Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal assistance that is typically quite expensive. However, not every legal issue is that complicated.

Many can be handled independently.

US Legal Forms is a web-based directory of current do-it-yourself legal papers covering everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to manage your affairs personally without the need for a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, greatly simplifying the search process.

- Utilize US Legal Forms whenever you require easy and secure access to the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual or any other document.

Form popularity

FAQ

To speak with someone at the Miami-Dade Clerk of Courts, you can call their main office directly or visit their website for contact information. Their staff can assist you with inquiries about obtaining a Miami-Dade Florida Satisfaction, Release, or Cancellation of Mortgage by Individual. Utilizing our USLegalForms platform can also guide you through your questions, providing helpful platform resources. Remember, it's always best to reach out during business hours for prompt assistance.

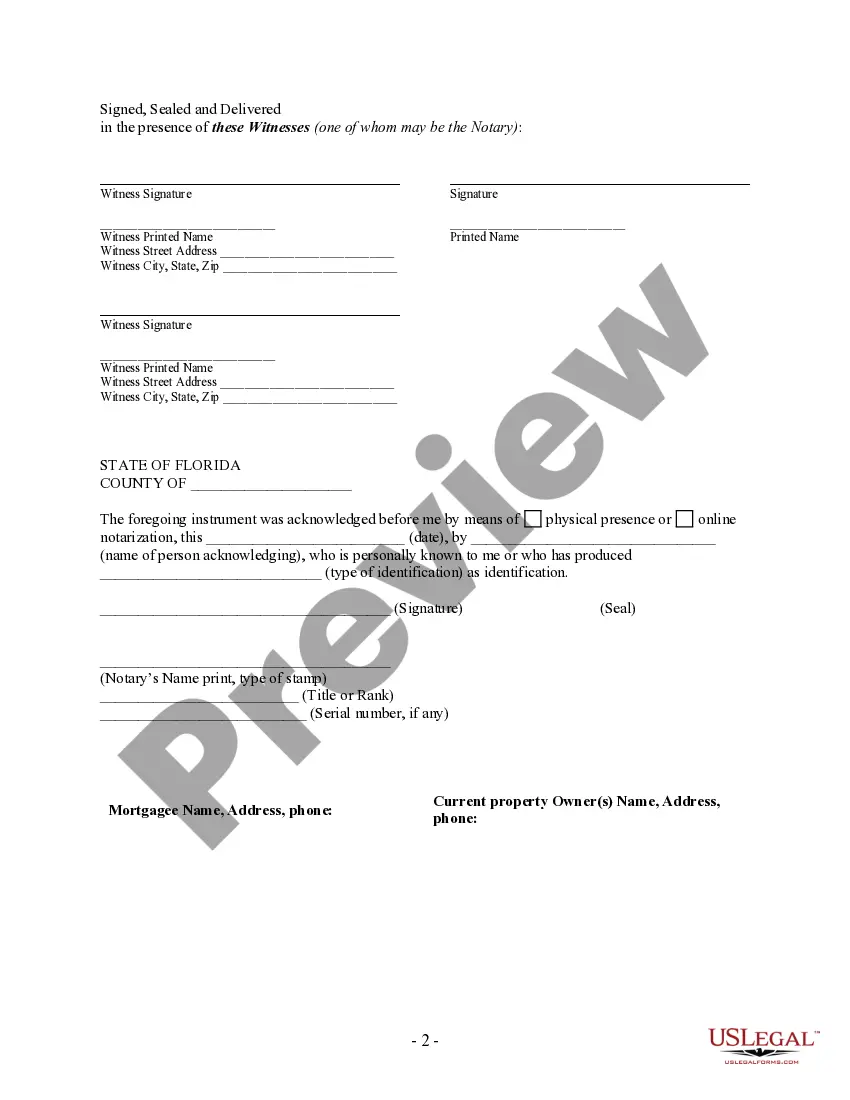

To record a satisfaction of a mortgage in Florida, first ensure that the satisfaction document is complete and notarized. Next, submit it to the appropriate county office, along with any necessary fees. By doing so, you will complete the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual, officially updating the public record.

Yes, in Florida, a satisfaction of mortgage must be notarized to be considered valid. The notarization process helps confirm the authenticity of the signatures involved, thereby providing legal backing for the document. This step is crucial in the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual to protect all parties involved.

In Florida, a satisfaction of mortgage typically does not require notarization for it to be valid; however, notarization may be beneficial for verification purposes. It ensures that both parties are protected and that the document can be trusted. When pursuing your Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual, having properly executed documentation is crucial for clarity and security.

The timeline for receiving a mortgage satisfaction letter can vary, but it typically takes a few weeks after the final payment. Lenders are legally obligated to provide the letter within a reasonable timeframe. If you need assistance in expediting this process, consider using USLegalForms to help you navigate your Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Statute 695 in Florida pertains to the recording of certain documents related to real estate transactions, including mortgages. This law outlines the requirements for recording a satisfaction of mortgage, ensuring that property owners have a clear record of their financial obligations. Understanding this statute can be beneficial when handling your Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual effectively.

In Florida, a lender is required to record a satisfaction of mortgage within 60 days after receiving the final payment. If they fail to do so, they may face penalties. It is advisable to monitor this timeline closely to ensure that your Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual is secured promptly.

When a satisfaction of mortgage is not recorded, it creates confusion regarding property ownership. A lack of record may lead potential buyers or title companies to believe that there are still outstanding obligations on the property. To protect your interests, it is crucial to ensure that the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual is properly documented to avoid future complications.

You can submit a notice of commencement by either mailing it to the Miami-Dade Clerk's office or delivering it in person. Ensure you have the correct information and signatures required on the form. Once submitted, the notice serves to inform all relevant parties about the commencement of any construction or improvement projects, aiding in the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

Filing a notice of commencement in Florida involves completing a statutory form and submitting it to the county Clerk's office. It is advisable to file this notice before significant work begins to protect your rights. Correctly filing this notice is also critical for the Miami-Dade Florida Satisfaction, Release or Cancellation of Mortgage by Individual, ensuring that all parties are well-informed of the project.