Montana Partnership Agreement for a Real Estate Development

Description

How to fill out Partnership Agreement For A Real Estate Development?

Selecting the appropriate authentic document template can be a challenge.

Certainly, there are numerous designs available on the internet, but how can you find the authentic form you seek? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Montana Partnership Agreement for a Real Estate Development, suitable for business and personal purposes.

You can view the form using the Preview button and read the form description to ensure it is right for you. If the form does not meet your requirements, use the Search area to find the correct form. When you are confident that the form is appropriate, click the Buy now button to purchase the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the authentic document template to your device. Fill out, modify, print, and sign the received Montana Partnership Agreement for a Real Estate Development. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to download properly-crafted paperwork that complies with state requirements.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to receive the Montana Partnership Agreement for a Real Estate Development.

- Use your account to review the legal forms you have previously purchased.

- Go to the My documents section of your account and download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your region/area.

Form popularity

FAQ

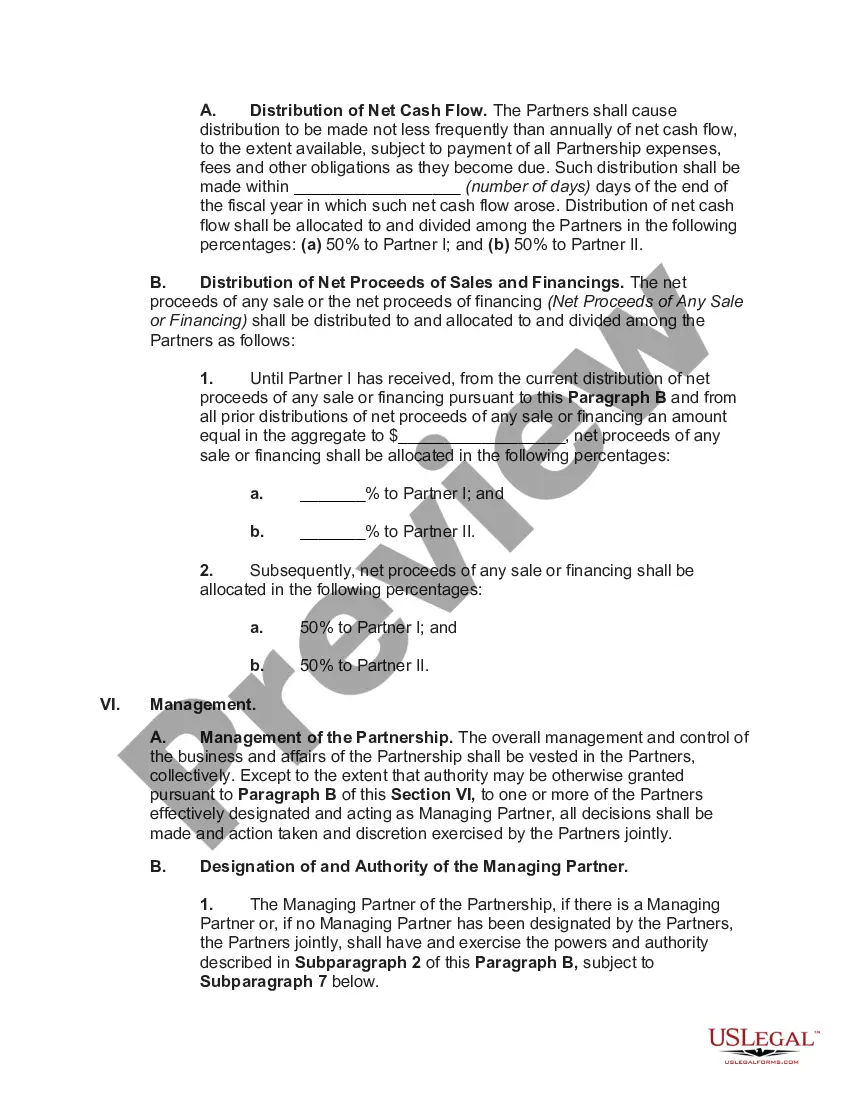

A partnership agreement in real estate is a legal document that outlines the terms of collaboration among partners involved in property investment. It defines each partner’s contribution, rights, and obligations while establishing how decisions are made and profits are shared. By creating a Montana Partnership Agreement for a Real Estate Development through platforms like US Legal Forms, partners can protect their interests and create a solid foundation for a successful venture.

To fill out a partnership agreement, begin by gathering input from all partners about their contributions, roles, and profit-sharing percentages. Clearly outline the terms and conditions that reflect your partnership's unique needs, including decision-making processes. Using a Montana Partnership Agreement for a Real Estate Development template from US Legal Forms can simplify this process, ensuring that you don’t overlook important details.

Real estate partnerships involve two or more parties pooling their resources to invest in property. Partners typically bring different skills, such as financial backing or management experience, to the table. A Montana Partnership Agreement for a Real Estate Development formalizes this collaboration, ensuring everyone understands their roles, responsibilities, and profit-sharing arrangements.

A partnership entails two or more individuals working together towards a common goal. For instance, two investors might establish a Montana Partnership Agreement for a Real Estate Development to jointly develop a piece of property. This collaboration allows them to share resources, risks, and profits, making it easier to achieve larger projects than they could individually.

The four types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has its own structure and implications for liability, profit sharing, and management. A Montana Partnership Agreement for a Real Estate Development can be adapted to fit any of these partnership types, ensuring that all partners understand their roles and responsibilities. Utilizing platforms like uLegalForms can help you select the appropriate partnership structure for your needs.

To create a simple partnership agreement for real estate development in Montana, start by defining the partnership's purpose and contributions of each partner. Outline the terms of profit sharing, responsibilities, and decision-making processes. It’s essential to include a dispute resolution clause to handle any conflicts that may arise. Using uLegalForms can simplify this process by providing templates tailored for a Montana Partnership Agreement for a Real Estate Development.

To create a simple partnership agreement, start by defining the roles and responsibilities of each partner. Include details such as profit sharing, decision-making processes, and what happens if a partner wants to exit the partnership. Utilizing a platform like uslegalforms can streamline this process, especially when drafting a Montana Partnership Agreement for a Real Estate Development. This ensures that all legal bases are covered and provides a solid foundation for your partnership.

Yes, an LLC must file a tax return in Montana, as the state requires this for tax purposes. However, the way taxes are reported may differ based on your LLC's tax classification. If you're unsure, creating a Montana Partnership Agreement for a Real Estate Development can help clarify the financial obligations of each partner. This agreement outlines the responsibilities and profits of each member, ensuring compliance with local tax laws.

Setting up a limited partnership for real estate begins with defining the limited and general partners' roles. You will need to file a certificate of limited partnership with your state, outlining key details. Furthermore, drafting a Montana Partnership Agreement for a Real Estate Development is essential in laying out terms and conditions for operations and profit-sharing. Utilizing resources from U.S. Legal Forms can simplify this process significantly.

Drafting a partnership agreement involves gathering input from all partners and identifying their expectations. Start with the basic components, such as roles, contributions, and profit-sharing ratios. Ultimately, using a professional template or service, like the ones from U.S. Legal Forms, can guide you in creating a solid Montana Partnership Agreement for a Real Estate Development.