Nebraska Notice to Buyer of Seller's Intention to Make Installment Deliveries

Description

How to fill out Notice To Buyer Of Seller's Intention To Make Installment Deliveries?

Have you ever been in a situation where you require documentation for either business or certain purposes almost every time? There are numerous legitimate document templates available online, but finding ones you can trust is not easy.

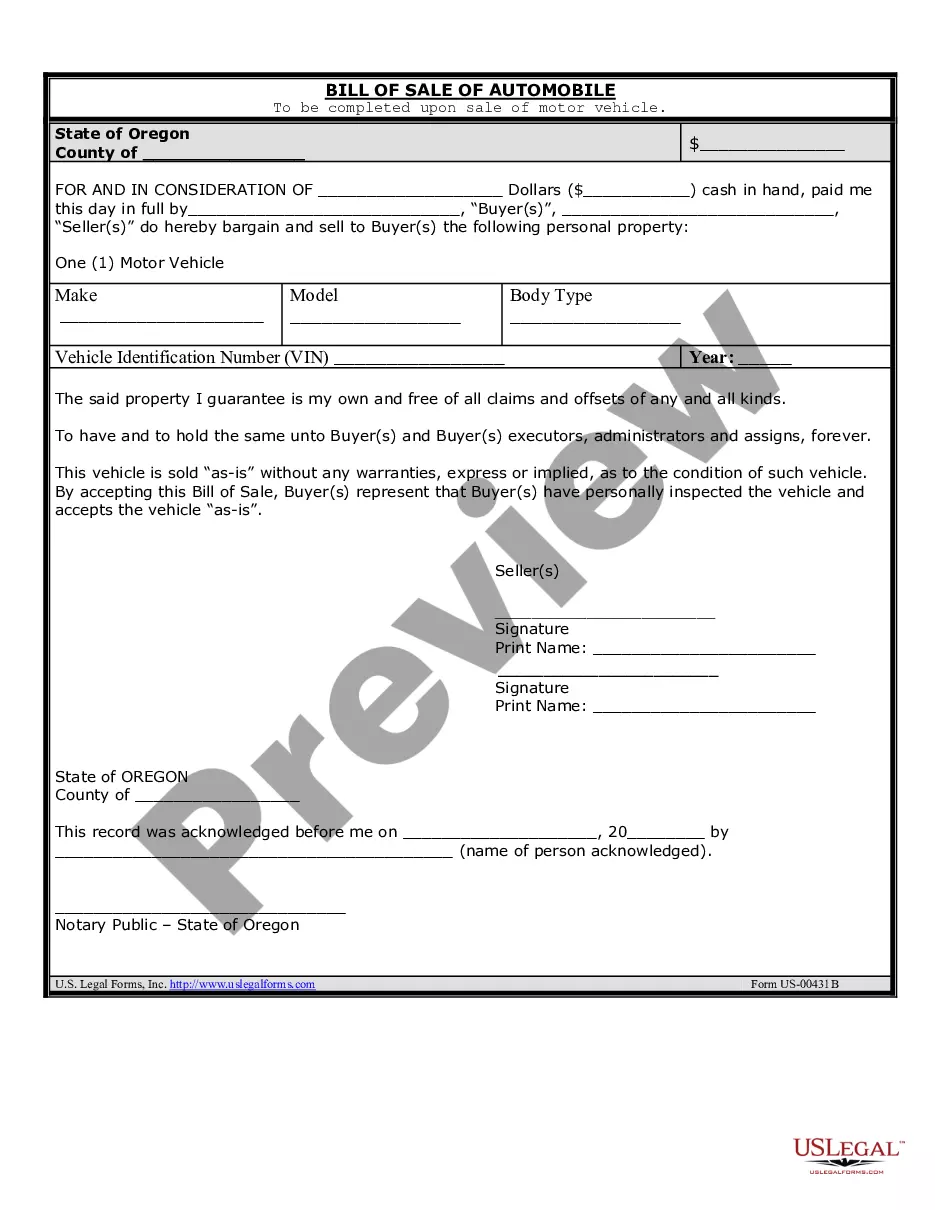

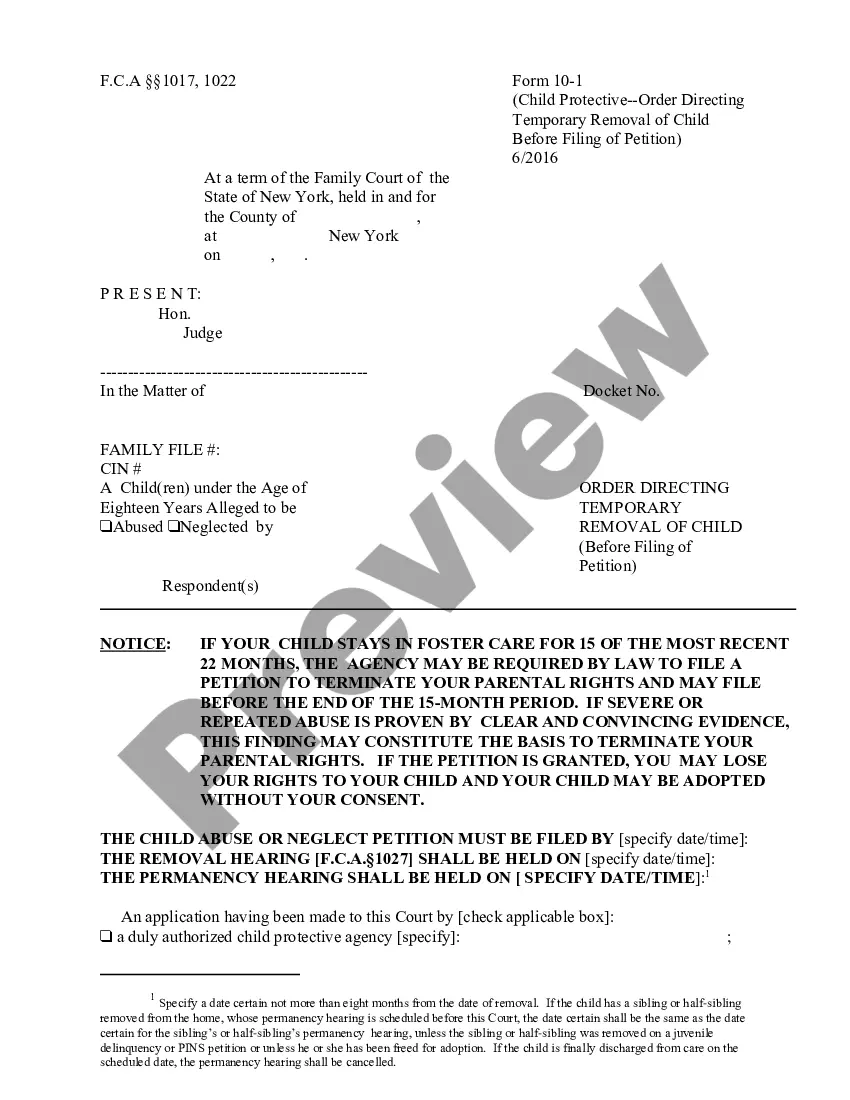

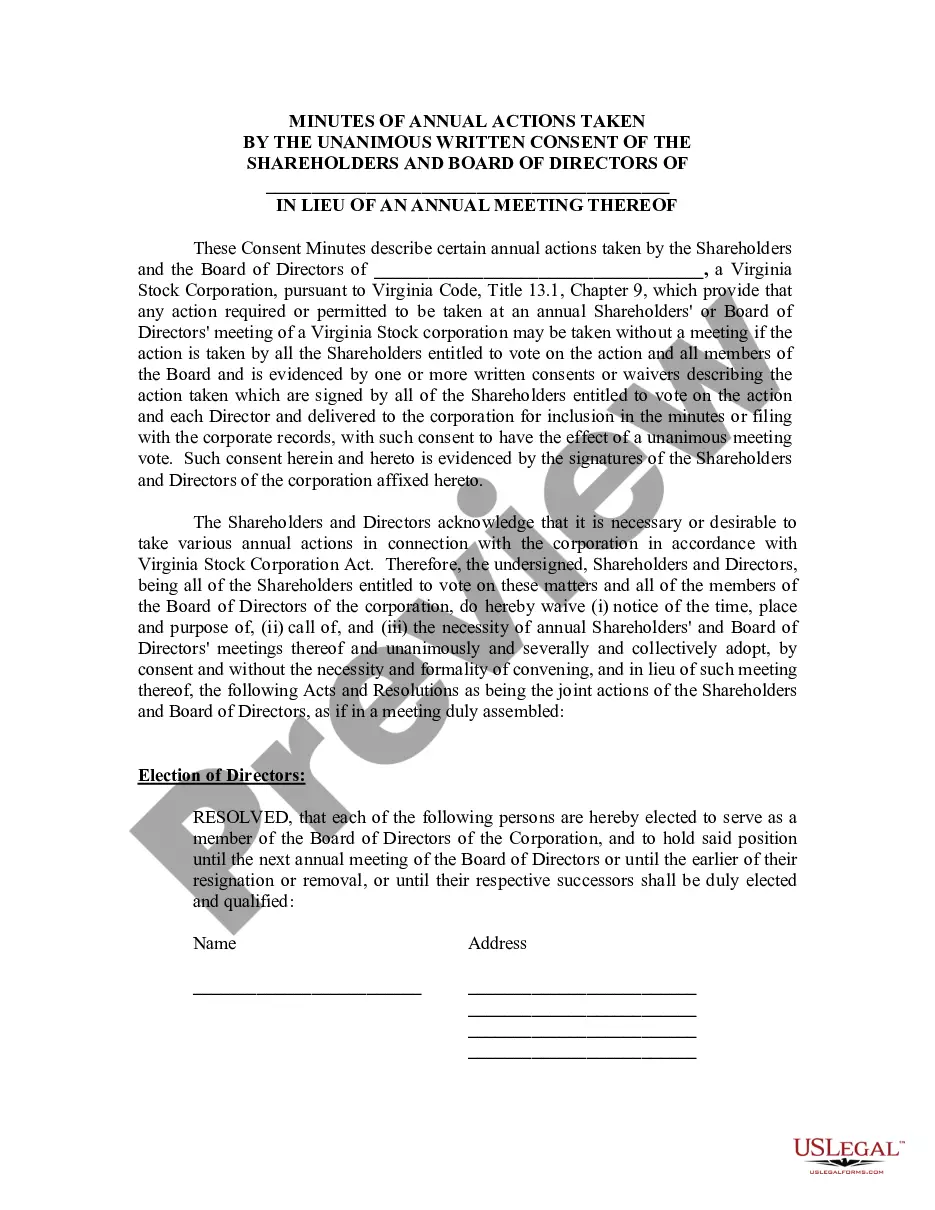

US Legal Forms offers thousands of form templates, such as the Nebraska Notice to Buyer of Seller's Intention to Make Installment Deliveries, which can be printed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Nebraska Notice to Buyer of Seller's Intention to Make Installment Deliveries template.

- Acquire the form you need and verify it is for the correct town/state.

- Use the Review button to examine the document.

- Read the description to confirm that you have chosen the correct form.

- If the form is not what you're looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you wish, provide the necessary information to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Under an installment contract, the buyer gets possession of the property and makes installment payments of the purchase price over an extended period of time to the seller, who conveys legal title to property once the purchase price is fully paid.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

Despite receiving installments over time, however, the seller can elect out of the installment method of recognizing gain for tax purposes and choose instead to report the entire gain in the year of the sale. Historically, many taxpayers have reported gains from M&A transactions using the installment method.

You may elect out by reporting all the gain as income in the year of the sale in accordance with your method of accounting on Form 4797, Sales of Business Property, or on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets.

Typically, articles of agreement will be related to either personal estate or real estate. Articles are best understood as a part of an agreement and can either be a minute or a memorandum. Generally, an article will be in writing, and it will be used to modify or dispose of a piece of property.

Contents. An installment agreement requires the buyer of real estate to pay the seller the purchase price in installments over time; the buyer takes immediate possession of the property but the seller retains legal title as security until the buyer pays in full.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

Buyer Becomes Equitable Owner; Seller Remains in Title This provides the seller securityif the buyer fails to make payments in accordance with the terms of the installment agreement, the seller may be able to recover possession of the property quicker and at less expense than if foreclosing on a mortgage.

When parties enter into an Installment Land Contract, the buyer typically takes possession of the property and assumes the rights and responsibilities of ownership, but the deed is not delivered to the buyer until the contract price has been paid in full.

When a buyer finances a purchase with an installment agreement, they are assuming installment debt. For example, few homebuyers can afford a home purchase with a single payment. Therefore, the cost of the home is amortized with monthly payments over 15 or 30-year payment schedules.