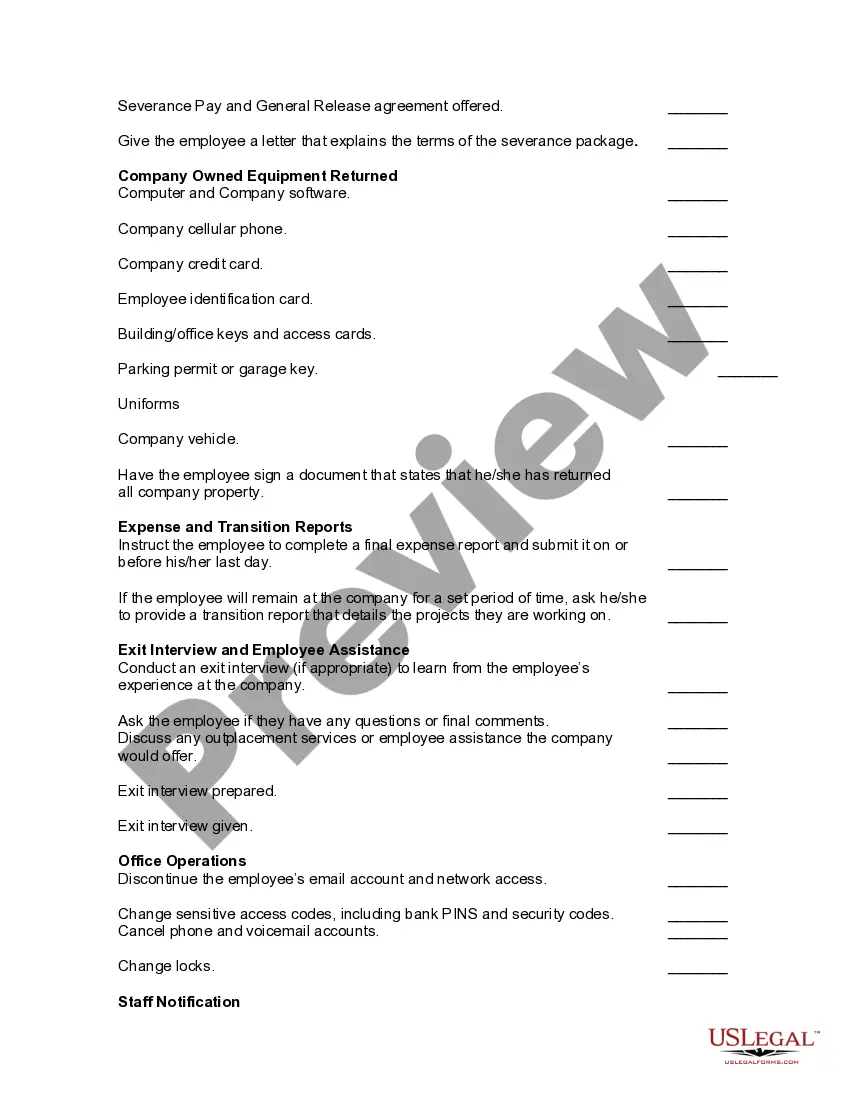

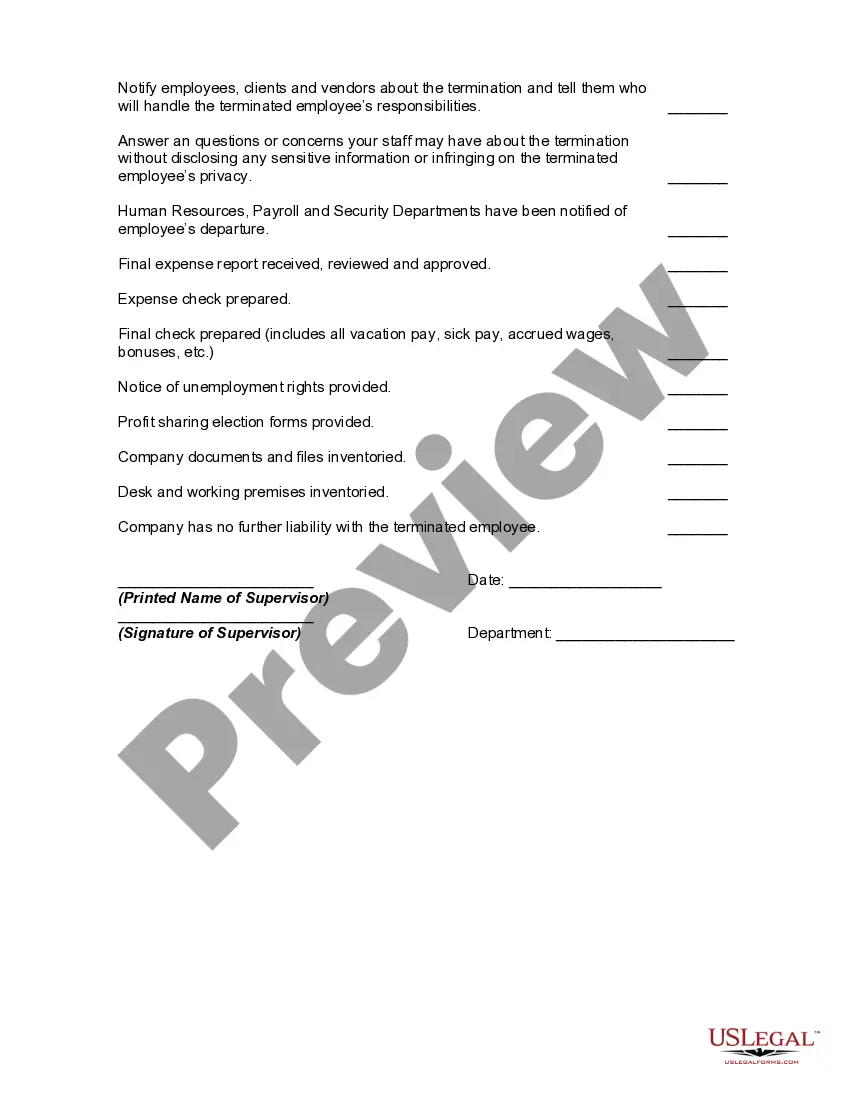

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Oregon Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

US Legal Forms - a leading repository of authentic documents in the United States - offers a variety of legal document templates available for download or printing.

By utilizing this website, you will access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can quickly find the latest versions of documents like the Oregon Worksheet - Termination of Employment.

If you currently possess a monthly subscription, Log In to download the Oregon Worksheet - Termination of Employment from the US Legal Forms library. The Download button will be visible on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the payment.

Select the format and download the document to your device. Edit. Fill out, modify and print your Oregon Worksheet - Termination of Employment.

Each template added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the document you need.

Access the Oregon Worksheet - Termination of Employment with US Legal Forms, one of the most extensive repositories of authentic document templates. Benefit from a vast selection of professional and state-specific templates that meet your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s content.

- Read the form description to confirm you have chosen the correct document.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you wish and provide your credentials to register for an account.

Form popularity

FAQ

Even though Oregon generally recognizes the at-will employment rule, certain discharges are considered by the courts to be wrongful. For example, it is wrongful to discharge an employee for resisting on-the-job sexual harassment, or for refusing to sign a statement attacking the character of another employee.

Oregon laws allow the termination of an employment relationship by either the employer or the employee, without notice and without cause.

Federally, and in most states, a termination letter is not legally required. In some states, currently including Arizona, California, Illinois and New Jersey, written termination notices are required by law. Some of these states have specific templates employers must use for the letter.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Form 1099-G is a report of income you received from the Department of Revenue during the calendar year. The Internal Revenue Service (IRS) requires government agencies to report to the IRS certain payments made during the year because those payments are considered gross income to the recipient.

You must be unemployed through no fault of your own. If you were laid off for lack of work you will qualify for benefits. If you are fired, you can get benefits unless the employer shows that you were fired for your "misconduct". If you quit a job you must show that you had a good reason and no other reasonable choice.

Form 1099-G is issued by a government agency to inform you of funds you have received that you may need to report on your federal income tax return. Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year, which generally need to be reported as taxable income on Form 1040.

If you receive unemployment compensation, your benefits are taxable. You will need to report Form 1099-G, Certain Government Payments, on your federal tax return. Most states mail this form to you, but some do not. (Some states may send more than one Form 1099-G.

Form 1099-G reports the amount of refunds, credits, and offsets of state income tax during the previous year. This amount may be taxable on your federal income tax return if you claimed your state income tax paid as an itemized deduction on your federal income tax return last year.

What is a 1099G? 1099G is a tax form sent to people who have received unemployment insurance benefits. You use it when you are filing federal and state income taxes to the Internal Revenue Service (IRS) and Oregon Department of Revenue. Sign up to receive email updates!