Idaho Invoice Template for Psychologist

Description

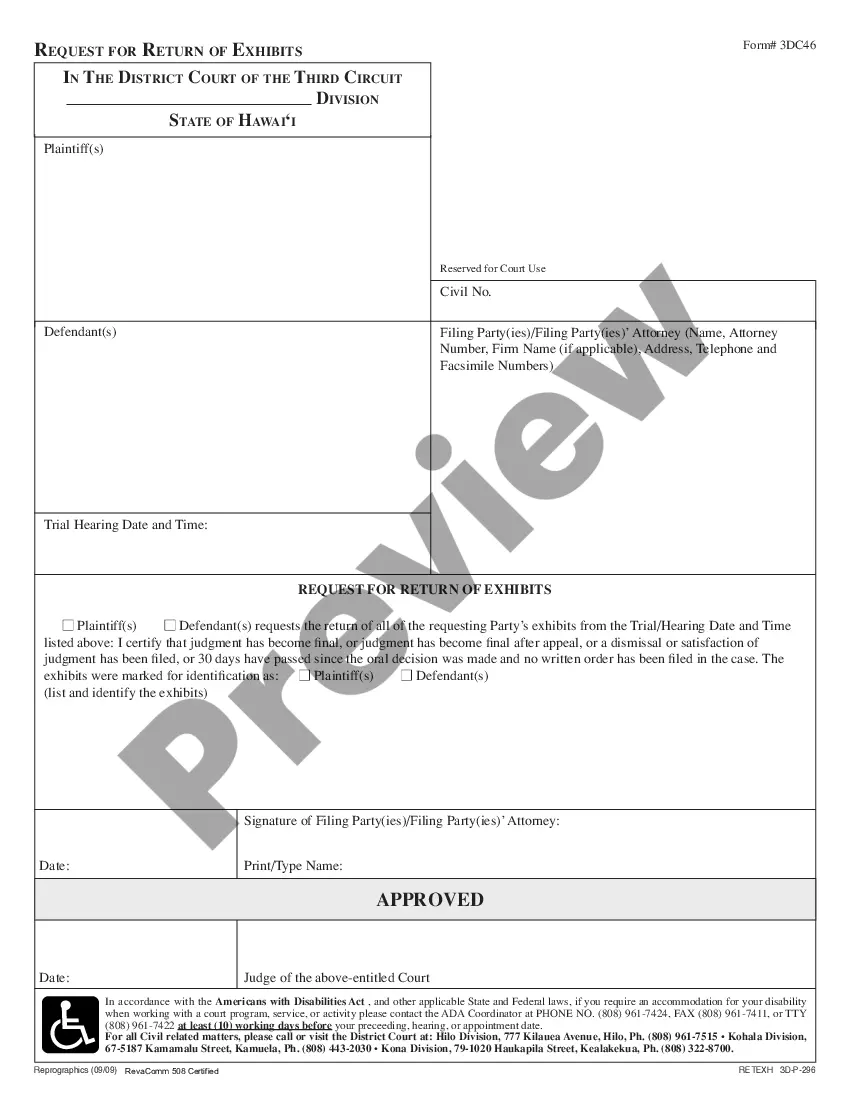

How to fill out Invoice Template For Psychologist?

If you need to extensive, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the website's user-friendly and convenient search to obtain the documents you require.

Numerous templates for business and personal purposes are classified by types and states, or keywords.

Step 4. Once you have located the form you require, click the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to acquire the Idaho Invoice Template for Psychologist in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Idaho Invoice Template for Psychologist.

- You can also access forms you've previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Filling out a tax invoice statement requires you to include your business details, client information, and a breakdown of services along with any applicable tax rates. Ensure you mention the total amount, clearly highlighting the tax portion. Listing payment details and terms is important as well. Utilize the Idaho Invoice Template for Psychologist to ensure that you capture all necessary information correctly.

To fill out a service invoice sample, begin with your contact details and the client's information at the top of the invoice. Next, specify the services or products provided, alongside the respective dates and amounts. Conclude with payment instructions and a polite message. An Idaho Invoice Template for Psychologist can be a valuable resource for understanding how to complete each section correctly.

To create a simple invoice, start with your name and address, followed by the client's information. List the services provided, specify costs, and include a total amount due. Don't forget to add payment terms and a customer thank you. Using an Idaho Invoice Template for Psychologist can simplify this process and ensure you include all necessary sections.

Writing an invoice properly involves using a structured format that includes essential elements such as your business information, client details, descriptions of services, and payment amounts. Be sure to number your invoices for tracking and consistency. Always clarify payment terms, such as due date and late fees. Refer to the Idaho Invoice Template for Psychologist for an effective format.

To write a therapy invoice, start with your business name and contact information at the top, followed by the client's details. Clearly list the services rendered, along with the dates and amounts charged. Include payment terms and a thank you note to foster goodwill. The Idaho Invoice Template for Psychologist can serve as a helpful guide to structure your invoices accurately.

The best wording for an invoice includes clear, concise language that specifies the services provided and the total amount due. Use polite terms such as 'Thank you for choosing our services' and detail the payment methods accepted. Incorporating phrases like 'This invoice is due upon receipt' enhances clarity. You can utilize the Idaho Invoice Template for Psychologist to ensure you include all necessary elements.

To create an invoice file, you can start with an Idaho Invoice Template for Psychologist as your foundation. Customize the file according to your needs in any word processor or spreadsheet software, then save the document in a suitable format, such as PDF or DOCX for ease of use.

Whether to use Word or Excel for creating an invoice depends on your comfort with each platform. Word is great for straightforward invoices, while Excel offers formula capabilities for calculations. An Idaho Invoice Template for Psychologist can be formatted in either program, making it adaptable to your preferences.

Creating a PDF invoice starts by preparing your document using an Idaho Invoice Template for Psychologist. After filling in the necessary information, choose the option to 'Save As' or 'Export' and select PDF as your format. This method ensures your invoice remains intact when shared with clients.

To make an invoice spreadsheet, you can start by choosing a software like Excel. Use an Idaho Invoice Template for Psychologist to guide your columns and rows, which should include service descriptions, rates, and totals. Organizing the data neatly ensures easy calculations and clear presentations.