Delaware Receipt for Payment of Rent

Description

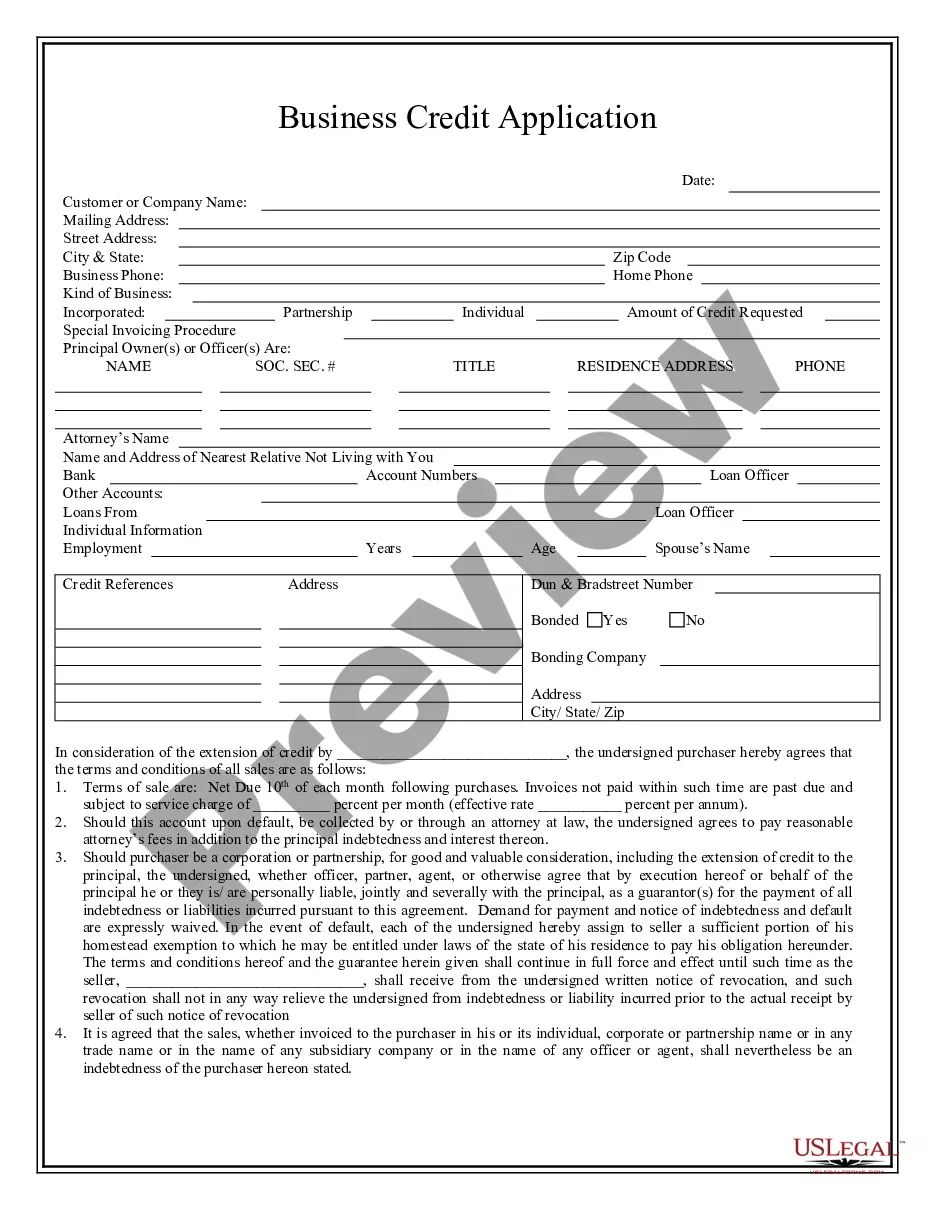

How to fill out Receipt For Payment Of Rent?

You might spend hours online searching for the legal document template that fits the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily obtain or print the Delaware Receipt for Payment of Rent from our service.

If available, take advantage of the Preview feature to check the document template as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can fill out, modify, print, or sign the Delaware Receipt for Payment of Rent.

- Each legal document template you purchase is yours forever.

- To acquire another copy of any purchased form, visit the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region that you choose.

- Review the form description to make sure you have chosen the correct form.

Form popularity

FAQ

Yes, if the estate's gross assets exceed certain limits, you must file a Delaware estate tax return. This requirement applies regardless of where the deceased person lived. Organizing relevant documents, including a Delaware Receipt for Payment of Rent, can assist in correctly reporting the estate's obligations.

Yes, you can file your Delaware state taxes online using approved platforms. This method is efficient and helps you avoid delays in processing your return. Utilizing documents such as a Delaware Receipt for Payment of Rent can support your filing efforts.

You can file your Delaware gross receipts tax online through the Delaware Division of Revenue's website. The process is streamlined for convenience; simply follow the instructions to submit your forms electronically. Using records like a Delaware Receipt for Payment of Rent can aid you in ensuring accurate reporting of your income.

Individuals and businesses that earn income within Delaware are required to file a tax return. This includes residents who earn income and non-residents with income sourced from Delaware. Keeping comprehensive documentation, including a Delaware Receipt for Payment of Rent, is vital for proper filing.

Any business that generates revenue in Delaware must file gross receipts tax. This includes various types of businesses, regardless of their business structure. To simplify the process and maintain compliance, businesses can utilize resources from uslegalforms, especially those concerning a Delaware Receipt for Payment of Rent.

In most cases, you must file a Delaware tax return if you receive income from Delaware sources. This applies to both residents and non-residents with income tied to Delaware. Keeping accurate records, including a Delaware Receipt for Payment of Rent, can assist you in the filing process.

Yes, Delaware requires taxpayers to file a state tax return if they meet certain income thresholds. This is important for individuals and businesses that generate income in Delaware. Proper documentation, such as a Delaware Receipt for Payment of Rent, can help substantiate your claims and ensure compliance with state tax regulations.

You can obtain a receipt for rent by asking your landlord directly after making your payment. Many landlords offer a receipt immediately, but if not, you might want to request it in writing. Using a Delaware Receipt for Payment of Rent can facilitate this transaction, ensuring you have documented proof of your rental payment.

To get a receipt for your rent payment, simply ask your landlord or property manager for one upon making your payment. Most landlords are required by law to provide a written receipt or proof of payment, especially if you request it. Utilizing a Delaware Receipt for Payment of Rent template can make the process more straightforward for both you and your landlord.

When writing a proof of rent payment letter, start by stating the date, amount, and purpose of the payment. Include your name, the property's address, and a request for the landlord to acknowledge receipt. Creating a formal document using a Delaware Receipt for Payment of Rent format can give your letter a professional touch and clarity.