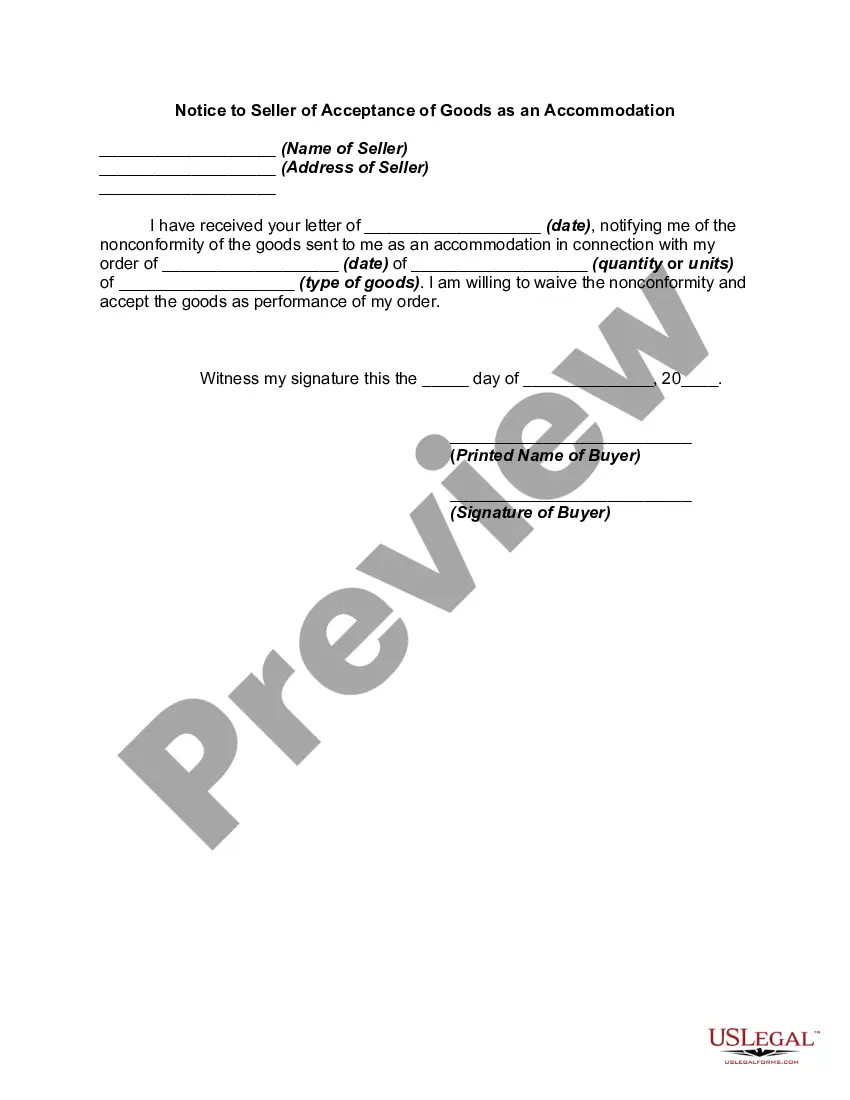

A Bailment is the temporary placement of control over, or possession of, personal property by one person, the bailor, into the hands of another, the bailee, for a designated purpose upon which the parties have agreed.

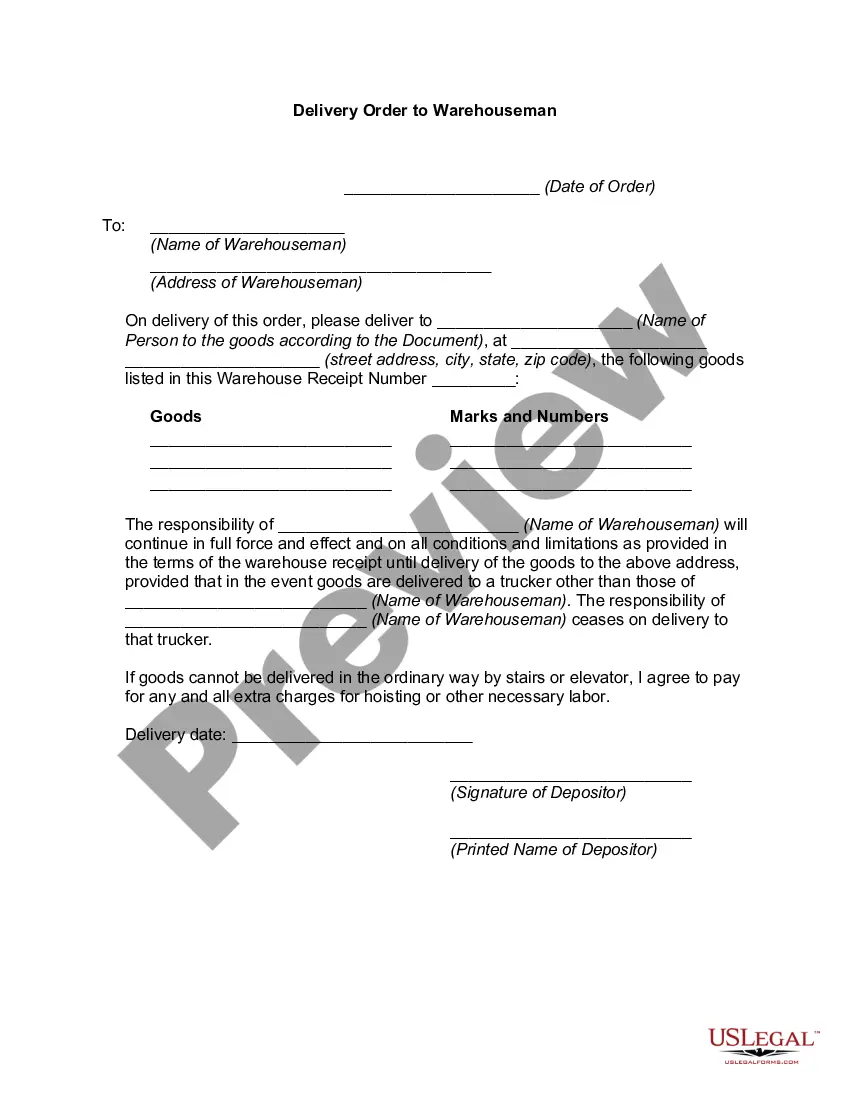

U.C.C. § 7-207 requires that a warehouse must generally keep separate the goods covered by each warehouse receipt so as to permit the identification of the goods covered by each receipt and their delivery or surrender to the holder of the receipt or other person entitled to the goods.