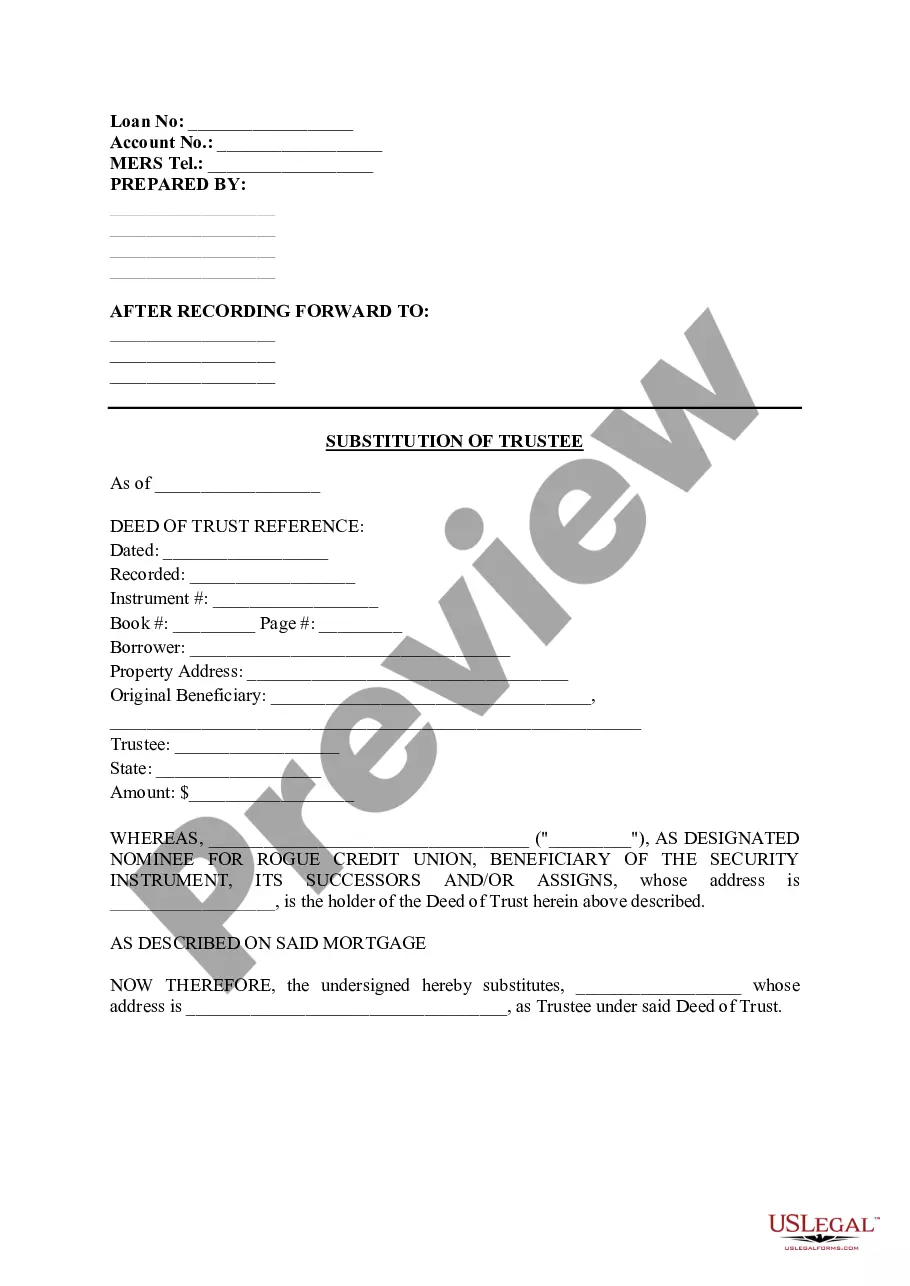

Portland Oregon Substitution of Trustee

Description

How to fill out Portland Oregon Substitution Of Trustee?

We consistently endeavor to minimize or evade legal repercussions when managing intricate legal or financial issues.

To achieve this, we enroll in legal services that are generally quite expensive.

However, not every legal matter is equally complicated. Many can be addressed by ourselves.

US Legal Forms is a digital repository of current DIY legal documents covering various topics, from wills and powers of attorney to articles of incorporation and dissolution petitions.

Just Log In to your account and click the Get button next to it. If you've lost the document, you can always download it again from within the My documents tab.

- Our platform empowers you to handle your issues independently without relying on a lawyer's services.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are specific to states and regions, which significantly simplifies the search process.

- Utilize US Legal Forms whenever you need to locate and download the Portland Oregon Substitution of Trustee or any other document quickly and safely.

Form popularity

FAQ

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

The trustee must be one of the following: An attorney under the Oregon State Bar. A law firm under the Oregon State Bar. A title company.

A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower. In most cases, the trustee is an escrow If you don't repay your loan, the escrow company's attorney must begin the foreclosure process.

A deed of reconveyance is a document that transfers the title of a property to the borrower from the bank or mortgage holder once a mortgage has been satisfied. It clears the lender from the title to the property.

A substitution of trustee simply names a new person to take over that position, as well as a secondary trustee if necessary. A substitution of trustee and full reconveyance serves two purposes: It enables a lender (such as a mortgage company) to appoint a new trustee. It allows the new trustee to release the lien.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOhioYOklahomaYOregonYPennsylvaniaY47 more rows

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

A substitution of trustee simply names a new person to take over that position, as well as a secondary trustee if necessary. A substitution of trustee and full reconveyance serves two purposes: It enables a lender (such as a mortgage company) to appoint a new trustee. It allows the new trustee to release the lien.