formal Notice of Intention to Claim Lien. A Formal Notice must be provided at least thirty (30) days before a lien claim is filed and must be served on the property owner in person, or on his agent, or by first class, registered or certified mail.

Introduction: A Pa file lien without notice, also known as a Pennsylvania file lien without notice, is a legal claim filed by a creditor against a property located in Pennsylvania without providing prior notice to the property owner. This type of lien is often utilized when a debtor fails to repay a debt or fulfill a financial obligation. Types of Pa file lien without notice: 1. Mechanics' lien: A mechanics' lien is a type of Pa file lien without notice that is commonly used by contractors, subcontractors, and suppliers in the construction industry. When these parties are not paid for their services or materials provided to improve a property, they can file a mechanics' lien to secure their financial interest in the property. 2. Tax lien: Another significant type of Pa file lien without notice is a tax lien. When an individual or business neglects to pay their taxes, the Pennsylvania Department of Revenue may file a tax lien against their property. This lien allows the government to claim some or all of the property's value to satisfy the tax debt. 3. Judgment lien: A judgment lien is yet another form of Pa file lien without notice that arises when a creditor obtains a court judgment against a debtor but fails to receive payment. The creditor can then proceed to file a judgment lien on the debtor's property, making it difficult for the debtor to sell or transfer the property without first satisfying the debt. 4. HOA lien: In Pennsylvania, homeowners' associations (Has) have the authority to file a lien against a homeowner's property without prior notice in cases of non-payment of association fees, fines, or assessments. This type of Pa file lien without notice allows the HOA to collect owed amounts and potentially foreclose on the property if the debt remains unpaid. 5. Utility lien: Utilities, such as water, gas, or electricity providers, can also file a lien without notice against a property owner who fails to pay their bills. This utility lien gives the utility provider the ability to seek payment by potentially foreclosing on the property if the debt is not resolved. Conclusion: A Pa file lien without notice is a legal claim against a property in Pennsylvania that allows creditors, contractors, tax agencies, Has, and utility providers to secure their interests when owed debts or obligations go unpaid. Different types of Pa file lien without notice include mechanics' liens, tax liens, judgment liens, HOA liens, and utility liens. Property owners should be aware of these potential liens and address any outstanding debts promptly to avoid legal complications.