Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Are you in a location where you frequently require documents for either personal or business use? There are numerous legal document templates available online, but finding reliable ones can be challenging.

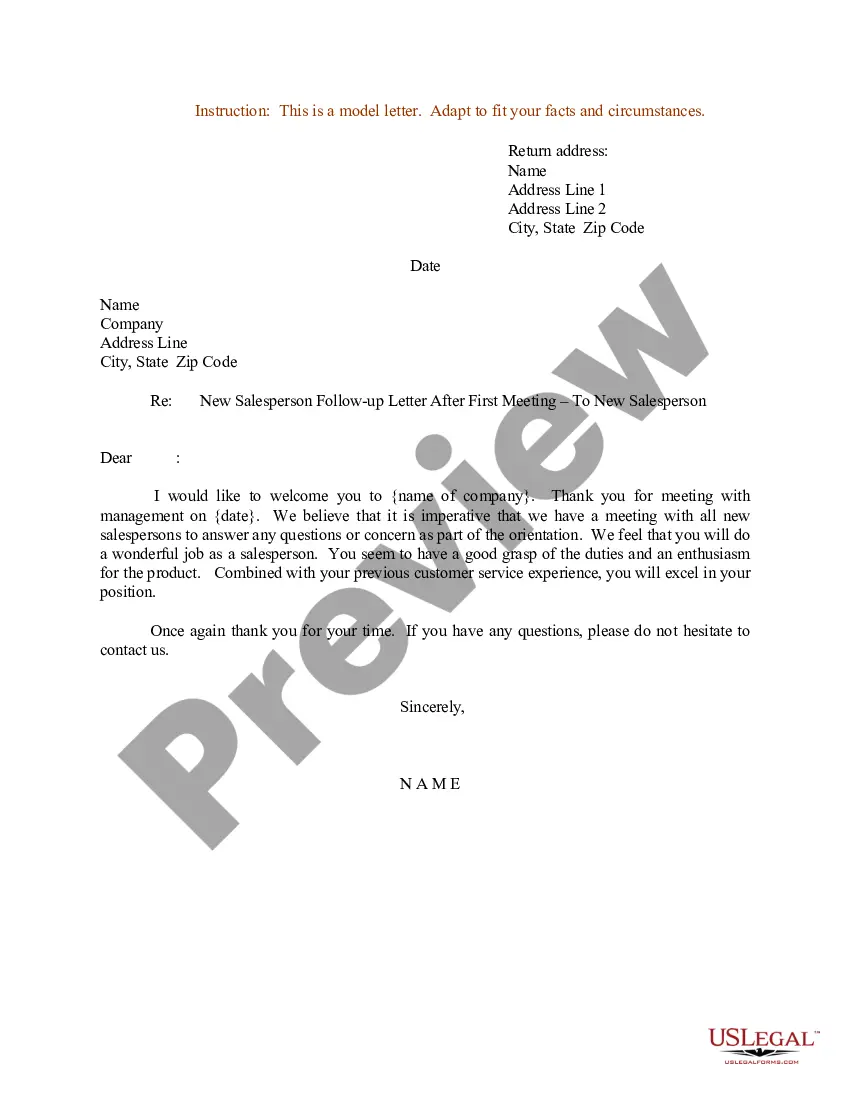

US Legal Forms offers a vast array of form templates, such as the Virginia Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation, designed to comply with both federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Virginia Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation template.

Select a convenient document format and download your copy.

You can view all the document templates you have purchased in the My documents section. You can obtain another copy of the Virginia Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation whenever necessary. Just access the desired form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate city/region.

- Utilize the Review feature to evaluate the form.

- Check the outline to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find a form that meets your needs and criteria.

- Once you have the correct form, click Get now.

- Choose the payment plan you prefer, fill in the required information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

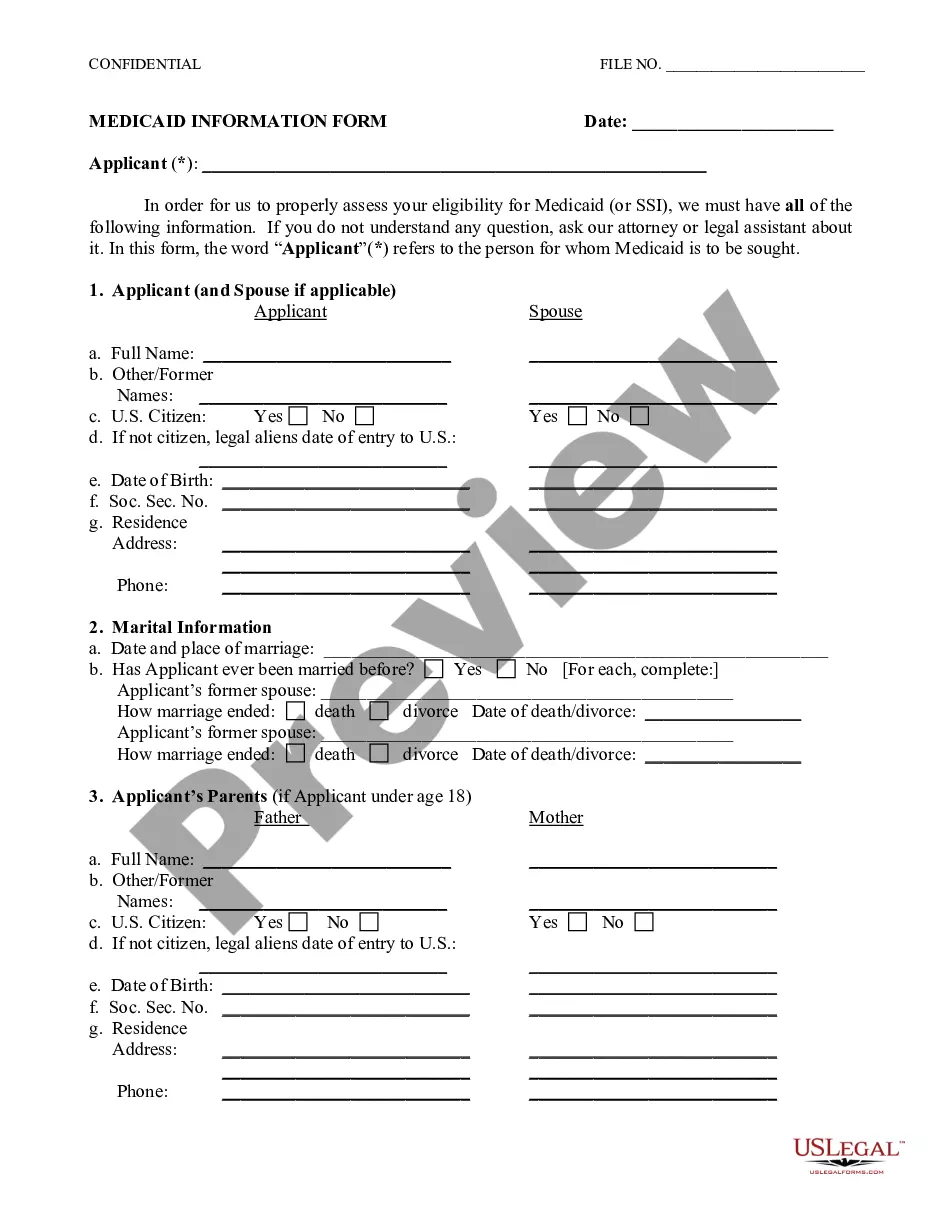

A shareholder buy-sell agreement is a legally binding contract that outlines how shares will be bought and sold among shareholders. This agreement is particularly important in the context of a closely held corporation, as it defines the conditions under which shares can be transferred. It protects the interests of existing shareholders by providing a fair mechanism for buying out shares. For those drafting a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, this document can help facilitate smooth transitions in ownership.

Another term commonly used for a shareholder agreement is a stockholders' agreement. This document is essential for outlining the rights and obligations of shareholders in a closely held corporation. By establishing clear terms, it helps prevent disputes and provides a roadmap for decision-making. If you require a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, such an agreement can be vital in ensuring collaboration among shareholders.

This process is known as a buyout under the buy-sell agreement, specifically through a provision designed for the death of a shareholder. A well-structured Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation includes clear terms that facilitate the smooth transition of ownership following a stockholder's death. This agreement safeguards the interests of remaining shareholders by ensuring that shares are transferred in a fair manner and that the corporation maintains control over who becomes an owner. By implementing this agreement, you can avoid prolonged legal disputes and emotional strain during an already difficult time.

To write a shareholders agreement, start by defining the roles and responsibilities of each shareholder. Include provisions for decision-making, management structure, and what happens in various scenarios, such as a shareholder's departure. Templates from platforms like USLegalForms can guide you through creating a comprehensive agreement, making sure it aligns with your Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

A shareholder agreement outlines the relationships and responsibilities between shareholders, while a buy-sell agreement specifies the terms under which shares can be bought or sold. The buy-sell agreement acts as a safety net to manage ownership transitions effectively, providing clear guidelines for valuing shares. Understanding these distinctions is crucial when creating a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

One disadvantage of a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is that it can impose financial constraints on shareholders when triggering events occur. Additionally, if not correctly valued, it may lead to disputes over ownership prices. There's also the potential for rigidity, as the agreement may not easily adapt to changing business circumstances. Careful planning and periodic reviews can help mitigate these challenges and keep the agreement relevant.

You might not need a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation if you have a clear exit strategy and trust that shareholder relationships will remain amicable. In small, family-run businesses where ownership transfer is uncomplicated, this agreement may seem unnecessary. However, do consider potential future conflicts that could arise; the absence of this agreement might lead to complications. Taking proactive steps can often save time and resources.

A shareholder agreement and a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation are related but serve different purposes. A shareholder agreement governs the rights and responsibilities of shareholders, while a buy-sell agreement specifically addresses the conditions under which shares may be sold or transferred. Both documents complement each other and can enhance the corporation's operational stability. It’s important to understand the distinctions when drafting these agreements.

The main purpose of a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is to establish a plan for the transfer of ownership. This framework protects both parties in the event of unforeseen circumstances, such as death or disability. It ensures the continuity of the business and minimizes disputes among shareholders. Ultimately, it provides peace of mind and financial security for all involved.

Setting up a Virginia Buy-Sell Agreement between Two Shareholders of Closely Held Corporation involves several key steps. Begin by clearly defining your goals and expectations with your co-shareholder. Next, draft the agreement to include essential elements such as valuation procedures, triggering events, and payment options. Utilizing platforms like uslegalforms can streamline the process, ensuring that you have all the necessary documentation in place.