New Mexico Checklist - Key Employee Life Insurance

Description

Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

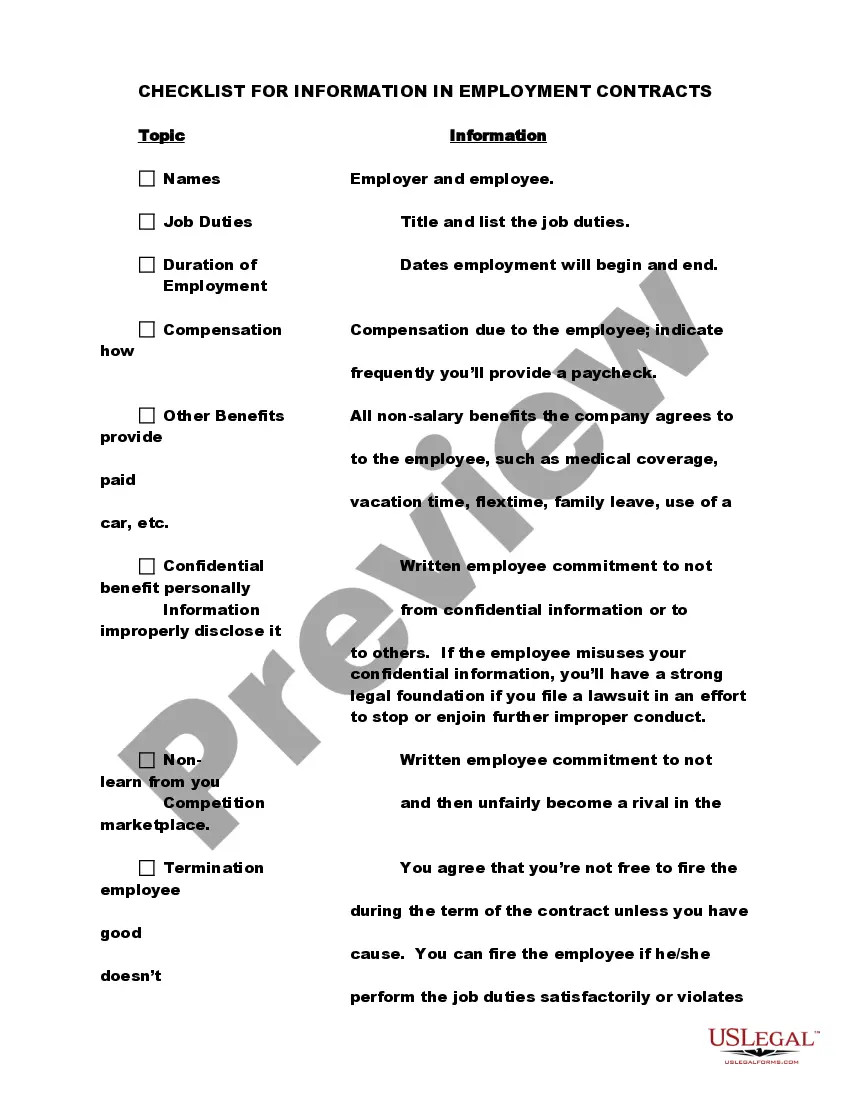

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

How to fill out Checklist - Key Employee Life Insurance?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or create.

Using the website, you can find thousands of forms for both business and personal purposes, categorized by groups, states, or keywords.

You can locate the latest versions of forms such as the New Mexico Checklist - Key Employee Life Insurance in just a few seconds.

Read the form description to confirm you have chosen the correct form.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have an active monthly subscription, Log In to download the New Mexico Checklist - Key Employee Life Insurance from your US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you select the appropriate form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

To obtain key man insurance, start by identifying the individuals in your company who are crucial to your success. Once identified, you can request quotes from insurance providers who specialize in this type of coverage. Utilizing resources like the New Mexico Checklist - Key Employee Life Insurance can streamline the process, ensuring you have all the necessary information to make informed choices.

Determining the right amount of insurance for a key employee involves evaluating their role and contributions to your business. Generally, you'll want enough coverage to replace lost income and recruit a suitable replacement. Using a comprehensive New Mexico Checklist - Key Employee Life Insurance can guide you in calculating the most appropriate coverage amount based on your unique business needs.

Investing in key man insurance can provide vital financial protection for your business. If a key employee passes away or becomes unable to work, this insurance helps cover lost revenue and allows your company to regroup. By reviewing your New Mexico Checklist - Key Employee Life Insurance options, you can decide how this coverage can be a smart investment for your business's future.

Key person insurance is designed for businesses where specific individuals play a crucial role in the company's success. Typically, those who qualify include business owners, executives, and key employees whose absence would significantly impact the business. For your New Mexico Checklist - Key Employee Life Insurance, consider the roles that are essential for day-to-day operations and long-term growth.

A key employee life insurance policy is specifically designed to cover the lives of essential personnel within an organization. This policy pays a benefit directly to the business upon the death of the key employee, helping to secure immediate financial needs. Using the New Mexico Checklist - Key Employee Life Insurance allows businesses to analyze their options, ensuring they select the most suitable policy for their specific circumstances. This kind of insurance acts as a financial safeguard for the future.

While key person insurance provides crucial benefits, it also has certain disadvantages. One significant downside is the premium costs, which can become burdensome for smaller businesses. Additionally, if the business does not properly evaluate the coverage needs, they may end up with insufficient protection. Understanding these drawbacks through the New Mexico Checklist - Key Employee Life Insurance can guide you to make informed decisions to ensure adequate coverage.

Life insurance is taken out on key employees to protect the organization against potential financial losses that could arise from the unexpected death of a valuable team member. These employees often possess specialized skills or knowledge critical to the company's success. By utilizing the New Mexico Checklist - Key Employee Life Insurance, businesses can secure the funds needed for recruitment, training, or other strategic actions during a difficult transition. This ensures business continuity and stability.

The most common type of life insurance used for key employee indemnification is term life insurance. This policy provides coverage for a specific period, ensuring financial stability for the business in case of an untimely loss. In this context, organizations can depend on the New Mexico Checklist - Key Employee Life Insurance to guide them in selecting the right policy to protect their interests effectively. This type of insurance allows businesses to avoid significant financial disruptions.

As mentioned previously, key employee life insurance is usually not tax deductible for businesses. The IRS does not allow deductions for premiums when the benefit is not for the employee’s estate or family. Being informed about this can help businesses strategize their financial commitments. For comprehensive insights, leveraging the New Mexico Checklist - Key Employee Life Insurance can enhance your understanding of these tax rules.

Yes, a business can take out life insurance on an employee, especially if that employee holds a key role. The company must inform the employee and secure their consent to do so. By doing this, businesses safeguard their financial standing and operations in the face of unforeseen events. The New Mexico Checklist - Key Employee Life Insurance provides essential steps to ensure compliance and transparency in this process.