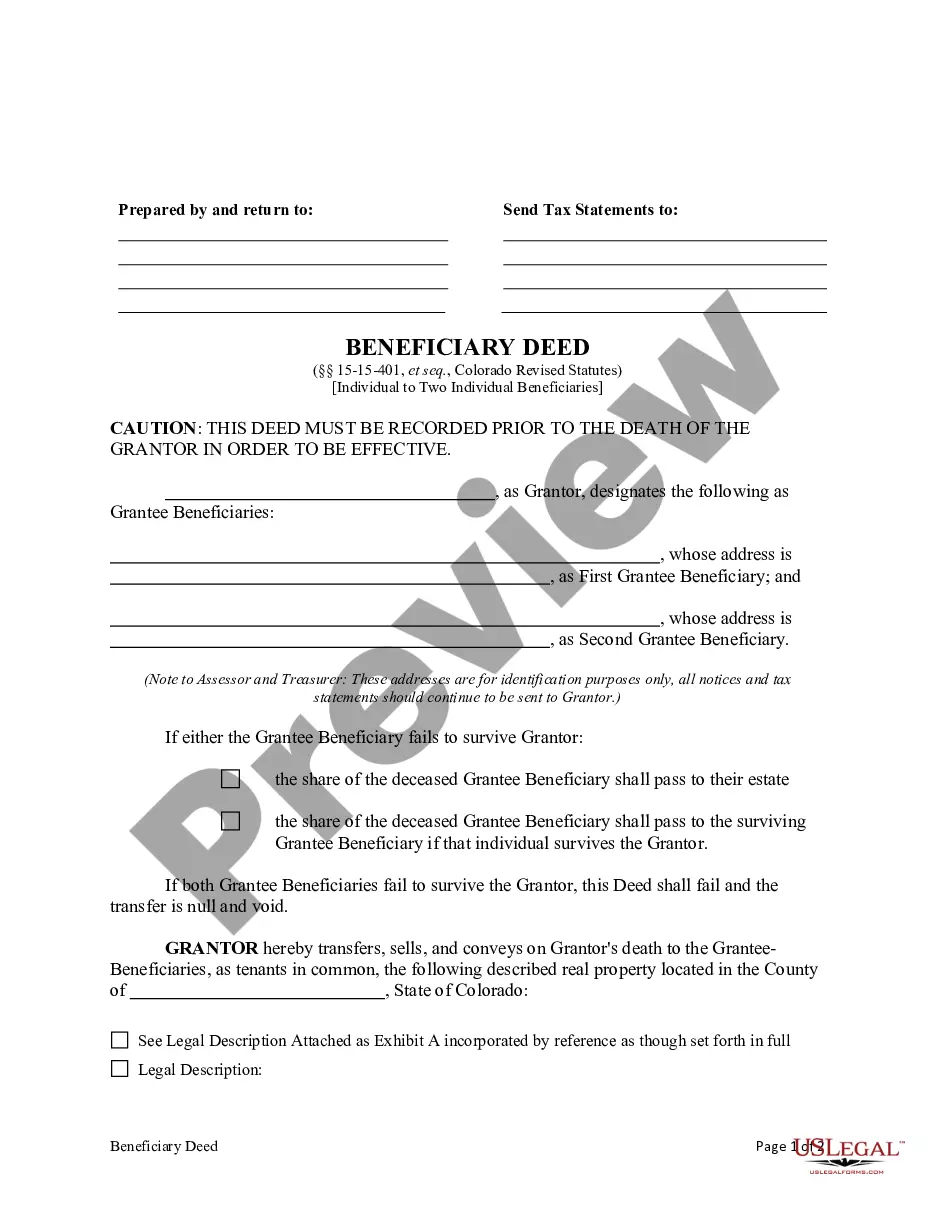

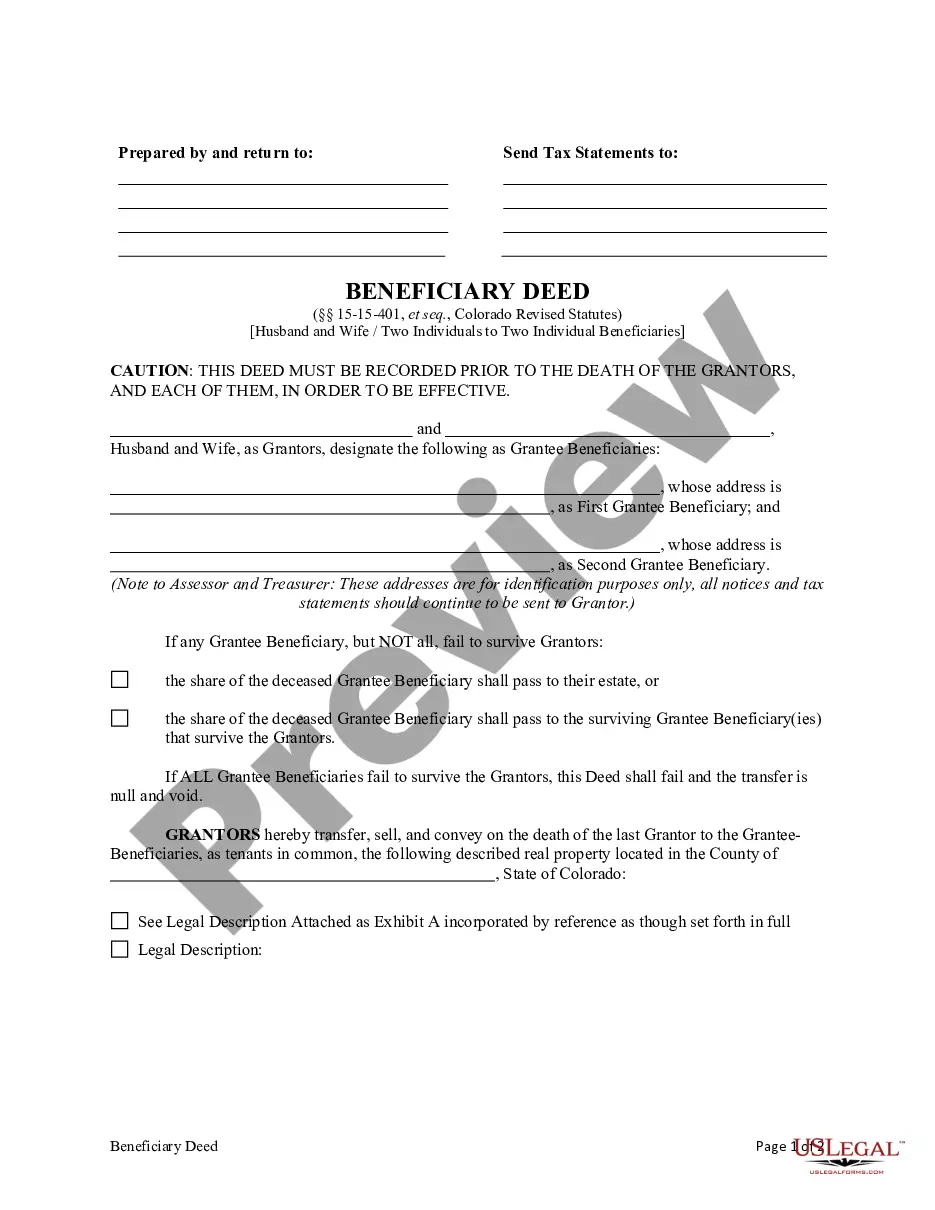

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries

Description

How to fill out Colorado Beneficiary Deed - Individual To Two Individuals Without Successor Beneficiaries?

If you are in search of a legitimate form template, it’s challenging to find a more suitable service than the US Legal Forms site – likely the most extensive online repositories.

Here you can discover thousands of form examples for both business and personal needs categorized by types and states, or by keywords.

Utilizing our high-quality search capability, locating the latest Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the file format and save it on your device. Edit. Fill out, modify, print, and sign the acquired Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries.

- Moreover, the significance of each record is validated by a group of professional attorneys who consistently evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have located the sample you require. Review its description and utilize the Preview option to inspect its content. If it doesn’t fulfill your needs, employ the Search feature at the top of the page to find the necessary document.

- Verify your choice. Select the Buy now option. Subsequently, choose your desired pricing plan and provide information to create an account.

Form popularity

FAQ

Among the drawbacks of transfer on death strategies is the fact that they do not protect against future financial issues. Should the property owner face financial difficulties or lawsuits, the property might still be at risk. Furthermore, establishing an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries does not guarantee the intended heirs will manage the property as desired. Engaging with a platform like UsLegalForms can clarify your options and help minimize issues related to property transfers.

Transfer on death (TOD) accounts may lead to complications if the account holder has substantial debts or legal issues at the time of their death. In such cases, creditors may claim a portion of that account before the beneficiaries receive any assets. Furthermore, an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries does not provide an opportunity for probate management. This can lead to potential conflicts among heirs and unnecessary stress during the transfer process.

One disadvantage of a transfer on death (TOD) deed is that it does not provide any management authority during the property owner’s lifetime. This means if you encounter issues with the property, such as needing repairs or disputes among heirs, the beneficiaries cannot act without your consent. Additionally, an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries does not allow flexibility once established, as it cannot be easily modified or revoked without proper procedures.

Yes, using an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries can help avoid capital gains tax. This type of deed allows the property to pass directly to the beneficiaries upon death, which means there isn't a taxable sale during the transfer. It is important, however, to understand how this impacts the overall tax situation for the beneficiaries inheriting the property. Consulting a tax professional can provide deeper insight into specific scenarios.

There are several disadvantages to consider with the Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries. For instance, if the beneficiaries do not get along, conflicts can arise over the property. Additionally, because the deed does not allow for asset protection from creditors, the property may still be vulnerable if the beneficiaries face financial issues.

While hiring a lawyer is not mandatory for creating an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, it can be beneficial. A real estate attorney can help you navigate the legal intricacies and ensure all requirements are met. This is particularly important if your situation involves complex family dynamics or properties with multiple owners.

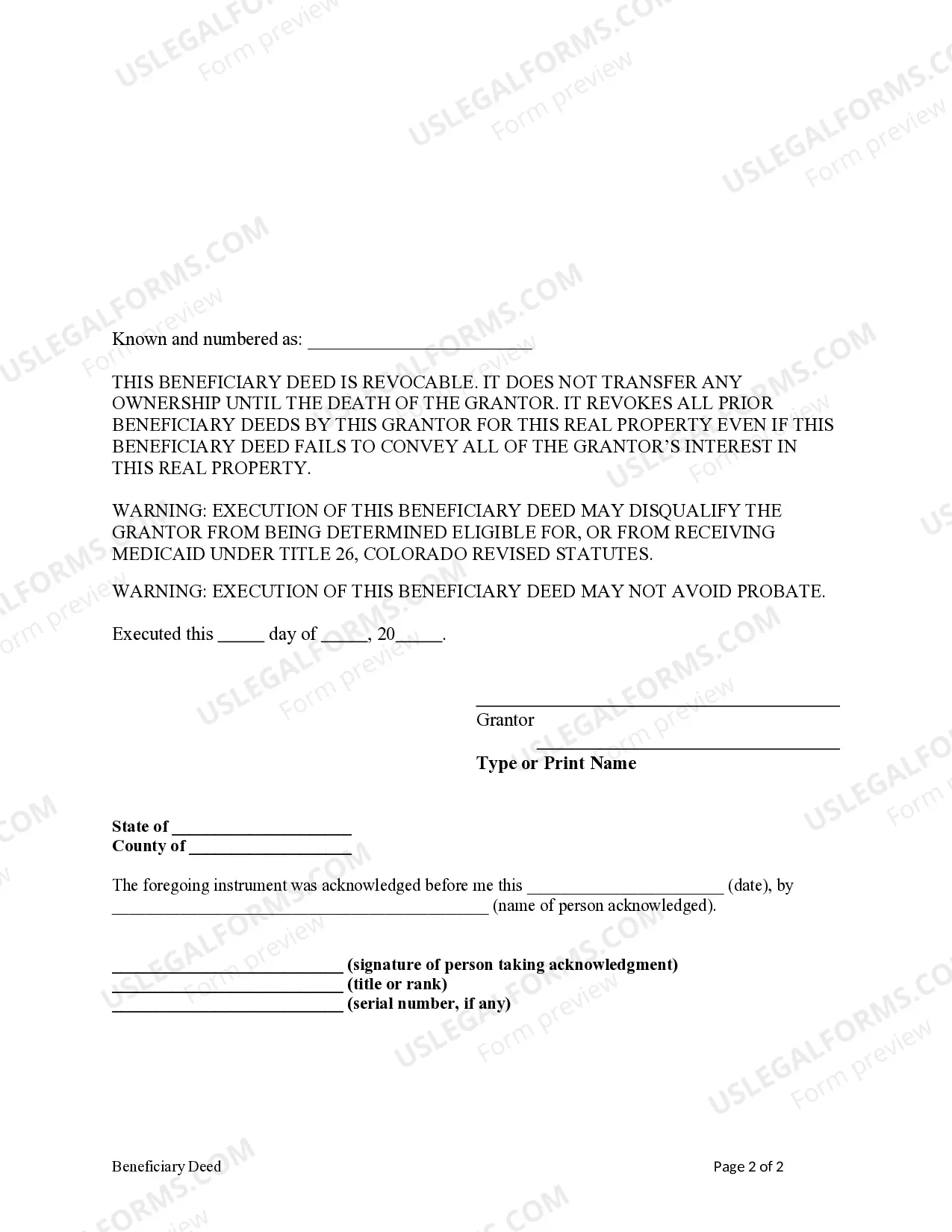

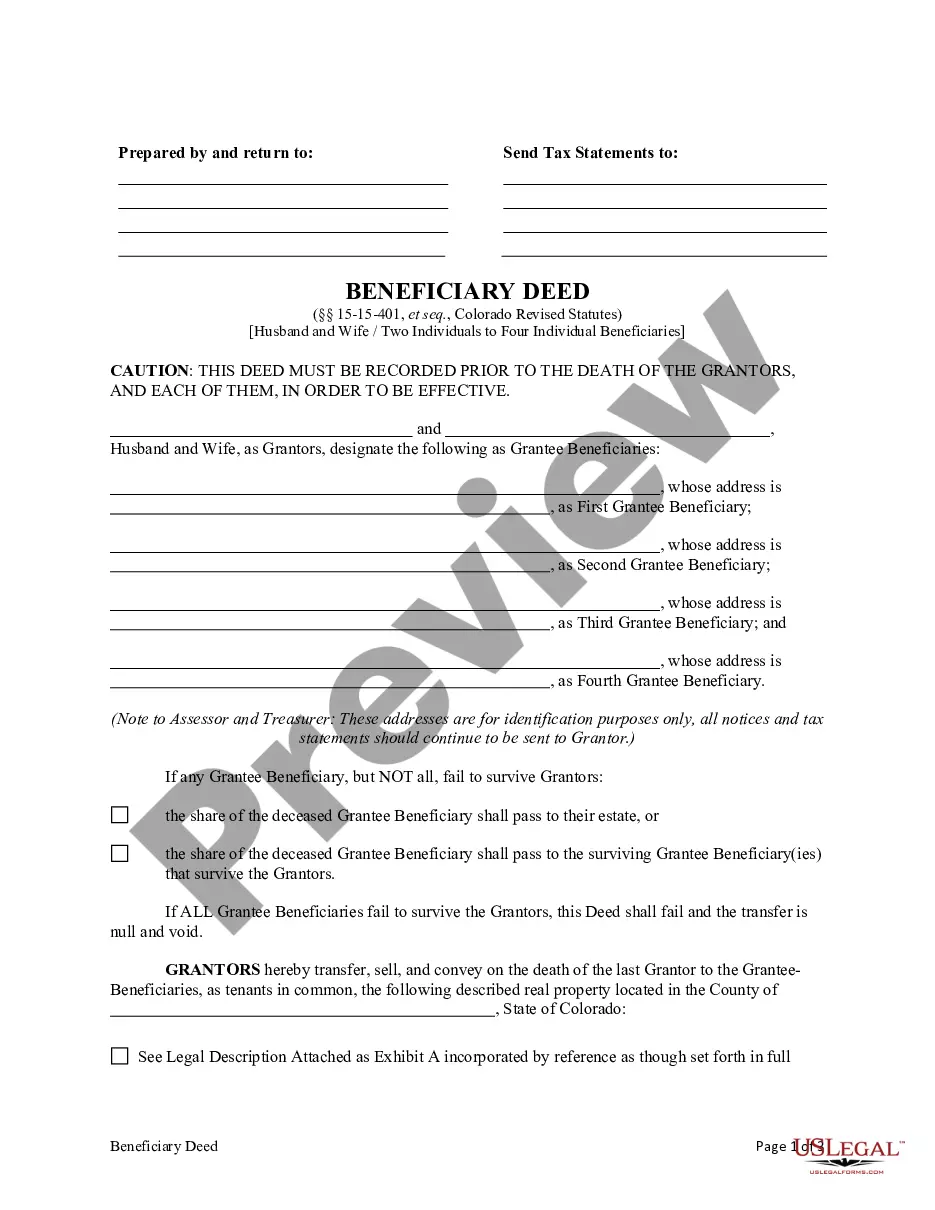

To properly execute an Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, you need to follow several requirements. The deed must contain the names of both individuals, a clear legal description of the property, and be signed by the owner or owners. You should also ensure the deed is notarized and recorded in the county where the property is located to become effective.

In Colorado, the Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries must meet specific rules to be valid. For instance, the deed must be recorded with the county clerk and recorder's office before the owner's death. Additionally, the deed should explicitly state the intention of transferring property to the two individuals without naming any successor beneficiaries.

The Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries does serve as proof of ownership for the property during the owner's lifetime. It ensures that the designated individuals inherit the property upon the owner's passing. However, until the owner dies, the deed does not transfer ownership or provide any rights over the property to the beneficiaries.

Writing a beneficiary deed requires careful attention to detail. Start with the title, then include the grantor’s name and the legal description of the property. Describe the beneficiaries accurately, following the guidelines for the Arvada Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries to ensure it meets legal standards and conveys your intention clearly.