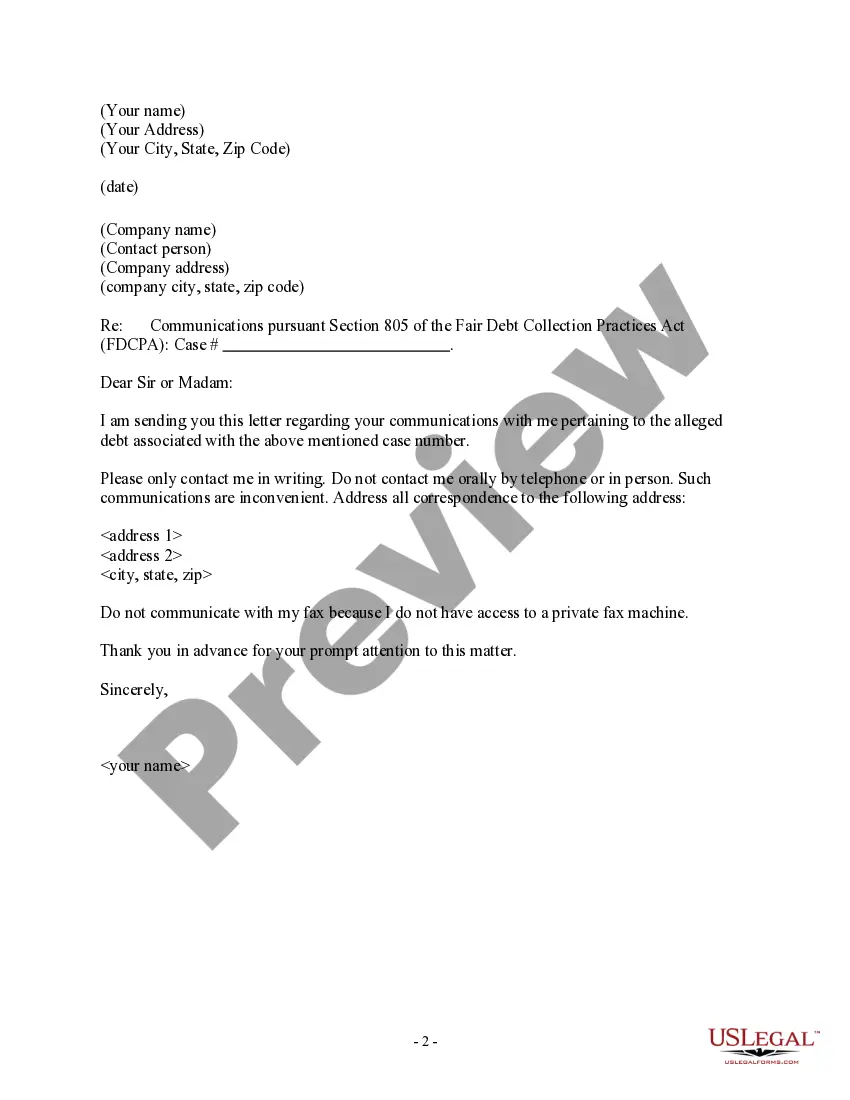

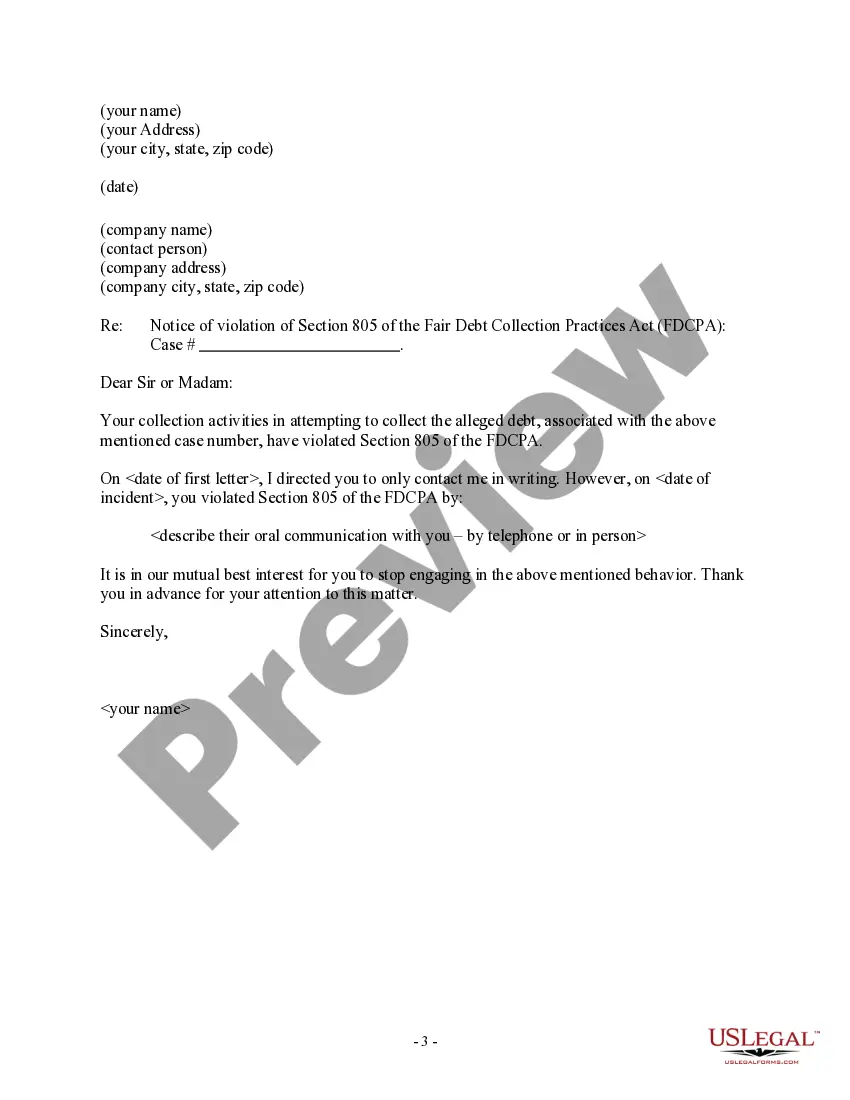

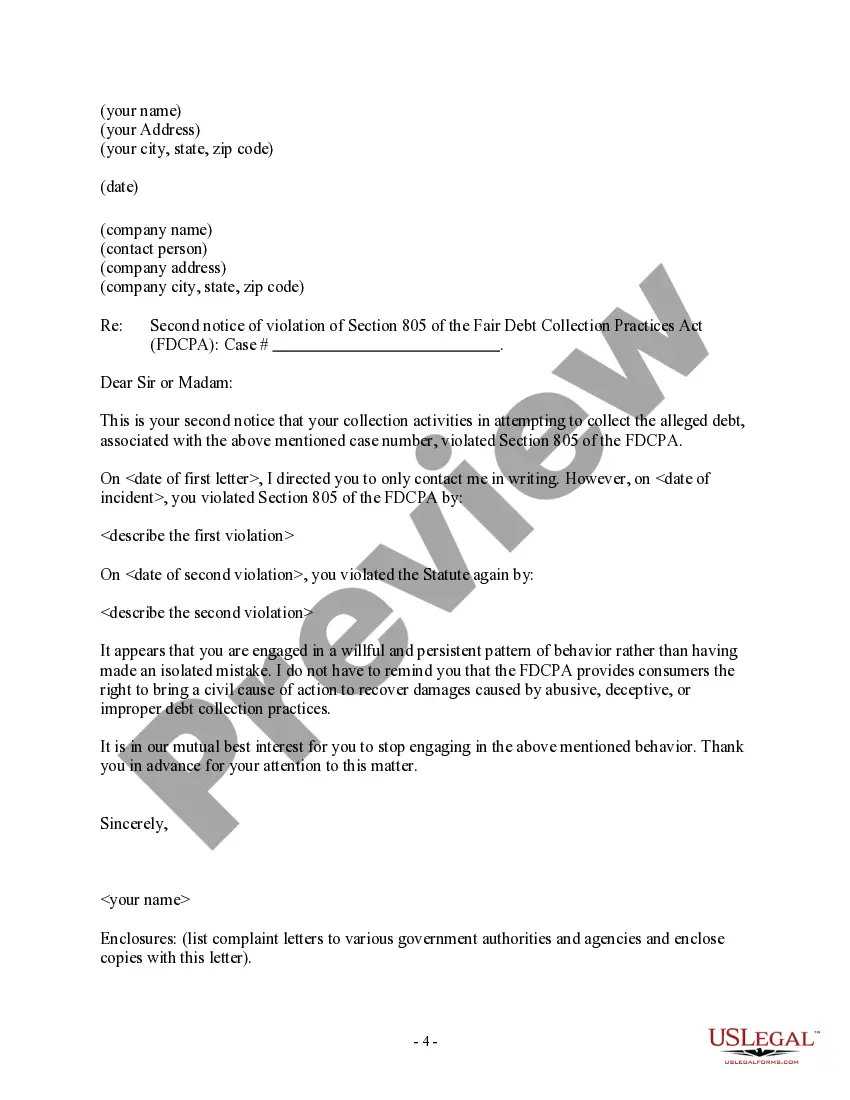

Rhode Island Letter to Debt Collector - Only Contact Me In Writing

Description

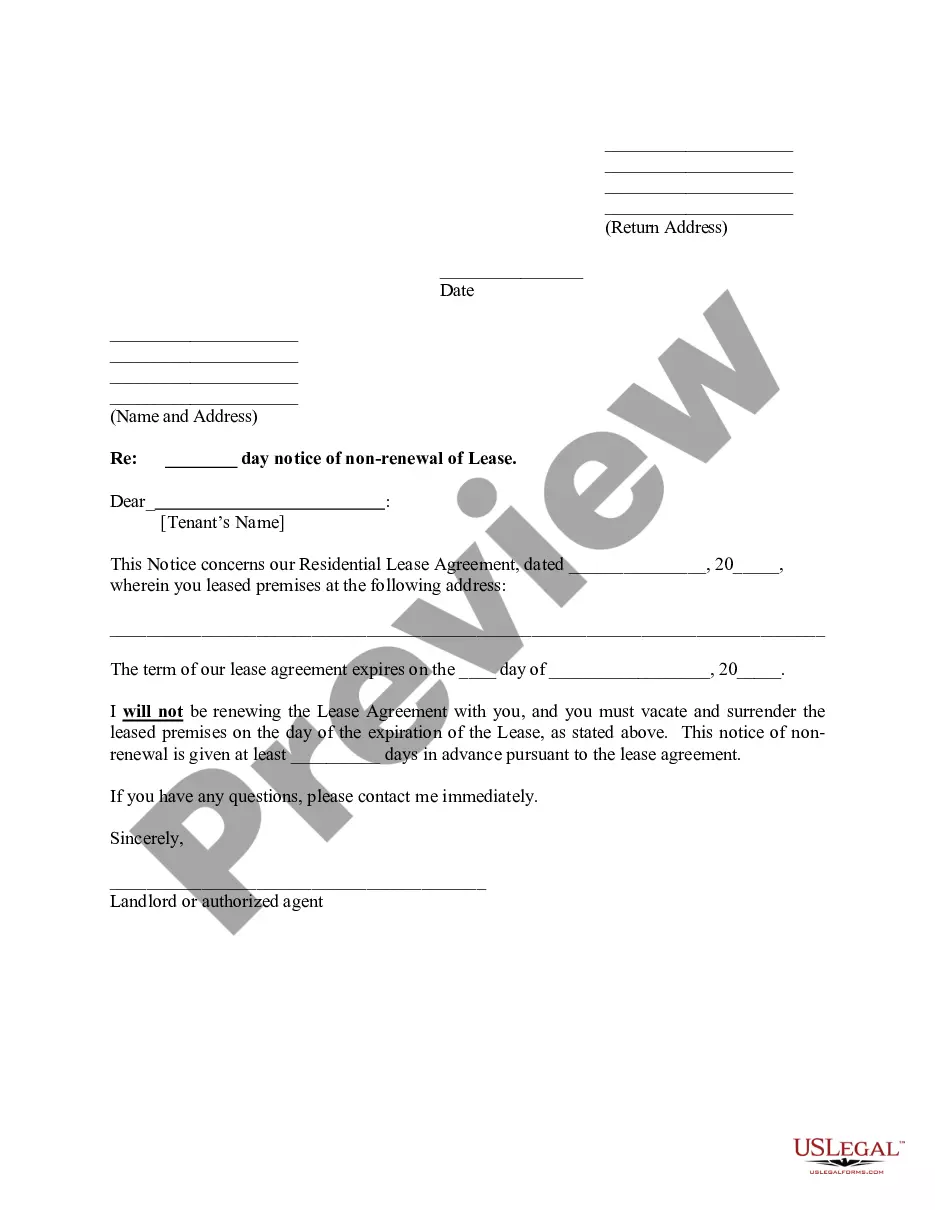

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

You have the opportunity to devote time online searching for the legitimate document template that matches the federal and state criteria you require. US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can conveniently acquire or print the Rhode Island Letter to Debt Collector - Only Contact Me In Writing from the service.

If you already have a US Legal Forms account, you can Log In and then click the Download button. Afterward, you can complete, modify, print, or sign the Rhode Island Letter to Debt Collector - Only Contact Me In Writing. Every legal document template you receive is yours indefinitely.

Complete the transaction. You can utilize your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to the document if needed. You can complete, alter, sign, and print the Rhode Island Letter to Debt Collector - Only Contact Me In Writing. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- To obtain another copy of the purchased document, visit the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for the county/region you choose. Review the document description to ensure you have chosen the right one.

- If available, utilize the Preview button to view the document template as well.

- If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you need, click Purchase now to proceed.

- Choose the pricing plan you want, enter your details, and sign up for a free account on US Legal Forms.

Form popularity

FAQ

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

For some folks, that means dealing with calls from debt collectors. Starting late next year, collectors will also be allowed to contact consumers by email, text message, and even through social media, according to the Consumer Financial Protection Bureau.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.