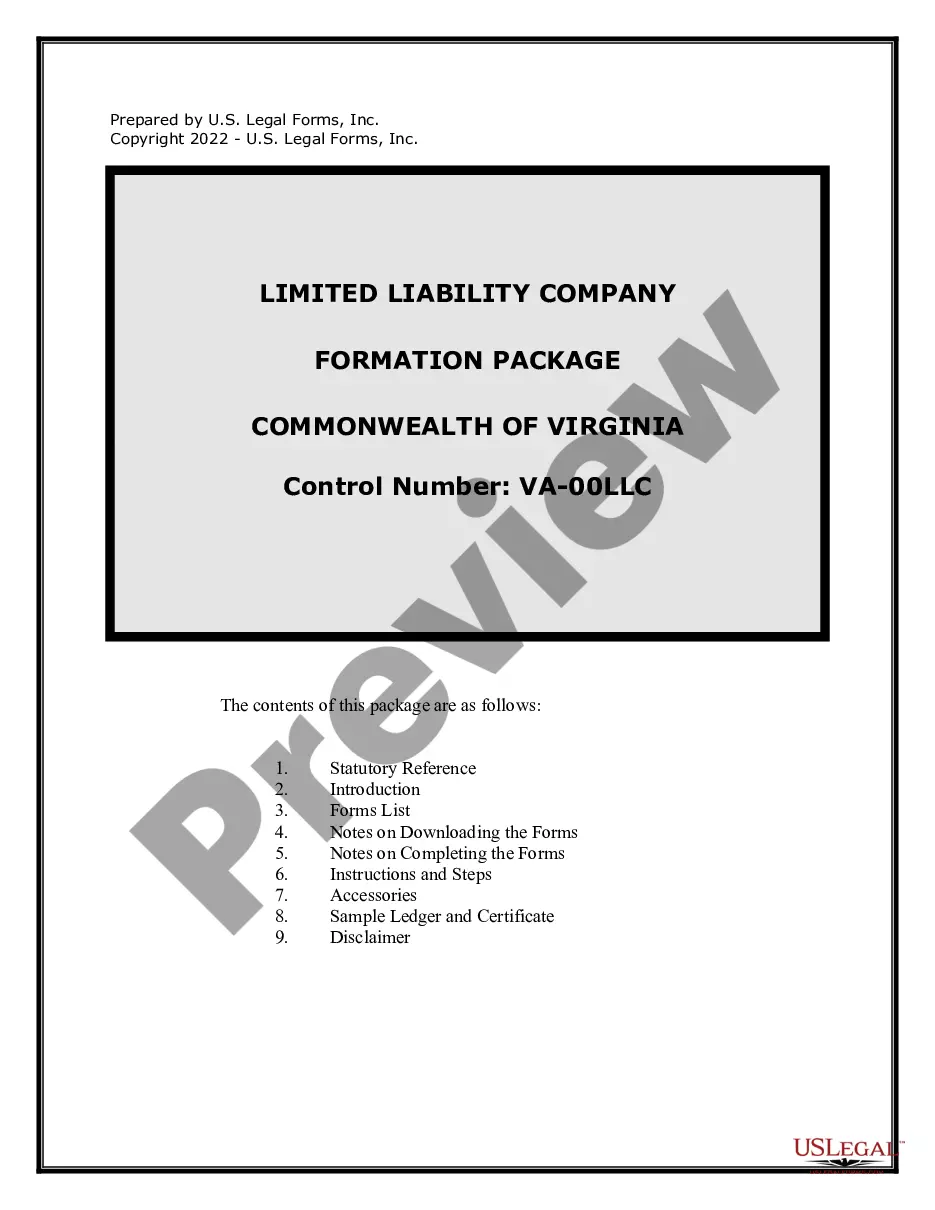

Virginia Dissolution Package to Dissolve Limited Liability Company LLC

Definition and meaning

A Virginia Dissolution Package is a collection of legal documents used to formally dissolve a Limited Liability Company (LLC) in the state of Virginia. This process involves winding up the business affairs of the LLC and filing the necessary forms with the State Corporation Commission to finalize the dissolution. It is crucial for LLC members to understand the implications of dissolving their business and the steps involved to do it legally.

Step-by-Step Instructions for Dissolving an LLC

The process of dissolving a Virginia LLC requires the completion of specific steps. Here’s a clear outline to guide you:

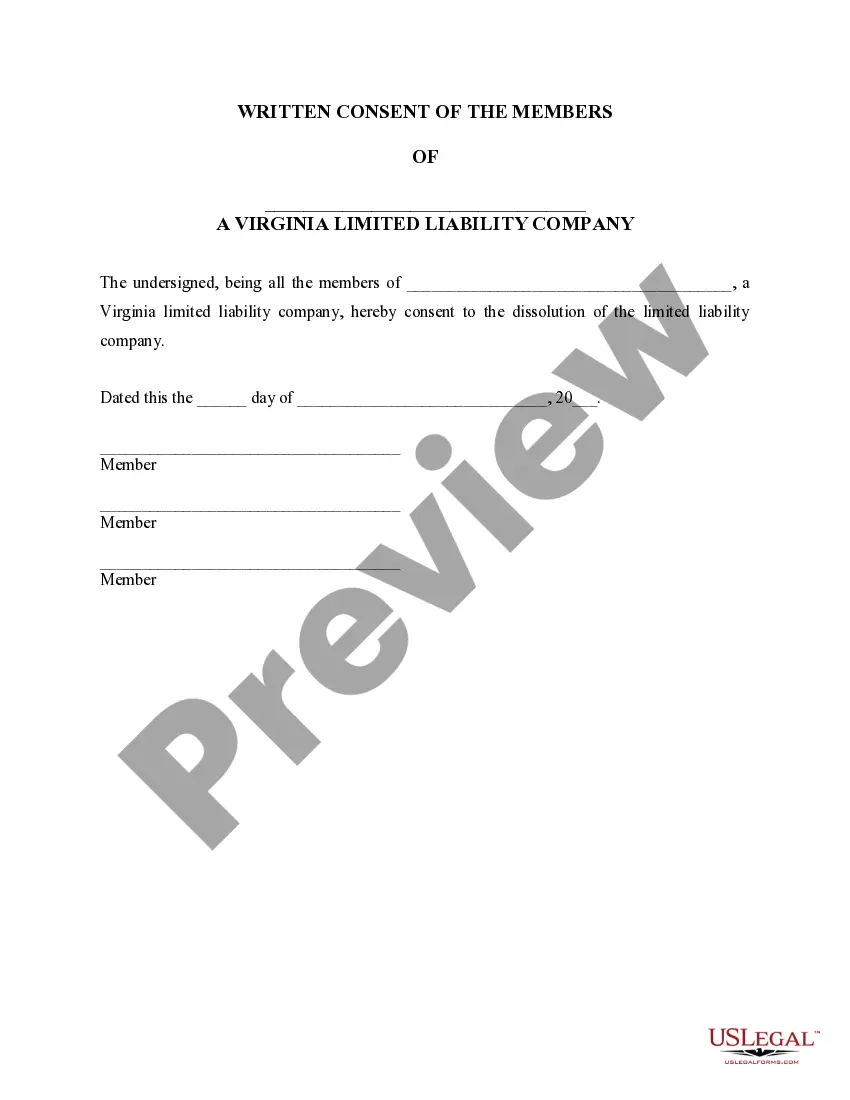

- Obtain Consent: Gather written consent from all members to dissolve the LLC.

- Wind Up Affairs: Follow the steps to wind up the LLC’s business, which includes settling debts and distributing remaining assets.

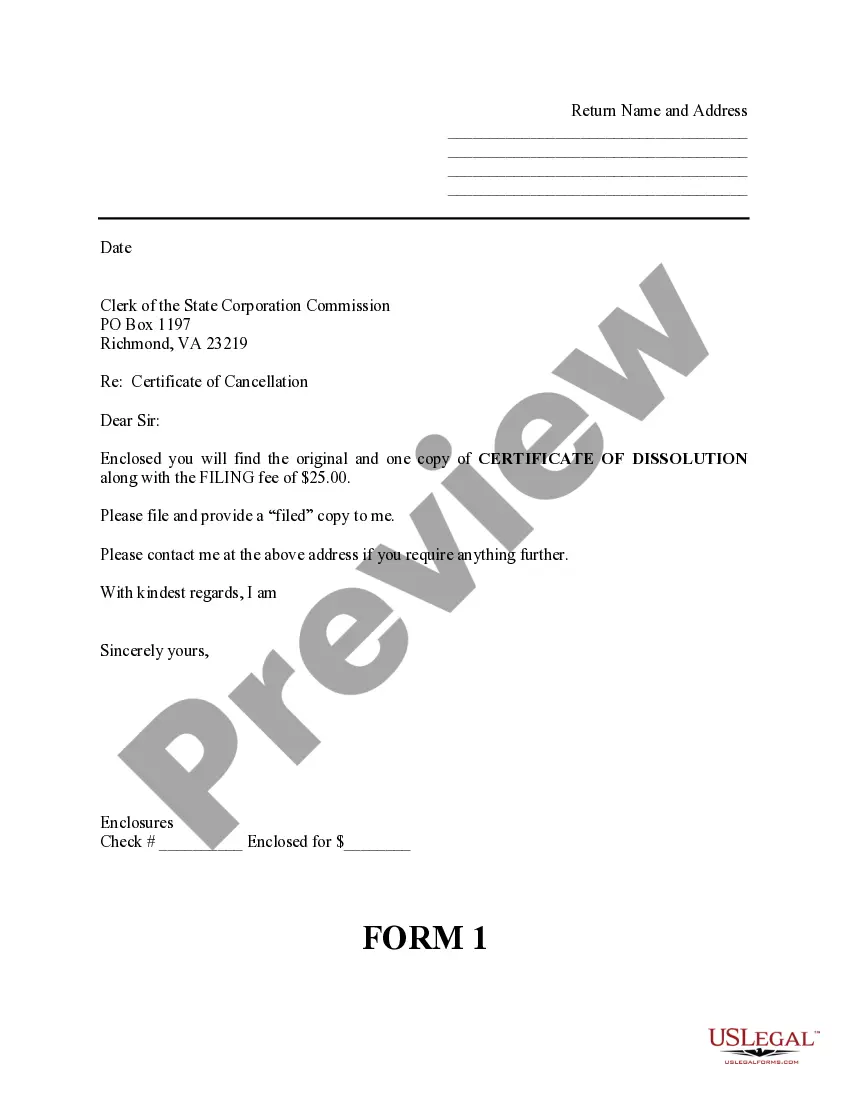

- Complete Certificate of Cancellation: Fill out the Certificate of Cancellation form, providing essential information regarding the LLC.

- File the Necessary Documents: Submit the original and one copy of the Certificate of Cancellation along with the filing fee to the State Corporation Commission.

Key components of the form

The Virginia Dissolution Package includes several critical components:

- Consent of Members: A document that captures the agreement of all LLC members to proceed with the dissolution.

- Certificate of Cancellation: This form officially denotes the dissolution of the LLC and must detail the reasons for cancellation.

- Filing Fee: A monetary requirement that must accompany the filing of the dissolution documents.

Who should use this form

This form is intended for owners and members of a Limited Liability Company (LLC) in Virginia looking to legally dissolve their business. If the LLC has concluded its operations or wishes to cease its business activities, this package is necessary to ensure compliance with state regulations and to formally end the company’s existence.

Common mistakes to avoid when using this form

To ensure a smooth dissolution process, avoid these common pitfalls:

- Failing to obtain unanimous consent from all members before dissolution.

- Neglecting to properly wind up business affairs before filing cancellation.

- Submitting incomplete or inaccurate forms and information.

- Ignoring the requirement to pay the filing fee, which can delay processing.

What documents you may need alongside this one

Along with the Virginia Dissolution Package, consider preparing the following documents:

- Operating Agreement: To reference the procedures for dissolution outlined in the agreement.

- Financial Records: Essential for settling debts and obligations before dissolution.

- Member Consent Documents: Any written agreements reflecting the members' consent to dissolve the LLC.

Form popularity

FAQ

If your nonprofit has members, by action of the directors followed by a vote of the members; or. if your nonprofit doesn't have members, by a vote of the directors.

1Holding a vote with LLC members to dissolve the LLC.2Recording the dissolution vote in the LLC's meeting minutes.3Determining the formal date of dissolution.4Distribution of LLC assets.5Notifying creditors and settling any business debts.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

1File a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).2Vote for dissolution.3File Form 990.4File the paperwork.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.