New Hampshire Employment Information Document with Insurance Information

Description

How to fill out Employment Information Document With Insurance Information?

If you're looking to finalize, acquire, or produce authorized document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to access the New Hampshire Employment Information Document with Insurance Information in just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the New Hampshire Employment Information Document with Insurance Information using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the New Hampshire Employment Information Document with Insurance Information.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you've selected the form for the correct city/state.

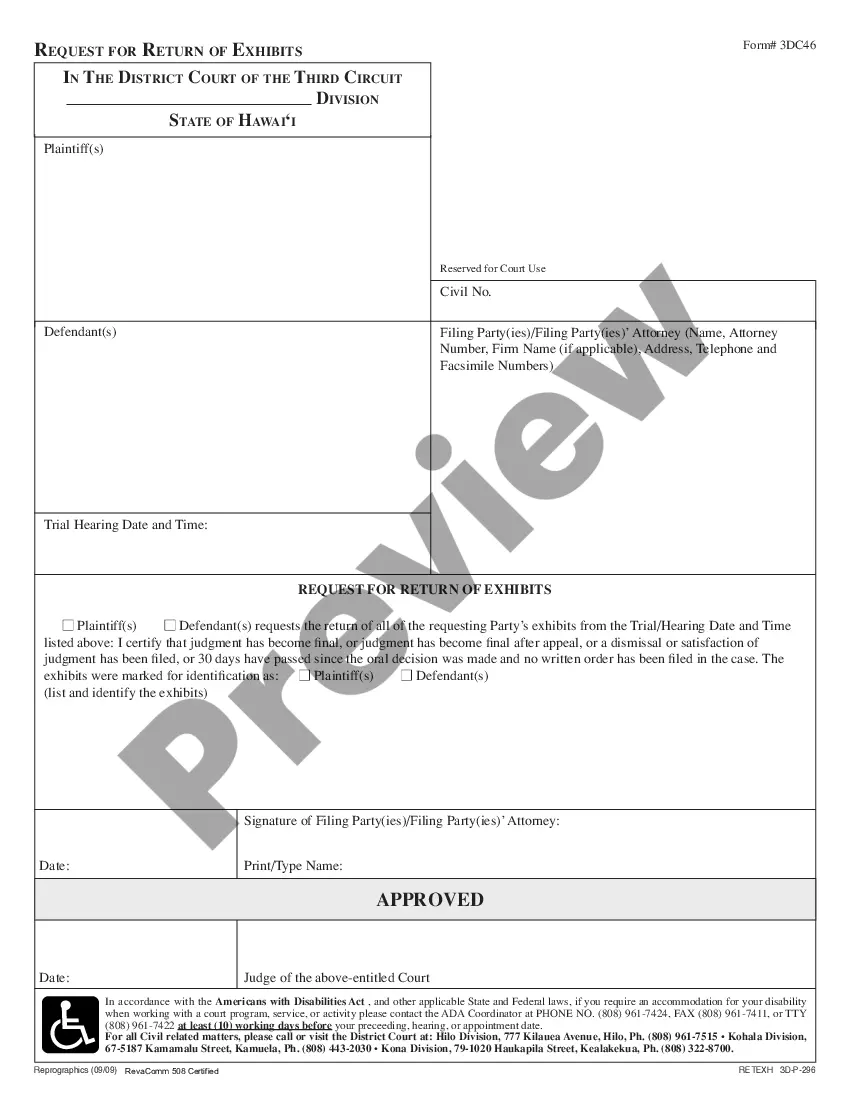

- Step 2. Utilize the Preview option to review the content of the form. Always remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you find the form you need, click on the Buy now button. Choose the payment plan that suits you and enter your details to register for the account.

- Step 5. Process the purchase. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the New Hampshire Employment Information Document with Insurance Information.

Form popularity

FAQ

Our goal is to pay eligible individuals benefits within 30 days. How quickly an eligibility determination is made and payment is issued may depend on you. Provide a complete work history record on your application.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.

Employer's telephone number (including area code) Beginning and ending dates of employment (day, month and year) Number of hours worked and pay rate if you worked this week (including Sunday) Reason why you are no longer working for employer.

To locate your NHES Employer Account Number: If you've filed state payroll tax returns in the past, you can find your NHES Employer Account Number on any previously submitted quarterly tax filing. The NHES Employer Account Number is a nine-digit number in the following format: XXXXXXXXX.

New Hampshire's unemployment tax rates for the third quarter of 2021 are unchanged, the state Employment Security department said July 9. Effective from July 1, 2021, to Sept 30, 2021, tax rates for positive-rated employers range from 0.1% to 2.7% and rates for negative-rated employers range from 4.3% to 8.5%.

How Do I Apply?You should contact your state's unemployment insurance program as soon as possible after becoming unemployed.Generally, you should file your claim with the state where you worked.When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.More items...

In order to be eligible for unemployment compensation, an individual: Must be totally or partially unemployed. Must register for work unless you have been specifically exempted. Must be available for full-time work on all shifts and during all the hours work claimant is qualified for is normally performed.

In New Hampshire, unemployment insurance benefits are administered by New Hampshire Employment Security (NHES), which provides temporary benefits for employees who are either partially or fully unemployed and meet all other requirements. All funding for unemployment insurance benefits are paid by employers.

In New Hampshire, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, New Hampshire does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.

Do You Need Help With SUI?Alabama. SUI Tax Rate: 0.65% - 6.8%Alaska. SUI Tax Rate: 1.00% - 5.4%Arizona. SUI Tax Rate: 0.05% - 12.76%Arkansas. SUI Tax Rate: 0.4% - 14.3%California. SUI Tax Rate: 1.5% - 6.2%Colorado. SUI Tax Rate: 0.62% - 8.15%Connecticut. SUI Tax Rate: 1.9% - 6.8%Delaware. SUI Tax Rate: 0.3% - 8.2%More items...