This Handbook provides an overview of federal laws addressing employer-employee rights and obligations. Information discussed includes wages & hours, discrimination, termination of employment, pension plans and retirement benefits, workplace safety, workers' compensation, unions, the Family and Medical Leave Act, and much more in 25 pages of materials.

Nevada USLF Multistate Employment Law Handbook - Guide

Description

How to fill out USLF Multistate Employment Law Handbook - Guide?

It is feasible to spend time online searching for the legitimate document template that aligns with the state and federal requirements you require.

US Legal Forms offers a wide array of legal documents that have been assessed by professionals.

You can either download or print the Nevada USLF Multistate Employment Law Handbook - Guide from the service.

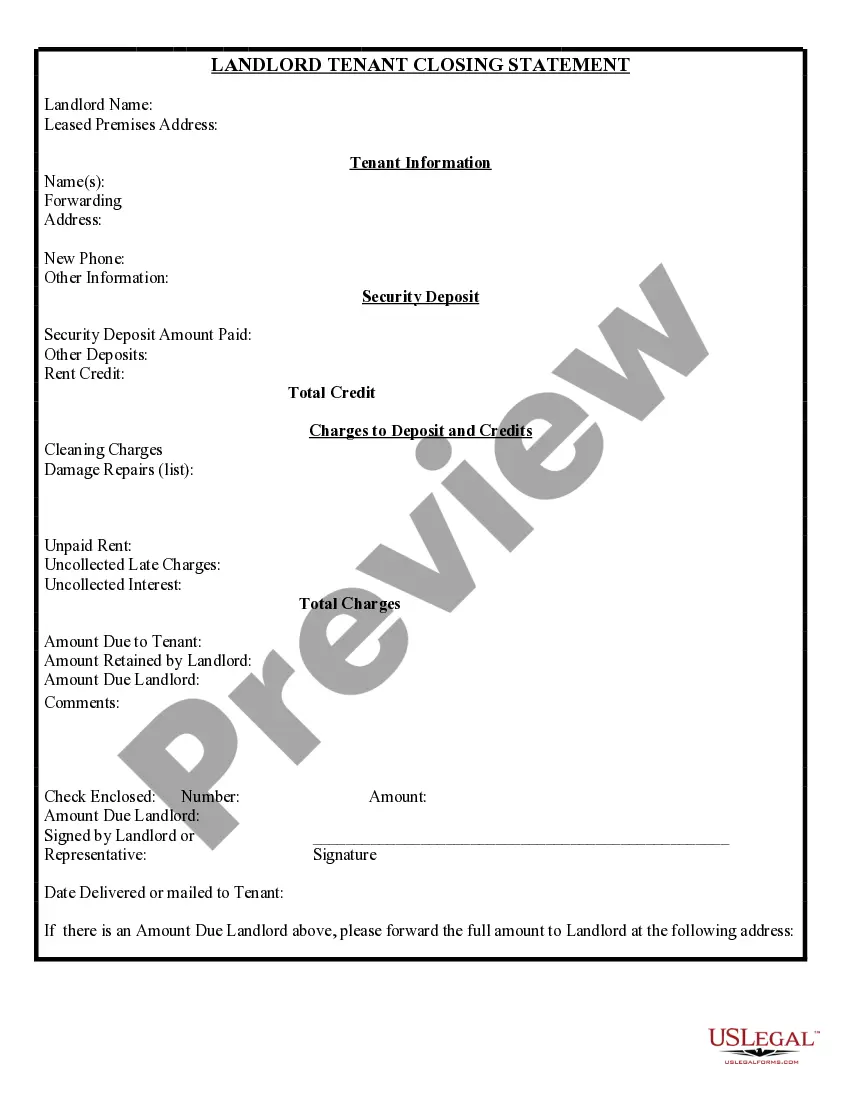

If available, use the Preview button to view the document template as well. If you want to find a different version of the document, use the Search field to locate the template that fulfills your needs and specifications.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Nevada USLF Multistate Employment Law Handbook - Guide.

- Each legal document template you obtain is yours permanently.

- To get an additional copy of any acquired form, navigate to the My documents section and click the related button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

How many hours is part-time? Part-time hours can be anywhere from a few hours a week, right up to 35 hours. As with full-time hours, there's no official classification. But no matter how many hours you work, employers must treat you the same as a full-time employee.

Your weekly benefit entitlement is calculated by taking a percentage of your earnings in the quarter in which you earned the most during your base period. There is no minimum weekly payment, but the maximum you can receive in unemployment benefits in Nevada per week is $469.

A full time employee is a person who is generally employed to work at least thirty-eight (38) hours each week. If an employee works more than thirty eight hours in a week, then usually the employee is entitled to be paid at overtime rates, or to receive paid time off in lieu of overtime payment.

time employee is, for a calendar month, an employee employed on average at least 30 hours of service per week, or 130 hours of service per month.

Official employer designations regarding full-time employment generally range from 35 to 45 hours, with 40 hours being by far the most common standard. Some companies consider 50 hours a week full-time for exempt employees.

There's no legal definition of full-time employment status but generally, consistently working 30 hours or more per week would be considered full time by the IRS.

Severance Pay, Dismissal or Separation Pay. Severance pay is not wages for unemployment insurance purposes. There is no specific code section in the California Unemployment Insurance Code which declares that severance pay is not wages.

Unfortunately, severance pay is not required under Nevada law and many employees who may expect a severance pay offer learn that they are being denied this important benefit.

You should file your claim immediately upon becoming unemployed. During the interview process, you will be asked to report your severance and/or vacation pay. Your period of disqualification will be determined through Adjudication. Click here for more information on Unemployment Benefits, including applying online.

Collecting Unemployment After Being Fired If, for example, you deliberately disregarded your employer's reasonable rules or policies, or you were so careless on the job as to demonstrate a substantial disregard of your employer's interests or your job duties, you will be disqualified.