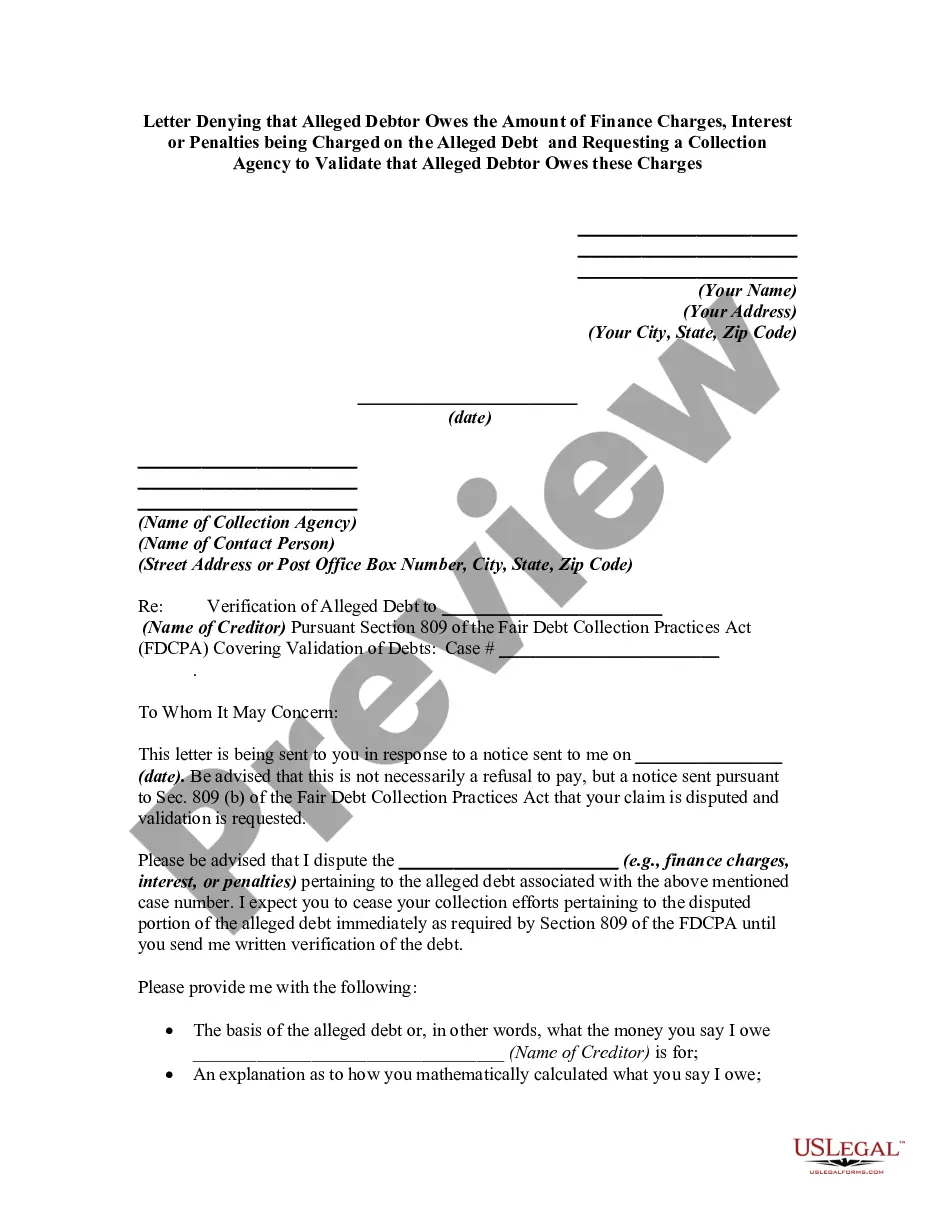

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

Missouri Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges

Description

How to fill out Letter Denying That Alleged Debtor Owes The Amount Of Finance Charges, Interest Or Penalties Being Charged On The Alleged Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes These Charges?

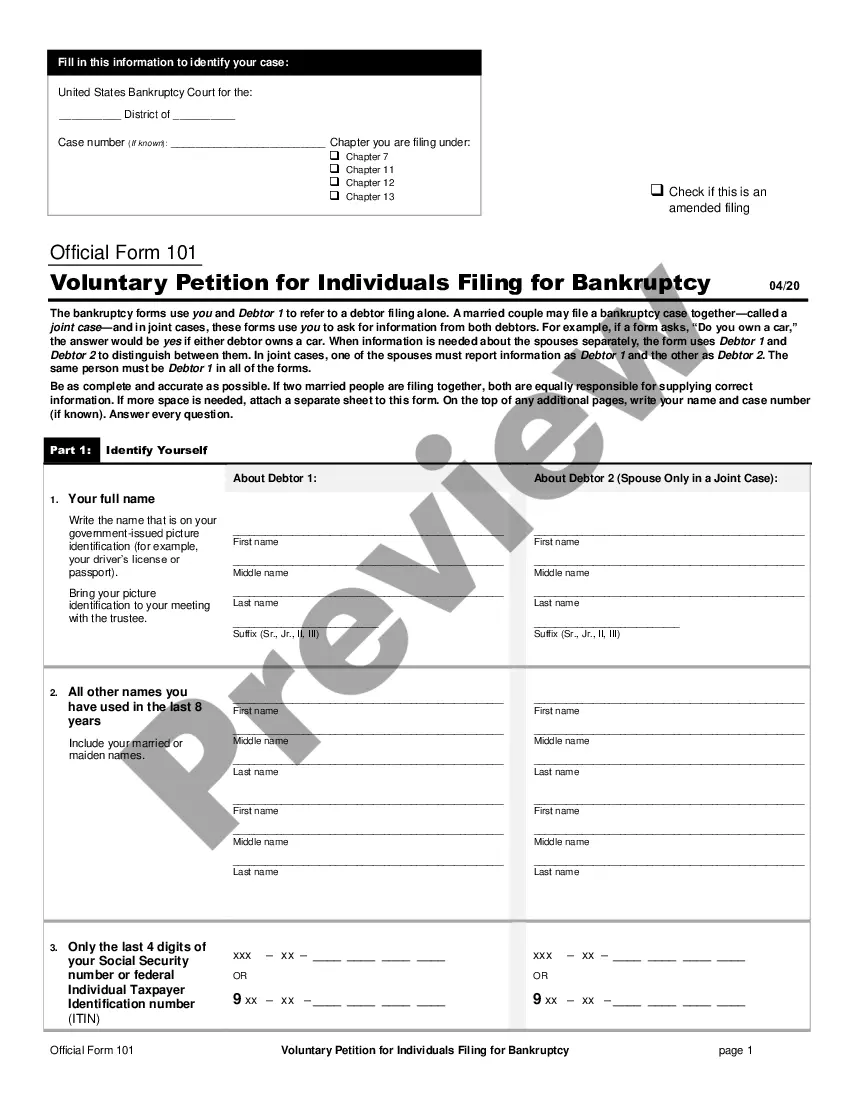

Choosing the right lawful record template might be a have difficulties. Of course, there are tons of layouts accessible on the Internet, but how can you find the lawful kind you will need? Make use of the US Legal Forms site. The assistance delivers 1000s of layouts, including the Missouri Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges, that you can use for company and private requires. All of the types are checked out by specialists and fulfill federal and state specifications.

In case you are already authorized, log in in your account and then click the Acquire button to find the Missouri Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges. Make use of account to check through the lawful types you possess purchased previously. Check out the My Forms tab of your account and acquire an additional backup from the record you will need.

In case you are a whole new user of US Legal Forms, listed below are simple guidelines so that you can comply with:

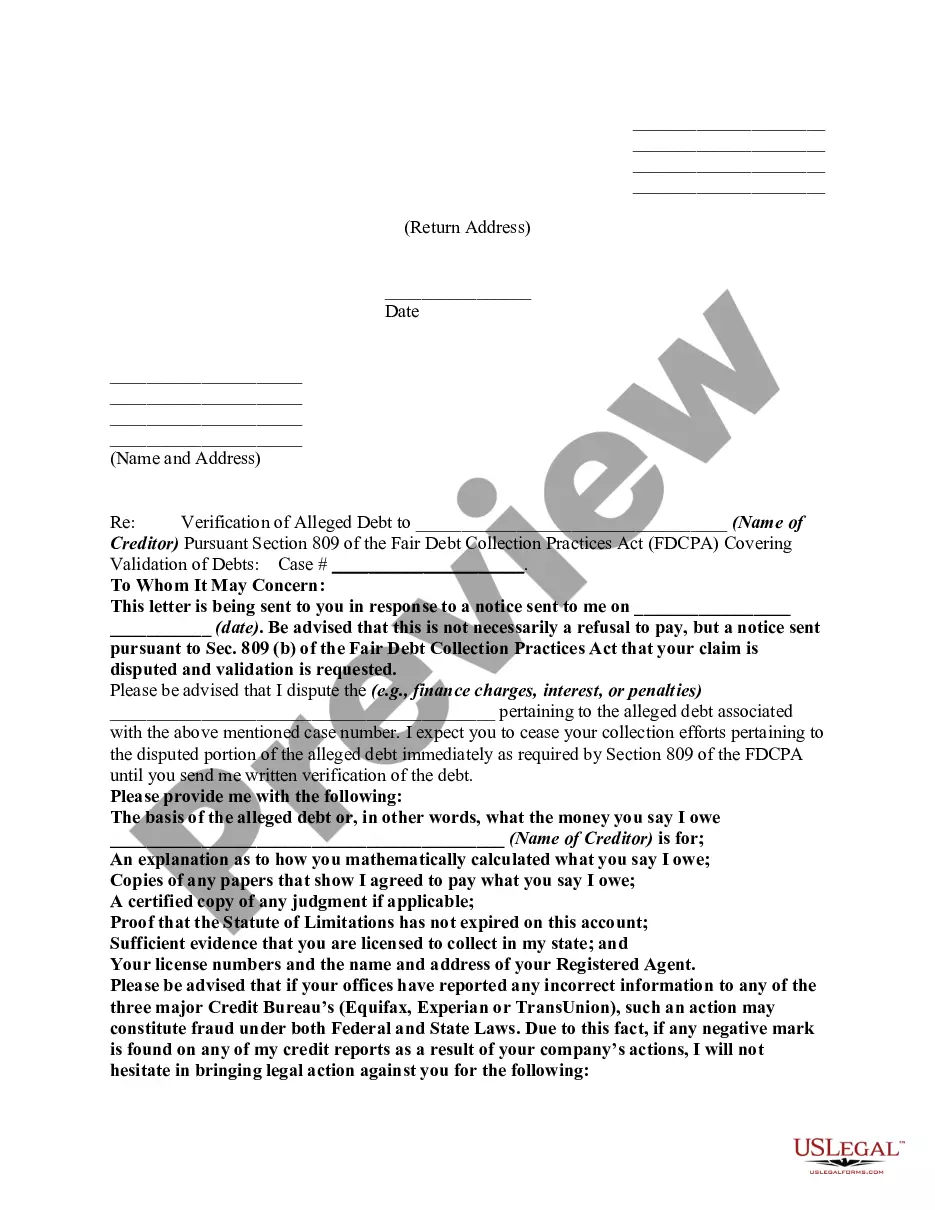

- Initially, make certain you have chosen the proper kind for your personal area/area. It is possible to look over the shape utilizing the Preview button and read the shape description to make certain this is basically the best for you.

- If the kind does not fulfill your requirements, take advantage of the Seach area to obtain the correct kind.

- When you are sure that the shape is proper, click on the Acquire now button to find the kind.

- Select the rates strategy you want and enter the essential info. Design your account and buy your order utilizing your PayPal account or charge card.

- Opt for the document file format and obtain the lawful record template in your system.

- Total, modify and printing and signal the acquired Missouri Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges.

US Legal Forms is definitely the biggest library of lawful types in which you can find different record layouts. Make use of the service to obtain expertly-produced documents that comply with status specifications.

Form popularity

FAQ

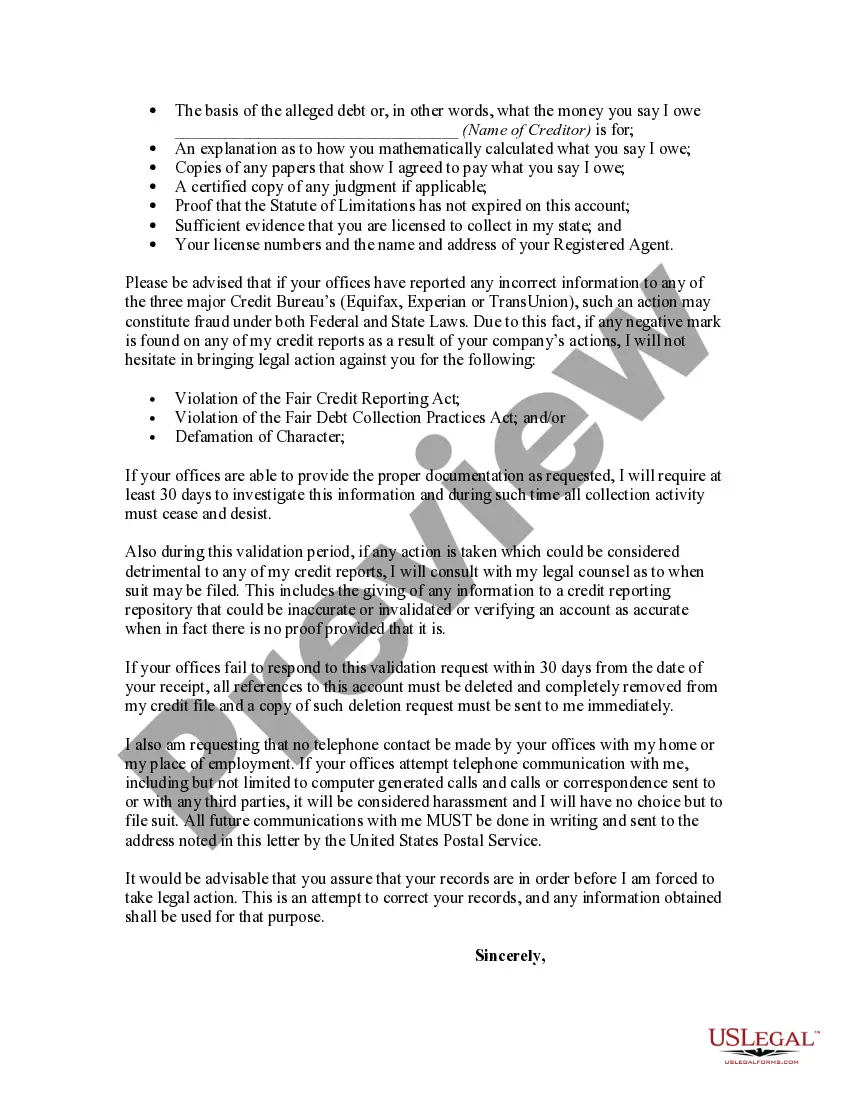

The best samples for debt validation letters provide clear structure and concise language. Look for formats that include elements of the Missouri Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or Penalties being Charged on the Alleged Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes these Charges. Ensure the sample advises you to detail the debt, request supporting documentation, and include your personal information for identification.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

Creditors can legally refuse partial payments and demand payment in full, including interest and extra charges like late fees. There are no laws that require them to accept your payments or partial payments. Some creditors are more willing to work with you than others.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

Can a Debt Collector Refuse a Payment Plan? It's important to know that collection agencies aren't legally obligated to accept or agree to payment plans. Debt collectors don't have to work with you or agree to any payment schedules based on what you're reasonably able to afford.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.