It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

Iowa Promissory Note - Forgivable Loan

Description

How to fill out Promissory Note - Forgivable Loan?

It is feasible to spend numerous hours online trying to locate the valid document format that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of legal templates that can be reviewed by professionals.

You can effortlessly obtain or create the Iowa Promissory Note - Forgivable Loan through our service.

If you wish to find another variation of the document, use the Search field to locate the format that meets your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- Afterward, you can complete, edit, create, or sign the Iowa Promissory Note - Forgivable Loan.

- Every legal document format you purchase is yours for an extended period.

- To get another copy of any purchased form, navigate to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document format for your chosen county/region.

- Review the form details to confirm you have chosen the right document. If available, utilize the Preview option to browse through the document format.

Form popularity

FAQ

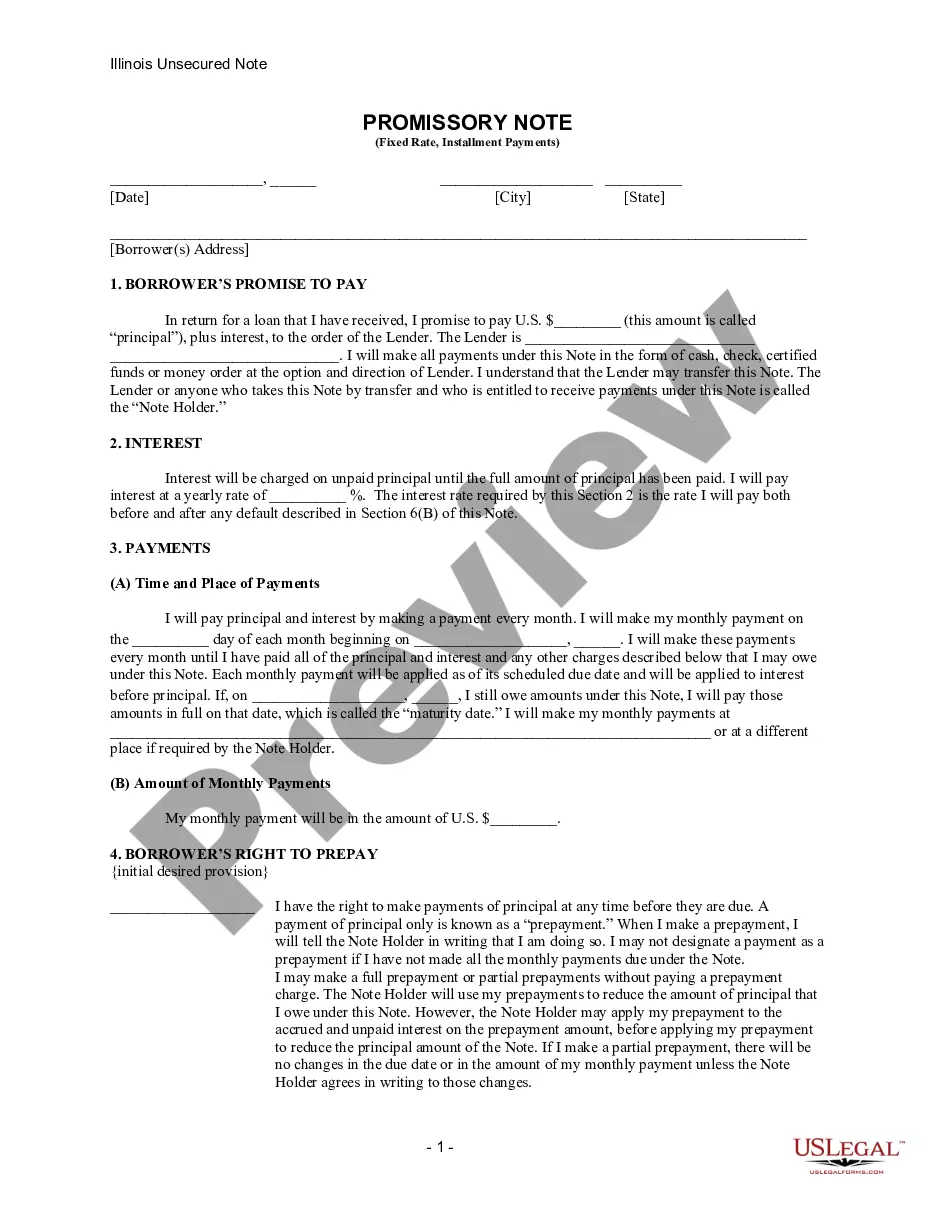

Contrary to a Promissory Note, which is an unconditional promise to repay money, a Forgivable Loan Agreement, or FLA, states that a specified portion of the new employee's loan balance will be forgiven. Presented at the time of recruitment, the FLA differs from a Promissory Note in that a certain percentage of the

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

Ocala Lawyers for Real Estate Closings In a promissory note, a buyer agrees to pay back any money borrowed to finance a transaction. If you have questions about a promissory note in connection with a property transaction, you can consult the skilled Ocala real estate attorneys of the Dean Firm.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment.

A forgivable loan is a type of loan that allows borrowers to have the balance of their loan either partially or totally forgiven if they meet certain conditions.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

How to get PPP loan forgivenessUse it for eligible expenses.Keep your employee headcount upDon't reduce an employee's wages by more than 25%Document everything.Talk with your lender.Apply for loan forgiveness.

Work full time for a government organization at any level (state, federal, local) or a tax-exempt nonprofit. Make 120 monthly on-time payments (they don't have to be consecutive; payments made during forbearance or in deferment don't count).

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.