West Virginia Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Sample Letter To Debt Collector Re Fair Debt Collection And Practices Act?

Are you currently inside a place the place you need to have paperwork for sometimes company or specific reasons virtually every day time? There are a lot of authorized record themes available online, but getting versions you can trust isn`t straightforward. US Legal Forms gives 1000s of form themes, such as the West Virginia Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act, that are written to fulfill state and federal requirements.

Should you be previously knowledgeable about US Legal Forms internet site and also have your account, just log in. Afterward, it is possible to down load the West Virginia Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act format.

If you do not offer an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for that proper metropolis/region.

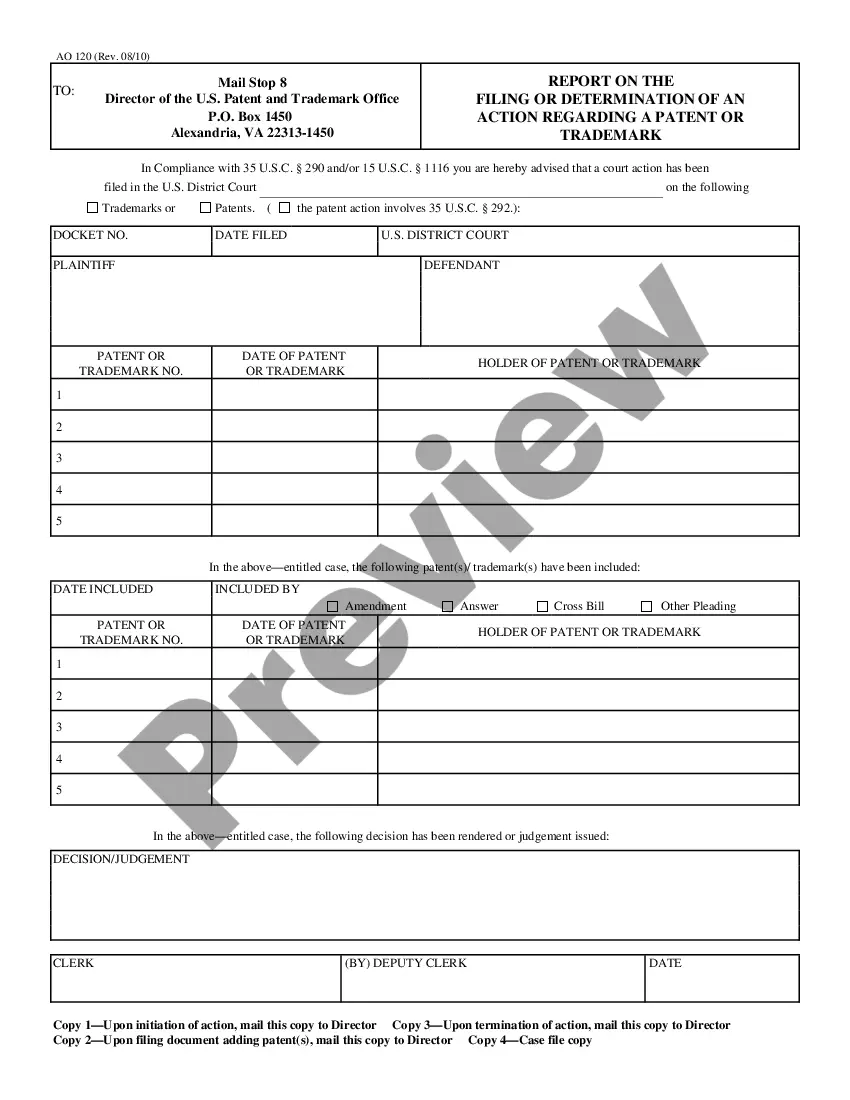

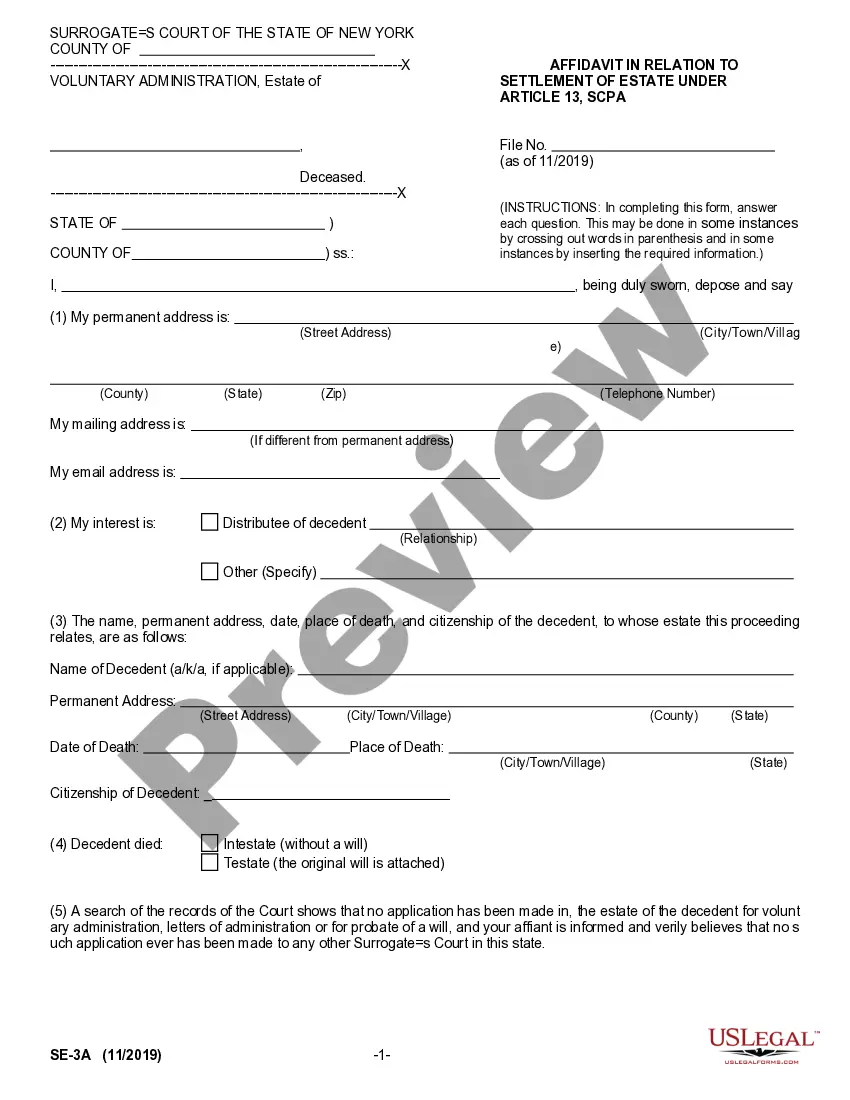

- Utilize the Review key to analyze the shape.

- Read the outline to actually have selected the correct form.

- In the event the form isn`t what you are searching for, use the Research industry to find the form that fits your needs and requirements.

- Once you get the proper form, just click Buy now.

- Opt for the prices plan you would like, fill out the required information and facts to create your money, and pay money for an order utilizing your PayPal or bank card.

- Select a practical paper format and down load your backup.

Discover every one of the record themes you might have purchased in the My Forms menu. You can aquire a further backup of West Virginia Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act anytime, if needed. Just select the essential form to down load or produce the record format.

Use US Legal Forms, by far the most considerable collection of authorized varieties, to save time and steer clear of errors. The support gives professionally created authorized record themes which can be used for a selection of reasons. Make your account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Creditors have five (5) years to file their debt collection suit for the sum of money owed on an open account. If the debt is for the non-payment of an outstanding balance on a credit card, then the creditor has ten (10) years to file a collection lawsuit against the debtor.

A debt collector may not harass, abuse, mislead, deceive, or be unfair to you. A federal law called the Fair Debt Collection Practices Act makes this illegal. This law does not cover business or commercial debts. This law applies to debt collectors but doesn't apply to creditors who collect their own debts.

West Virginia deceptive trade practices laws are stated in West Virginia Consumer Credit and Protection Act (?Act?). The Act is stated in West Virginia Code, Chapter 46A. Section 46A-6-102 prohibits false advertising. Under Section 46A-6-106 a consumer who has suffered any ascertainable loss can bring an action.

West Virginia law, specifically WV Code §46A-2-127, states that debt collectors should not deceive, mislead, or perform fraudulent activities when collecting and attempting to collect a debt. Examples of these bad business practices include: Refusal to give their true name and hide behind the company's name.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.